35pc taxpayers in 41 zones each skipped filing

- Update Time : Monday, September 1, 2025

TDS Desk:

Around 35 per cent of taxpayers in each of the 41 tax zones across the country did not file tax returns in the last fiscal year despite having the taxpayer identification number (TIN).

A gap analysis, conducted by the National Board of Revenue (NBR), has revealed the alarming picture where TIN holders have not been followed up properly by taxmen in most of the tax zones.

The analysis was done following a nominal year-on-year increase, nearly 6.0 per cent, in the number of return filers in FY25.

A persisting gap between the number of TIN holders and return filers is a widely-discussed issue in Bangladesh, which has one of the poorest tax-to-gross domestic product (GDP) ratios – 6.7 per cent – in the world.

In the last fiscal year, some 5.3 million TIN holders did not submit returns. However, taxmen opened files for only 1.3 million of them.

A senior tax official says tax zones are responsible for opening a tax file for each TIN holder listed in their jurisdiction to follow up and raise the number of taxpayers.

He says both taxpayers and taxmen are responsible for the poor tax base in Bangladesh.

The NBR recently issued orders to all tax zones to serve notices to all non-filers in their jurisdictions.

In FY25, taxmen served notices to 0.9 million TIN holders for not filing returns.

However, only 17.28 per cent of the non-filers received notices, an analysis by journalist.

The tax official says the income tax act 2023 has penal provisions for non-compliant taxpayers who fail to submit returns.

However, it is a nominal amount for taxpayers who file returns for the first time.

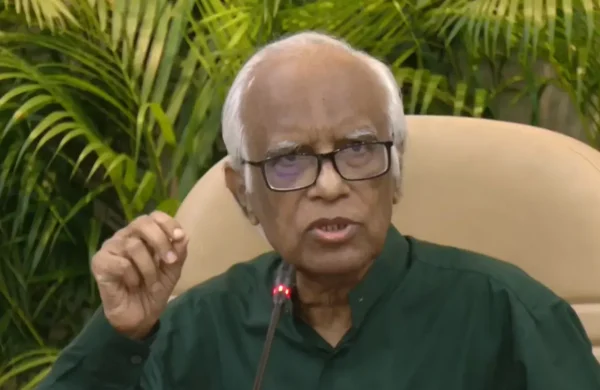

Income tax Member (tax admin and human resource management) GM Abul Kalam Kaikobad said the NBR had sent letters to the tax zones, asking them to follow up with the TIN holders who were not filing returns.

The gap analysis reveals only 18.4 per cent of taxpayers responded after notices were served. Some 171,049 taxpayers submitted returns after receiving notices.

Taxmen in field offices say they are occupied with the existing returns due to insufficient manpower and logistics, as well as the lack of automation in the tax administration.

They say chasing marginal taxpayers does not yield significant returns for the exchequer.

“We usually chase well-off taxpayers to meet revenue collection targets. The tax we can get from one such taxpayer is equivalent to the combined amount from 100 marginal ones,” says a field-level tax commissioner, preferring anonymity.

Tax officials say the number of submitted returns is really frustrating in Bangladesh.

In FY15, the number of registered taxpayers was less than 1.7 million.

Ten million taxpayers were added over the last decade, but the increase was not reflected in the number of returns.

Citizens currently need proof of tax return submission to avail 40 services.

As per the income tax act, all TIN holders must submit returns.