11.5 months of FY25:Govt borrows Tk1.08 lakh cr from commercial banks

- Update Time : Sunday, May 18, 2025

Staff Correspondent:

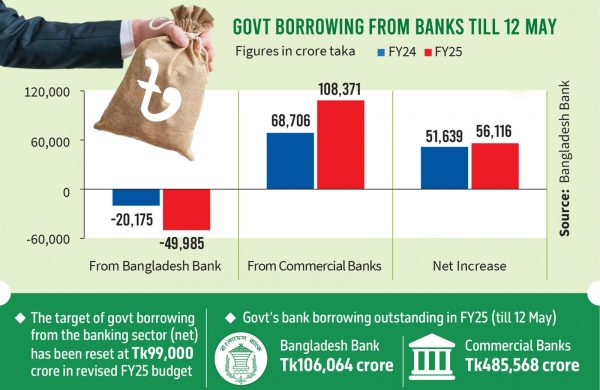

The government has borrowed Tk1,08,371 crore from scheduled banks in the first eleven and a half months of FY25, up by 57% from the previous fiscal year, according to the monthly report on government domestic borrowing by the Bangladesh Bank.

The report shows that as of 12 May, the amount of outstanding loans from the scheduled banks has reached Tk4.85 lakh crore, which was Tk68,706 crore during the same period in FY24.

Though the government has borrowed Tk1,08,371 crore from scheduled banks, it has already repaid Tk49,984 crore in outstanding loans to the Bangladesh Bank, meaning the government’s net debt in the current fiscal year has stood at Tk56,116 crore so far.

As such, the government’s outstanding borrowings from the central bank have decreased by around 32%, falling from Tk1.56 lakh crore in June 2024 to Tk1.06 lakh crore.

Industry insiders say the government’s bank debt has increased significantly due to various reasons, including a slowdown in revenue collection, increased borrowing to cover the budget deficit, slow credit growth in the private sector, and the ongoing uncertainty in businesses after the August 2024 political changeover.

At the same time, the government has reduced borrowing from the central bank, and paid more in order to continue the contractionary monetary policy to control inflation. As a result, inflation has started to decline somewhat towards the end of the current fiscal year.

The FY24 national budget, passed at the Awami League-led parliament, had set a target for the government debt from the banking system at Tk1.37 lakh crore, which has been cut short to Tk99,000 crore by the current interim government.

However, it will be restricted to Tk90,000 crore, taking the current circumstances of the banking sector into cognisance, Bangladesh Bank Governor Ahsan H Mansur said.

Central bank officials say government debt typically rises at the end of a fiscal year. However, the amount of debt taken so far is much less than the target.

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, that the government is currently repaying its debt to the central bank by borrowing from commercial banks as part of the contractionary monetary policy.

By repaying the central bank’s debt, its balance sheet is being compressed, correcting the previous unusual expansion, he said.

Commenting on the potential inflationary pressure had the government not increased borrowing from commercial banks, the economist said, “Without the increased borrowing, the money supply would have been significantly higher.”

The managing director of a private bank that private sector credit growth has slowed significantly over the past eight to nine months. “In addition, deposits have been withdrawn from weaker banks and placed in banks with better indicators, leading to the banks providing loans to the government with excess liquidity.”

The MD pointed out that treasury bills and bonds have become an attractive investment for banks due to the reduced demand for loans in the private sector. “The government guarantees these bonds, making them more attractive to banks due to their lower risk.”

However, the interim government is planning to significantly reduce bank borrowing to reduce the budget deficit in the next fiscal year. The amount of bank borrowing for FY26 will be reduced by about 25% from the original target for the current fiscal year to Tk1,04,000 crore, say officials.

“It would not be appropriate to finance the budget through bank loans or by printing additional money. The budget for the next fiscal year will be implementable,” Finance Adviser Saleh Uddin Ahmed recently told the media.

BANK LOAN TARGETS ARE A REASON FOR RELIEF

The government borrows money from banks in two ways to cover its budget gap—either from commercial banks or from the central bank. When it borrows more from commercial banks, those banks have less money to lend to businesses and people. But if the government borrows too much from the central bank, it can cause inflation. This means prices go up, which puts extra pressure on everyday people. This is a basic rule in economic policy.

According to the Bangladesh Bureau of Statistics, inflation in the country was 9.17% in April. Officials from the Finance Division agree that government borrowing from banks is one reason for the high inflation. However, they also say the government does not have many other options.

Prof Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, said, “If the government borrows excessively from the banking system, it has a negative impact on credit growth in the private sector.”

A large portion of the revenue is spent on paying the interest on bank loans. So, the government will have to be careful about the issue in the next fiscal year, he noted.

“If the FY26 budget is kept within Tk7.9 lakh crore, it will be a relatively small budget at the current inflation rate. Therefore, the main objective of the budget should be to increase revenue collection,” he said further.