Racing against rising costs: How people are coping

- Update Time : Thursday, October 17, 2024

TDS Desk:

As the prices of essential commodities continue to rise, many Bangladeshis are being forced to cut back on household expenses, impacting not only their own lives but also the livelihoods of others.

According to the Bangladesh Bureau of Statistics (BBS), inflation is nearing 10%, meaning that what cost Tk1,000 a year ago now costs Tk1,100. Food inflation, in particular, has remained above 10% for six consecutive months since April 2024 and overall inflation has been consistently above 9% since March 2023.

People are managing the rising costs by reducing personal indulgences and making lifestyle adjustments. Many are buying cheaper foods, cutting down on outings, skipping social events, walking instead of taking rickshaws and even dismissing household help.

This belt-tightening, however, is creating a ripple effect, as reduced consumer spending negatively impacts others. Local food stalls and street vendors are seeing a drop in sales and workers such as domestic helpers are struggling to make ends meet.

For instance, the dismissal of household help leaves those workers wondering how they will survive. Similarly, clothing sellers despite raising prices, report fewer customers and tea vendors who once saw regular foot traffic, now face a sharp decline in customers.

Economists are unsure when the situation will improve, as global strategies to curb inflation have been largely ineffective. This has left many frustrated and anxious about the future.

Former finance adviser to the caretaker government AB Mirza Azizul Islam warns that reduced spending will further strain the economy.

“When people cut back on expenses, sectors like dining, travel and retail take a hit. This creates a chain reaction that affects the livelihoods of those who depend on these industries,” he told media.

PERSONAL STORIES OF SURVIVAL

Aminul Islam, a resident of Shewrapara, works in a private firm and supports a family of four. Rising costs have forced him to downsize from a three-room apartment to a two-room one. The family no longer dines out on weekends and has stopped attending social gatherings.

“Our rent has gone up by Tk2,000 in two years and with my son starting school soon, I do not know how we will manage,” he said.

His company’s financial struggles during the COVID-19 pandemic have meant no salary increments for the past four years, while his wife lost her job when the school she worked at shut down during the pandemic.

Sadekur Rahman, a Dutch-Bangla Bank employee, has also made lifestyle changes.

“I used to take a rickshaw to work, but now I walk,” he said.

To save on household expenses, his family has cut down on meat and fish, simplifying their meals.

Similarly, Nigar Sultana, a college lecturer, and her husband have drastically scaled back on luxuries.

“We used to dine out and go to the movies, but now all of that has stopped. Even visits to the beauty salon have been cut out. Everything we used to spend on extras now goes to essential household expenses,” she said.

THE RISE IN COSTS

According to the BBS, inflation reached 9.92% in September, with food inflation at 10.4%. This means that expenses of Tk10,000 the last year now cost Tk10,920. Some essentials, such as rice, cooking oil, lentils and vegetables, have seen even higher price increases.

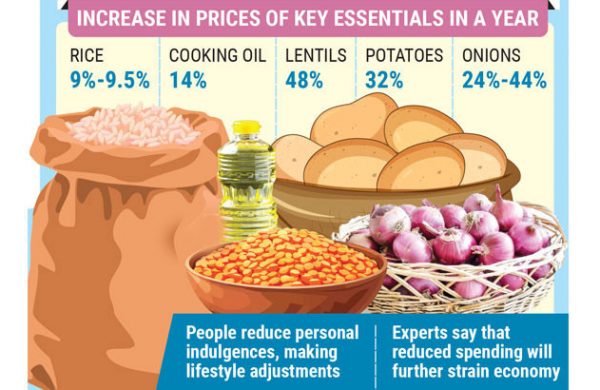

For instance, vegetable prices now exceed Tk80-100 per kilogram. Data from the Trading Corporation of Bangladesh (TCB) shows rice prices have risen by 9-9.5%, while cooking oil has increased by up to 14%. Lentils have surged by 48%, potatoes by 32% and onions by 24-44%, depending on quality.

THE DEBT TRAP

For those at the bottom of the economic ladder, rising prices have led to a dangerous cycle of debt.

Halima Khatun, a domestic helper in six households, earns just Tk10,000 a month. After paying Tk4,000 in rent, she is left with only Tk6,000 to feed her family of four.

“Fish and meat are out of the question and I can barely afford vegetables. Everything is too expensive,” she said. To make ends meet, Halima has resorted to borrowing from NGOs and lenders at high interest rates.

“If I borrow Tk20,000, I have to repay Tk25,000. Every month, I struggle to make loan payments of Tk1,500 to Tk2,000,” she said, further complicating her financial woes.