18 banks await BB sign-off on financial reports

- Update Time : Wednesday, May 14, 2025

Staff Correspondent:

Delays in the regulatory approval process have left 18 banks, accounting for half of all stock market-listed banks, unable to finalise their annual financial reports.

As a result, board recommendations for dividend declarations remain pending, creating uncertainty for investors.

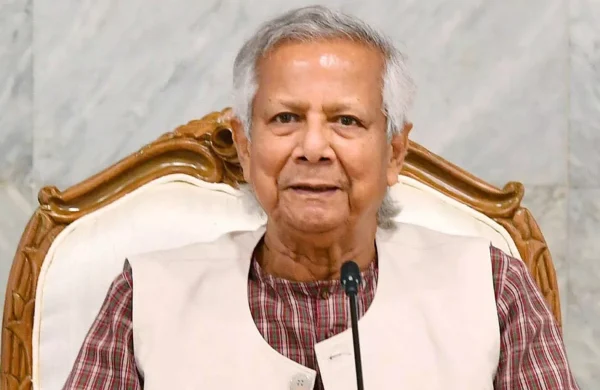

According to officials from the Bangladesh Bank and the Ministry of Finance, the ministry has already given its necessary consent on the matter. Now, the process awaits approval from Bangladesh Bank, which is expected to be completed once Governor Ahsan H Mansur returns from a visit to the United Arab Emirates.

Describing the situation as “uncomfortable” and not conducive to investor confidence, Saiful Islam, president of the DSE Brokers Association of Bangladesh (DBA), said the delay stems from Bangladesh Bank’s inability to issue timely approvals.

“The market is already under pressure. The absence of announcements from banks at this time is intensifying that pressure,” he said. “It’s creating a sense of uncertainty. Typically, banks declare dividends by May, and investors look to the banking sector during this period, expecting good returns since it’s considered one of the most reliable sectors.”

He added that the DBA plans to raise the issue with the Bangladesh Securities and Exchange Commission (BSEC) via the Dhaka Stock Exchange, urging a quick resolution.

Nazma Mubarak, secretary of the finance ministry’s Financial Institutions Division, said: “This has happened once before. Referring to that precedent, we have informed Bangladesh Bank, and upon their request, the ministry extended the deadline for dividend declarations to the end of May.”

Arif Hossain Khan, executive director and spokesperson of Bangladesh Bank, said: “The ministry has granted approval. A final decision will be made once the Governor returns.”

Following the ministry’s directive, the central bank issued a circular on May 8, saying it had granted exemption from the reporting requirements under the Bank Company Act. “As a result, the deadline for submitting audited annual reports of scheduled banks to the Bangladesh Bank has been extended to May 31, 2025.”

Governor Mansur was last in office on May 12 before departing for the UAE for two days. He is scheduled to attend a session of the International Sukuk Forum on May 13 and 14, and is also expected to meet with several foreign banks to discuss increasing credit limits for private Bangladeshi banks. Several managing directors of private banks are also currently in the UAE, according to industry insiders.

Under the circumstances, 18 out of 36 listed banks are still waiting for Bangladesh Bank’s no-objection certificate (NOC) to finalise their financial reports for 2024.

Officials at the central bank say the matter is “sensitive”, and they are holding off on approvals until the governor returns.

Uncertainty also looms over when exactly the approvals will be granted.

As per regulations, Apr 30 was the last date for finalising annual reports for the 2024 financial year and declaring dividends accordingly. Banks had submitted their reports to Bangladesh Bank in advance for approval.

However, by the deadline, these banks had not received the necessary NOC from the central bank, resulting in board meetings concluding without any decisions.

The delay has not only blocked dividend declarations for investors but also prevented the preparation of unaudited financial statements for the first quarter (January–March) of 2024.

The banks awaiting approval include state-owned Rupali Bank, and privately owned Islami Bank Bangladesh, Standard Bank, One Bank, Premier Bank, IFIC Bank, Al-Arafah Islami Bank, First Security Islami Bank, EXIM Bank, Southeast Bank, Social Islami Bank, NRBC Bank, South Bangla Agriculture and Commerce Bank, Mercantile Bank, NRB Bank, AB Bank, United Commercial Bank, and Global Islami Bank.