Businesses scuffle amid rising interest rates

- Update Time : Saturday, November 16, 2024

TDS Desk

The business sector in Bangladesh is grappling with a crisis due to successive increases in loan interest rates. Rising costs have stalled investments, creating widespread challenges. Business leaders point out that while consumer loan rates are typically raised globally to curb inflation, in Bangladesh, industrial loan rates have also been hiked for this purpose, disproportionately impacting businesses reliant on bank financing.

Adding to the turmoil, the aftermath of Sheikh Hasina’s fascist government saw factories across the country attacked and vandalized, forcing many to halt production.

Industry insiders revealed that the policy interest rate has been raised three times since August this year, currently standing at 10%. Consequently, loan interest rates have soared past 15%, with further hikes expected in the future.

Rising commodity prices have led to decreased demand for consumer goods, causing a sharp decline in manufacturers’ sales and increasing pressure on debt repayment. Higher interest rates are directly impacting employment, exacerbating the situation. The growing production costs are particularly affecting individuals with low or fixed incomes, leaving many unemployed or unable to cope with the high-cost market. Despite repeated hikes in the repo rate aimed at curbing inflation, it remains stubbornly high at 10.87%.

The installment payment period has also been reduced. Previously, a customer was considered in default after failing to pay six installments. However, starting last September, this threshold was reduced to three missed installments. Furthermore, from March next year, missing just one installment will result in default. Businesses are struggling to cope with these stringent rules.

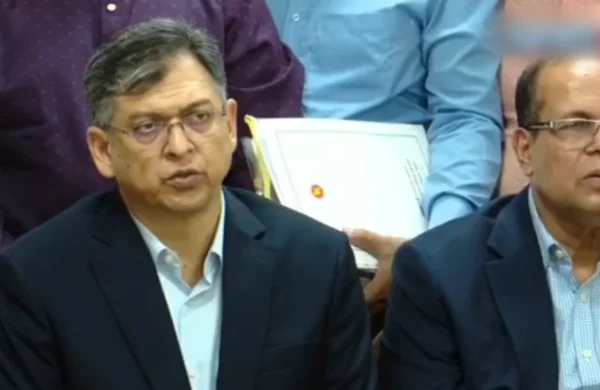

In this context, Md Jasim Uddin, former president of the FBCCI—the apex organization of the country’s business and industrial sectors—told that the interest rate on one-time loans, previously capped at 9 percent, has now exceeded 15 percent. Despite rising prices, fuel supply remains inadequate, and imports of capital equipment and raw materials have significantly declined.

He added that many factories have recently faced disruptions due to attacks, halting production. As a result, numerous business owners are struggling to pay salaries and loan installments on time. He expressed concern that from next March, traders will face default status after missing just one installment. Moreover, if one company within an industrial group defaults, banking facilities for all associated companies are suspended, making it impossible to import raw materials.

Jasim Uddin emphasized that these strict default rules should be implemented gradually, allowing businesses more time to adapt. As conditions improve, repayment periods could be progressively shortened. He also called for the publication of a list of willful defaulters, pointing out that 95 percent of businesses repay their loans. “How have the banks grown so large if the money wasn’t returned?” he asked, urging a fairer approach to address the challenges faced by legitimate businesses.

According to data from Bangladesh Bank, the opening and settlement of letters of credit (LCs) for importing goods decreased by approximately 13% during the first two months of the current fiscal year (2024-25). In July and August, LCs worth $10.03 billion were opened, marking a $1.48 billion (12.85%) decline compared to $11.51 billion during the same period last fiscal year.

Private sector credit growth has also slowed. In June of the 2023-24 fiscal year, private sector credit grew by 9.84%, down from 10.58% in the same period the previous year. By the end of June 2024, total bank loans to the private sector stood at Tk 16.41 trillion, compared to Tk 14.94 trillion at the end of the previous fiscal year.

Rising interest rates have compounded the challenges. Bangladesh Bank data shows the average interest rate on bank loans rose from 7.79% in July 2020 to 11.57% in July 2023.

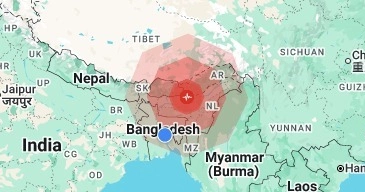

Since assuming office, economist and current Bangladesh Bank Governor Ahsan H. Mansur has prioritized inflation control through tighter monetary policy. On August 25, he raised the policy rate by 50 basis points to 9%, followed by another 50-basis-point hike to 9.5% in September. Most recently, the policy rate was increased further to 10%.

Former Dhaka Metropolitan Chamber of Commerce and Industry President, Syed Nasim Manzur, recently stated, “No country allows businesses to thrive under double-digit bank interest rates.”

Meanwhile, Mohammad Hatem, President of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), warned in an interview with this correspondent that traders may start defaulting on loans if they fail to meet installments from next March. He noted that this would further increase the volume of non-performing loans. Referring to World Bank data, Hatem highlighted that Bangladesh is among seven countries at risk of economic insolvency. He urged authorities to reconsider recent measures, including the reduction of the defaulting period to three months, suggesting a temporary withdrawal of the circular for at least a year to ease the crisis.

In response, Husne Ara Shikha, spokesperson and executive director of Bangladesh Bank, emphasized the governor’s firm stance- policy interest rates will continue to rise until inflation drops to single digits.