Bangladesh Bank hikes policy rate to 10pc

- Update Time : Tuesday, October 22, 2024

TDS Desk

The Bangladesh Bank has increased the policy rate, a key monetary policy tool, by 50 basis points to 10%.

It will be effective from 27 October, the central bank said in a circular issued Tuesday (22 October).

On 24 September, the central bank increased the policy rate to 9.5% from 9%. It was effective from the next day.

The Business Standard Google News Keep updated, follow The Business Standard’s Google news channel

With the latest hike, the policy rate has been increased ten times since May 2022, when it was only 5%.

It is also the fifth time the Bangladesh Bank has hiked the rate this year.

Additionally, the Standing Lending Facility (SLF) has also increased by 50 basis points, reaching 11.5%.

The Standing Deposit Facility (SDF) has also been hiked by 50 basis points, reaching 8.5%.

The SLR is the facility through which the central bank grants overnight credits (emergency funds) to eligible banks, while the SDF allows banks to deposit their excess liquidity.

Earlier yesterday, the Bangladesh Bank also decided that banks will be able to borrow through repurchase agreements (repo) from the central bank once a week, only on Tuesdays.

This move comes after the central bank halted its daily repo lending from 1 July, as part of efforts to stabilise the currency market and improve currency management. Since then, banks have been able to access repo loans on Mondays and Wednesdays.

Repo lending allows banks to borrow short-term funds from the central bank. The open-market operations involve the central bank buying and selling government securities to regulate money supply and credit conditions.

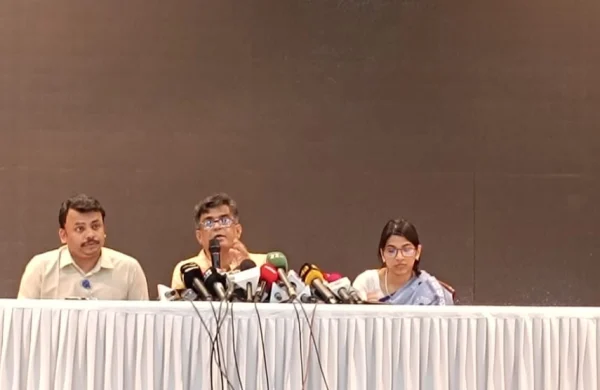

In September, Bangladesh Bank Governor Ahsan H Mansur announced that the policy rate would be increased several times.

“A contractionary monetary policy will be followed as long as inflation does not come under control. The policy rate will be hiked again next month,” he told journalists during a briefing on September 24.

Earlier on 25 August, the central bank increased the policy rate by 50 basis points to 9% in an effort to combat high inflation, marking the third time that the key interest rate has been raised this year. It was then hiked to 9.5%.

Governor Mansur had previously announced that the policy, or repo rate, would first rise to 9% and then potentially to 10% in phases.

The latest hike comes in line with his announcement.