Cenbank’s bond game: Profit for some, inflation for all

- Update Time : Thursday, August 22, 2024

- 11 Time View

TDS Desk:

Bangladesh Bank’s former governor Abdur Rouf Talukder and deputy governor Kazi Sayedur Rahman unlocked a lucrative opportunity for banks: invest in treasury bills and bonds, borrow against them, and earn up to 4% in profit margins with minimal effort.

Bankers and analysts warn that this monetary policy translates to printing money, fueling inflationary pressures in the economy — directly contradicting its goal of curbing inflation.

As a result of this strategy, the central bank extended a record Tk32.21 lakh crore in loans to commercial banks during the 2023-24 fiscal year, a figure that exceeds the combined total of the previous seven fiscal years.

A significant portion of these borrowed funds was invested by commercial banks in government treasury bills and bonds, capitalising on easy, guaranteed returns ranging from 1.6% to 4% depending on the tenure, treasury officials of several banks told that.

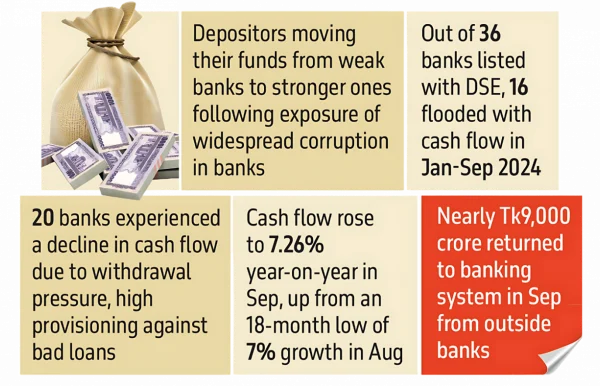

Thirty-six banks are listed on local stock exchanges, and 23 have reported their financial results for January-March this year. Among them, 17 showed profit growth from both lending and government securities, with some achieving over 100% growth from investments in treasury bills and bonds.

“This is effortless income for any bank. Even more concerning, there is no limit to it, which is increasing the money supply and fueling inflation,” said the treasury head of a leading private bank, on condition of anonymity.

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, told that that whether it is through repo or refinance schemes, any form of financing by the central bank ultimately contributes to money creation within the country’s banking system.

Mustafa K Mujeri, former chief economist at the Bangladesh Bank, told that the central bank announced a contractionary monetary policy at the start of FY24, aiming to reduce money flow to the market.

However, he noted that the central bank’s actions have been counterproductive. Due to significant lending through repos, the money supply has increased, stoking inflation rather than controlling it.

Central bank data show that of the total lent amount, Tk30.34 lakh crore was provided through repo and other liquidity facilities. In addition, Islamic banks borrowed Tk1.87 lakh crore during the same period.

This marks a substantial increase from the 2022-23 fiscal year, when commercial banks borrowed Tk13.08 lakh crore, while Islamic banks borrowed Tk1.16 lakh crore, bringing the total to Tk14.24 lakh crore.

Top treasury officials said 24 primary dealer banks invest in government treasury bills and bonds, but these funds ultimately come from the central bank.

The treasury head of a private commercial bank told that as primary dealers, these banks are obligated to purchase government treasury bills and bonds, which offer interest rates ranging from 11.60% to 12.75% depending on the tenure.

The central bank then provides repo and other liquidity facilities against these investments, he said.

Another treasury official said banks pay 8.5% to 10% interest on central bank borrowings and use these funds to buy treasury bills and bonds, earning a 1.6% to 4% profit. This is a key element of their treasury management strategy.

Is BB printing money?

A senior central bank official stated that banks borrow for a period of one to 180 days, and the borrowed funds are repaired regularly. So, the total borrowed amount cannot be categorised as money printing.

The central bank holds 240 repo auctions annually. Dividing the total loan amount by 240 provides an average figure, which reflects the amount circulating in the market and can be seen as money printing, estimated at Tk13,240 crore, said the official.

However, the managing director of a private bank suggested that the actual amount of money printing could be higher.

He said at the start of this year, the government issued special purpose bonds worth approximately Tk20,000 crore to address electricity and fertiliser debts.

“These bonds can be deposited with the central bank and used by commercial banks for borrowing. Many cash banks are doing so using bonds as collateral. This Tk20,000 crore is clearly an instance of money printing,” he explained.

Amid criticisms, the central bank is lending newly printed money to banks rather than to the government. Hence, the central bank’s balance sheet reflects an increase in government treasury bills while the amount of cash decreases, the banker added.

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, said while this money creation takes time to impact inflation, it primarily affects non-food inflation.

The economist also said that attractive interest rates on repos and treasury bills discourage banks from lending to the private sector.

He explained, “Banks prefer risk-free investments in treasury bills and bonds rather than lending to the private sector. This results in a cycle where banks repeatedly buy treasury bills, deposit them, and take out repos, raising questions about whether banks can effectively utilise the liquidity support they receive.”

Zahid Hossain said the Interest Rate Corridor (IRC) was introduced to curb repo lending. “The corridor allowed the central bank to increase interest rates from 8.5% to 10%, but the previous governor didn’t seize this opportunity.”

“Under the new management, banks are now being charged higher interest than the policy rate, which is good for the banking industry,” the economist added.

Selim RF Hussain, chairman of the Association of Bankers Bangladesh (ABB) and managing director of BRAC Bank, said facing liquidity stress, banks are forced to borrow from the central bank.

However, the gap between the policy rate and the treasury bill-bond interest rate is over 300 basis points, which needs to be adjusted, he added.

How BB lends money to banks

Usually, the central bank provides 1 (overnight), 7, 14, and 28-day central bank repo facilities to banks and financial institutions to alleviate transitory liquidity problems and boost the money supply in the economy.

Furthermore, the Bangladesh Bank provides a special repo (liquidity tool) for specific situations.

In addition to repo facilities, the central bank offers primary dealers (PDs) banks Assured Liquidity Support (ALS) against G-Sec allotted to them at auctions for up to 90 days from the date of issuance. Accordingly, it provides assured repo and standing lending facility (SLF) to the Banks.

To support liquidity management and deepen the financial system, on 5 December 2022, the Bangladesh Bank introduced the Islamic Banks Liquidity Facility (IBLF) for the Shariah-based banking system in Bangladesh.

The tenor of the IBLF is 14 days and underlying eligible securities are unencumbered Bangladesh Govt Investment Sukuk (BGIS).

Later, on 5 February 2023, the central bank introduced 7, 14 and 28 days collateralised Mudarabah Liquidity Support (MLS) for the Islamic banks in Bangladesh. Also, the Bangladesh Bank provides Special Liquidity Support (SLS) to these banks. (Collected)