LPG industry spins into troubled business model

- Update Time : Saturday, November 9, 2024

TDS Desk

Is there any business in the world that sells products at a fraction of their cost? Perhaps only charities can operate this way, but in the commercial sectors, it’s a recipe for disaster.

Yet, for nearly a decade, this unlikely model has been the reality for Bangladesh’s Liquefied Petroleum Gas (LPG) industry. Around two dozen companies have fiercely competed, selling gas cylinders at prices far below production costs. Some even gave cylinders away for free, hoping customers would commit to monthly refills.

But the strategy backfired, as each new entrant offered even lower prices, trapping the market in a cycle of unsustainable undercutting.

Consequently, only seven to eight companies now import Liquefied Petroleum Gas instead of nearly two dozen just three years ago. In addition, most of the around 30 companies that began bottling and selling LPG, now depend on a few importers for their survival.

“This is a very capital-intensive business. To capture the market, you have to inject cylinders, which require significant cash flow. But, many companies that came into the business are weak,” said Azam J Chowdhury, Chairman, Omera Petroleum.

HALF OF 58 LICENSEES WAIT AND SEE

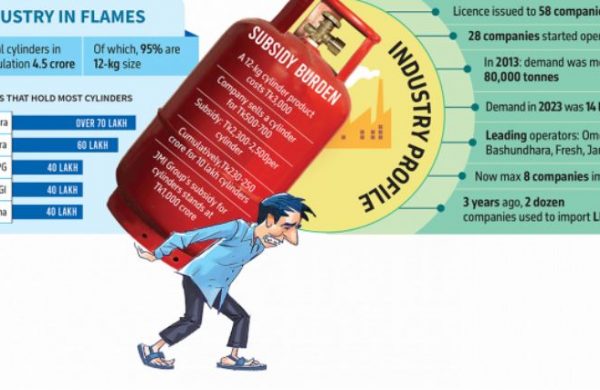

In this business situation, half of the 58 LPG licensees in the country have not started their businesses. Industry insiders said only companies with huge reserves of hundreds of crores of taka can survive in this cash-hungry market now.

So what does a cylinder really cost? The actual production cost hovers around Tk3,000 per cylinder. Yet major players like Omera, Bashundhara, and MGI (Fresh) sell theirs for Tk800-900, absorbing an immense Tk2,100-2,200 subsidy per cylinder.

For a company introducing 10 lakh cylinders, this subsidy alone amounts to Tk210-220 crore; for those with 40 lakh cylinders in the market, the figure soars to nearly Tk1,000 crore — a burden many simply cannot bear.

Industry insiders estimate that around 60-70% of the country’s 4.5 crore cylinders in circulation were sold for as low as Tk500-700, almost half the price if the cylinder is sold as scrap, underscoring the immense financial strain on companies.

Consider the experience of Md Abdur Razzaq, the founder and managing director of JMI Group. A newer player in the LPG business, Razzaq entered the market in 2020, and his 32 lakh cylinders earned him no more than Tk600 each – if anything at all – against a production cost of Tk3,000. His unexpected subsidy expenses climbed close to Tk1,000 crore, a sum he had not anticipated initially.

Originally, Razzaq had budgeted Tk700-800 crore for his LPG plant, including cylinder production and gas bottling. But with delays spurred by the pandemic and massive cylinder subsidies, the actual cost surged to around Tk3,000 crore, including over Tk2,000 crore in bank loans.

“The biggest hit came for me from the massive losses from cylinder sales – Tk1,000 crore,” he said.

“This business has now become viable only for companies with huge cash reserves, ones that can keep investing daily and hope to see profits in six or seven years,” said Md Abdur Razzaq, Founder and MD, JMI Group.

A BUSINESS FOR DEEP-POCKET COMPANIES

JMI Group, the country’s largest medical device manufacturer, now faces slim margins in LPG, with gross profits on a 12-kg cylinder falling in a range of Tk40-50, which was Tk300 a decade ago.

“This business has now become viable only for companies with huge cash reserves, ones that can keep investing daily and hope to see profits in six or seven years,” Razzaq told this correspondent.

Humayun Rashid, managing director of Energypac, which entered the LPG market eight years ago with its G-Gas brand, is still navigating challenges in the sector.

He alleged that mafia-like groups are manipulating the industry to expand their market shares, notably through a “cylinder game” – selling cylinders well below cost to drive out competition.

“They have set a clear plan to eliminate competitors, if necessary, by providing heavy subsidies,” Rashid said, pointing to these influential groups. “Dealers are encouraged to sell cylinders as scrap, fetching around Tk1,500 per cylinder,” he added.

Energypac has invested Tk800 crore in its LPG operations and has 26 lakh cylinders in circulation. Despite eight years in the business, the company has yet to see a profit.

Anup Sen, chief operating officer of Orion Gas, recalls that when Totalgaz, a French energy company, entered the Bangladesh market in 2002, it sold LPG cylinders profitably, without any subsidy. However, as more companies entered, some began offering cylinder subsidies to gain market share.

Operators believed that once a cylinder was sold, consumers would return for refills once or twice a month, building a long-term business given a cylinder’s minimum 15-year lifespan. But the reality has been different – about a quarter of Orion’s 10 lakh cylinders in the market are refilled each month, he said.

Echoing Energypac MD Humayun Rashid’s sentiments, Anup said, “If a 12-kg cylinder is sold as iron scrap, its price would exceed what LPG operators currently charge.”

Tanzeem Chowdhury, CEO of Omera Petroleum, said that competition among LPG operators intensified in 2017 when seven to eight companies entered the market simultaneously. Even before then, LPG operators had to provide a subsidy of up to Tk100 per cylinder.

“Now, many companies are offering subsidies as high as Tk2,500 per cylinder, which is unsustainable,” Chowdhury added.

Bashundhara Group, Bangladesh’s first private-sector LPG operator since 1999, is now feeling the strain of the industry’s unsustainable pricing practices.

“We used to make a nominal profit of Tk30-40 per cylinder back in 2014-15 when the production cost was Tk1,800,” said a senior official at Bashundhara LPG, who wished to remain anonymous.

“Now, we’re selling cylinders at just one-fifth of our cost,” he said.

With over 70 lakh cylinders in circulation, the highest in the country, Bashundhara remains unprofitable, the official said, blaming the industry’s pricing woes.

Reflecting on this financial toll, he said that while three years ago, 22 to 23 companies imported LPG, today, only seven to eight operators remain active, signalling the financial strain across the sector.

DECLINE OF LPG OPERATORS

Bashundhara Group was the first private-sector LPG operator in Bangladesh, followed by Jamuna Spacetech Joint Venture Ltd, French Totalgaz, Sri Lankan Laugfs, and Australian Kleenheat.

Until 2010, the market remained small with only six operators, including one state-owned firm. However, after the Awami League assumed office in early 2009, licences were issued in large numbers while the government decided that no new natural gas connections would be provided at the household level – only LPG would be available for future household needs. As a result, 58 licences have been granted as of June 2024.

Industry operators said that the market was stable, and cylinder prices remained at manageable levels until 2014-15. After that, the government began issuing two to three new licences annually.

Major conglomerates, including Omera LPG, Beximco Group, Meghna Group of Industries, Bengal Group, S Alam Group, TK Group, BM Energy (BD) Ltd, Energypac, Navana Group, Orion Group, JMI Group, Index Group, and Sena Kalyan Sangstha, entered the market.

Among these, Bengal Group sold its LPG unit to City Group, one of the country’s largest conglomerates, which is now poised to enter the market with the largest storage capacity. Many of these companies are seeking to sell their LPG units but face challenges due to substantial liabilities accrued from heavy subsidies provided on cylinders.

“This is a very capital-intensive business. To capture the market, you have to inject cylinders, which require significant cash flow. But, many companies that came into the business are weak,” said Azam J Chowdhury, chairman of Omera Petroleum, currently the largest LPG operator in Bangladesh.

He added that many consumers cannot afford a cylinder priced at Tk3,000.

Chowdhury explained that he invests $3-$4 million annually just to sustain his LPG business and remain competitive. However, he views cylinders as assets since they are repeatedly refilled, unlike some operators whose cylinders ended up as scrap in steel mills due to operational failures.

The LPG Operators Association of Bangladesh reported the issue of scrapped cylinders to the Bangladesh Energy Regulatory Commission and the Chattogram district administration in 2023.

LPG MARKET

The use of LPG as a cooking fuel began gaining traction in the early 2000s amid discussions about the potential depletion of Bangladesh’s natural gas reserves leaving LPG as a viable, safe, and eco-friendly alternative.

In 2010, the LPG market in Bangladesh was limited to 70,000 tonnes due to the small number of suppliers. Today, the country consumes around 140,000 tonnes of LPG each month, which totals nearly 1.7 million tonnes annually.

According to industry insiders, the LPG market has grown by 15-20% annually over the past decade and is expected to reach up to 3 million tonnes by 2030.

While the Bangladesh Energy Regulatory Commission sets the retail price for LPG at the beginning of each month, it does not control cylinder pricing. For October, BERC set the price of a 12-kg LPG cylinder at Tk1,456 for retail consumers, up from Tk1,421 the previous month.

BANKS CONCERNED OVER HUGE LPG INVESTMENT

The ongoing price-cutting war over LPG cylinders and the resulting financial losses, which have made the business commercially unsustainable, are raising concerns among lenders. Banks have significant reasons to worry as they have financed 60-70% of the more than Tk30,000 crore invested in the LPG industry.

Typically, banks offer loans to the LPG industry with a maximum repayment period of five to six years, which, according to Razzaq of JMI Group, is not feasible. “In India, this loan repayment period is 18 years because it is a very capital-intensive sector with low margins,” Razzaq explained.

“We are aware of the challenges facing the LPG industry. We also know that many cylinders are not being returned to operators,” said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

He agreed with Razzaq that the loan repayment period should ideally be extended to at least 8 to 10 years. However, he pointed out that banks face limitations, as they rely on short-term deposits to fund these kinds of long-term projects.