Small investors’ woes in stock market not over yet

- Update Time : Saturday, October 12, 2024

UNB, Dhaka

Small investors in Bangladesh’s stock market remain trapped, with their woes persisting due to a lack of confidence, weak governance and economic instability, despite assurances from regulators of an eventual market rebound, according to experts.

“No one, not even the regulator or stock market authorities, pays heed to our screams,” said Saiful Islam, a grocery owner and one of the affected investors,” in a broken voice while talking to UNB regarding the capital market.

Saiful invested Tk 14 lakh in 2010 to buy shares of different companies listed in the Dhaka Stock Exchange (DSE).

After graduating in 2004, Saiful found no suitable job and then started a small business in the Motijheel area in 2007 with support from his father-in-law.

He made a good profit in the business and invested the money in the share market.

In 2010, Saiful invested around Tk 14 lakh, of which Tk 6 lakh was his own and Tk 8 lakh he borrowed from relatives. All of his investment was stuck in shares of different companies due to a major scam in the capital market in 2011.

Like Saiful, thousands of investors lost their hard-earned capital in 2011, and after that, some were able to regain part of their capital. However, most of them left the capital market, losing nearly all their investment.

Many such investors are still in the market, hoping for a rebound in the DSE, but without any good news.

DSEX drops by 43 points as prices of 288 companies fall, Chittagong Stock Exchange follows suit

There is no sign of lifting the floor price before the next election. However, economists say that people do not have confidence in the market. The BSEC advises investors to remain patient.

Analysts say that the small investors’ woes in the capital market are unlikely to end before the national election as their wait for a good time is prolonged by Bangladesh’s recent ‘instability’.

The small investors’ shares were once stuck at the floor price (minimum sale rate) due to the overall economic downturn. The floor price barrier ended after the change in government in Bangladesh.

However, the prices of most companies’ shares have not increased to the desired level for small investors.

This has been painful for many unfortunate small investors in the capital markets, according to market analysts.

Policymakers and the Bangladesh Securities and Exchange Commission (BSEC) paint a rosy picture for small investors, saying that the stock markets will rebound with the enlistment of new companies and the injection of large investments. However, the situation for small investors seems hopeless.

A large number of shareholders have been stuck with their investments in the capital market for over a decade amid fading hopes.

EXPERTS’ ANALYSIS

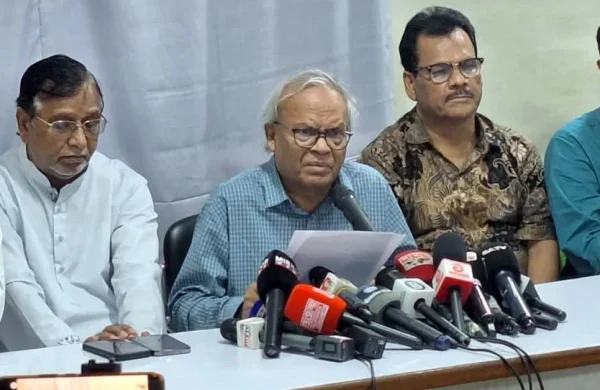

Dr ABM Mirza Azizul Islam, an economist and former adviser of a caretaker government, told UNB that there has been a crisis of confidence among investors in the stock market for a long time.

“To this are added various economic crises, the international situation, and everything, including elections and national politics. As a result, first of all, steps should be taken to eliminate the trust crisis. In this case, trust should be ensured by establishing good governance,” he added.

“That means investors have to be assured that if someone steals their money through manipulation, they will be prosecuted. Besides, the supply of good shares should be increased. Through these two steps, it is possible to solve the market problem. But it is not easy at all,” said Dr Azizul Islam.

Dr Abu Ahmed, Chairman of the Investment Corporation of Bangladesh (ICB) and former professor of Dhaka University’s Economics Department, said there are two crises in the market: one on the demand side and the other in investor confidence.

On the supply side, he said, the problem is that there are fewer good companies. As a result, it is a win-win situation for manipulation and syndicates. “All in all, the stock market is currently in an unstable condition and the situation is gradually getting worse. The passage from here is very difficult,” he said.

Ahmed also noted that people are sometimes investing in weak shares with the expectation of a big profit, which is not the right way of investing due to a lack of financial literacy.