15 years of Hasina’s dictatorship: Banking sector dips into grafts

- Update Time : Wednesday, October 9, 2024

Loan scams, siphoning were regular phenomenon

TDS Desk:

The fall of the Sheikh Hasina government in the face of a mass upsurge has exposed a horrifying picture of widespread corruption and financial malpractices within the country’s banking sector.

Powerful political figures and businessmen, aided by government patronage, have looted billions of taka from banks over the past 15 years.

There is no specific information on bank looting as the Bangladesh Bank (BB) remained tightlipped in this regard during the period.

However, according to BB’s internal sources and other bank data, there were many big loan scams that involved Hallmark Group, Crescent, AnonTex, Bismillah Group, S Alam Group, PK Halder and BASIC Bank.

According to the BB, controversial businessman and owner of S Alam Group Mohammed Saiful Alam embezzled nearly Tk1 lakh crore from the banking sector alone.

Another controversial businessman and a key figure in Beximco Group, Salman F Rahman, looted over Tk50,000 crore. In addition, it is alleged that several businessmen, including Nazrul Islam Mazumder, former chairman of Bangladesh Association of Banks (BAB) and Exim Bank, and Chowdhury Nafeez Sarafat, former chairman of Padma Bank, embezzled thousands of crores of taka from banks under the government’s patronage.

After taking office as the BB governor, Ahsan H Mansur got increasingly astonished by the extent of the bank looting that occurred during the previous government’s tenure. He told a press conference, “The way S Alam Group has looted money from the banks is an unprecedented incident not only in Bangladesh but also anywhere in the world.” Economists say the governor’s comments indicate that the reality of the looting in the country’s banking sector is even more alarming than what the public is aware of.

However, it can be assumed that a big part of this money has been syphoned out of the country and a small part might have been added to the economy.

AB Mirza Azizul Islam, a former adviser to a caretaker government, told that the last 10-15 years have been the most alarming and dark chapter for the banking sector in the country’s history.

“During this long period, opportunities for bank looting were facilitated under the patronage of the government or state, which had never been seen before. I now see in newspapers that the money looted from these banks has also been given to individuals in top government positions and their family members. The banking and financial sectors of the country have completely been crippled through collusion in looting.”

“As the new government assumes responsibility, even more alarming revelations about the plundering of the banking sector are emerging. My expectation from the interim government is that whoever is involved in the bank looting, regardless of how powerful they may be, must be brought to justice,” the economist added.

Centre for Policy Dialogue (CPD) Executive Director Fahmida Khatun said the indices of the banking sector have been continuously declining since 2008. “Loan defaults have surged since 2012 due to irregularities. The financial irregularities, including sanctioning loans with fake documents, loans under the name of non-existent institutions and embezzlement of money, took place during the period.”

BANKING SECTOR LOOTING

Last December, the CPD revealed that around Tk92,261 crore has been plundered from the country’s banking sector over the past 15 years from 2008. A recent report from the central bank has noted that as of 20 August, the amount of loans taken by bank directors reached Tk233,885 crore. In 2016, this amount was nearly Tk90,000 crore.

This indicates that in the last eight years of the ousted government’s tenure, loans increased by almost 160%. It is believed that the majority of this borrowed money has been embezzled.

BIG LOAN SCAMS

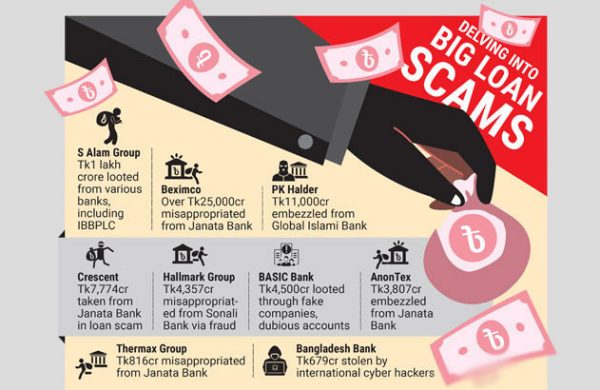

According to BB and CPD data, Hallmark Group Managing Director Tanvir Mahmud and 26 others were accused of misappropriating around Tk4,357 crore from state-owned Sonali Bank through various means, including fraud and deception.

After 2008, the biggest loan irregularities in the banking sector happened in BASIC Bank. From 2009 to 2013, about Tk4,500 crore was looted from the bank through various irregularities, fake companies and dubious accounts.

From 2010 to 2022, a loan scam took place in Janata Bank in several stages. Crescent took Tk7,774 crore, AnonTex Tk3,807 crore, Bismillah Group and its fake sister concerns Tk1,174 crore and 30 companies under the Beximco umbrella owned by Salman F Rahman took more than Tk25,000 crore from the state-owned bank.

Besides, in 2021, when PK Halder was the managing director of Global Islami Bank (former NRB Global Bank), the incident of loan irregularities of about Tk11,000 crore came to light in the financial sector.

The biggest loan default in the banking sector happened involving Islami Bank Bangladesh PLC as Tk50,000 crore has been taken by S Alam Group alone. Besides, the group took nearly Tk50,000 crore more from six other Islamic banks.

In addition, between 2013 and 2017, former Farmers Bank (now Padma Bank) was involved in a loan irregularity amounting to Tk500 crore while from 2013 to 2016, Janata Bank faced irregularities to the tune of Tk816 crore related to Thermax Group.

NRB Commercial Bank experienced a loan irregularity of Tk701 crore. International cyber hackers took away Tk679 crore from the treasury account of Bangladesh Bank with New York’s US Federal Reserve Bank.

A loan officer of Dhaka Bank embezzled Tk7.8 crore from accounts of around 38 clients between 2018 and March 2019. Social Islami Bank Limited allowed Sharp Knitting and Dyeing of Gazipur to import goods worth over Tk17,079 crore by using 889 back-to-back letters of credit even though the company did not renew the license for its bonded warehouse, which is a must to avail such facilities.