BB reverts to bank bailout despite inflation worries

- Update Time : Friday, November 29, 2024

TDS Desk

The Bangladesh Bank (BB) has backtracked on its decision to refrain from injecting fresh funds into crisis-hit banks in its efforts to curb persistent inflation.

Yesterday, the central bank said it had started giving money to troubled banks with depositors’ interests in mind and to prevent a bank run, which occurs when many customers rush to withdraw their funds from lenders.

While the injection of fresh funds is likely to increase inflationary pressure, the effect of any bank run would be far worse, two economists said.

However, if the banks still fail to stand on their own feet and return to the central bank for more funds, it would be very bad for the economy, they added.

“The fund injection will prove to be logical only if banks can rebound strongly,” said Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development.

“Banks should drive strongly to recover loans that are already non-performing,” said Mujeri, who is also a former chief economist of the Bangladesh Bank.

The BB’s U-turn follows a recent decision from the higher levels of the interim government to not allow any bank to collapse and cause pain to thousands of depositors, who have been struggling to get their money back from ailing lenders despite repeated attempts.

“I said earlier that the central bank would not print money to support weak banks, but we have temporarily backtracked from that considering the interest of depositors,” Bangladesh Bank Governor Ahsan H Mansur said during a press conference at the central bank headquarters on Thursday.

In September, Mansur had said that the Bangladesh Bank would not provide liquidity support to weak banks by printing money like the Awami League regime did.

Mansur added that the government and central bank are committed to ensuring the depositors’ interests. “We are providing liquidity support to those banks so depositors can get their money back.”

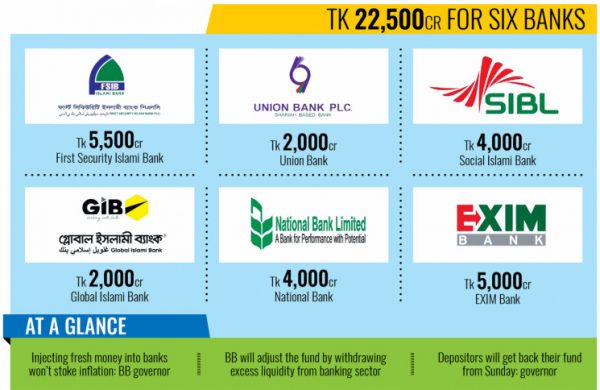

He said the banking regulator had provided more than Tk 22,000 crore to six crisis-hit banks.

“We hope this will be enough for them to mitigate the current crisis, but they will get more funds if needed,” Mansur said, adding that the central bank is always willing to tackle volatility in the banking sector.

“I want to assure depositors again that their money is fully safe in banks,” he said, adding that depositors would be able to get back their money from Sunday.

The injection of fresh money into the banking sector will not impact inflation, Mansur mentioned, saying the BB would adjust the funds by withdrawing excess liquidity from the banking sector by issuing Bangladesh Bank bills.

On Wednesday, the central bank introduced two more bills with much longer tenures than the three bills that were available at the time in an effort to mop up excess liquidity from the money market and rein in runaway inflation.

Mansur added that the central bank would maintain a tight monetary policy stance by withdrawing excess funds from the banking sector so that it would not hit inflation.

The monetary policy will remain neutral in this case, he said, adding that BB will manage it nicely.

Replying to a question, Mansur said that fund diversion from those ailing banks has now stopped, which is the biggest change at those lenders.

“The other change is that the banking regulator continues to monitor those banks,” he said.

Under the Awami League regime, the central bank provided liquidity support to those banks as per their demand, but there was virtually no accountability in the process.

On November 25, the central bank injected Tk 18,500 crores into First Security Islami Bank, National Bank, Social Islami Bank and EXIM Bank against demand for promissory (DP) notes.

Another Tk 4,000 crore was allocated to Union Bank and Global Islami Bank, according to central bank officials who are directly involved in the process.

A DP note is a written instrument that promises to pay a specific amount of money on demand to the bearer of the note. The central bank usually accepts such notes when a bank does not have available bills or bonds to provide as collateral.

The lenders were given the funds for a-six-month tenure at the repo rate, which currently stands at 10 percent.