Now 50 products to be considered to calculate inflation

- Update Time : Sunday, December 1, 2024

TDS Desk

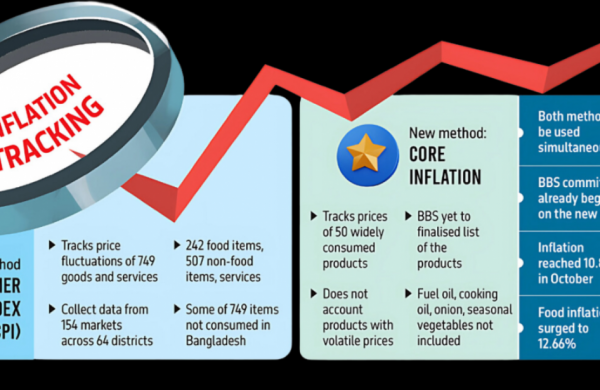

The interim government plans to introduce a new inflation calculation system within six months, alongside the existing method, to get a “more accurate picture” of the market, according to officials from the Bangladesh Bureau of Statistics (BBS) and the Ministry of Finance.

Officials say the new method, known as core inflation, will use the price fluctuations of 50 products that are most widely consumed by the people. However, the BBS has not yet finalised which products will be included in this list.

However, it says the new method does not account for products with volatile prices, such as fuel oil, cooking oil, onions and seasonal vegetables, which tend to decrease in price during the season and rise afterward.

A BBS committee has already begun work to determine which products will be included in the new inflation calculation. Officials have also indicated that another committee will be formed in this regard.

Currently, inflation in Bangladesh is calculated in line with United Nations guidelines, known as the Consumer Price Index (CPI). This method tracks price fluctuations for 749 goods and services, including 242 food items and 507 non-food items and services.

To calculate CPI, data are collected by the BBS from 154 markets across 64 districts at specific intervals. However, some of the 749 items included in the index are not consumed in Bangladesh.

According to sources, while most countries use the CPI as their primary measure of inflation, many also use Core Inflation as a secondary measure to help policymakers understand underlying inflation trends.

Experts say that core inflation is a logical method, as it focuses on frequently consumed items, offering a clearer picture of inflation.

BBS Director General Mohammed Mizanur Rahman told that over the phone on 26 November that the initiative to introduce the new method is being taken in response to requests from various quarters.

He said, “The finance adviser has provided instructions, and the BBS is analysing how the work can be carried out. A formal meeting will be called to decide which items to include. The method is likely to include 50 or 60 items.”

Mizanur Rahman added, “The previous inflation calculation method will still be used, and this new system will be introduced alongside it. The core inflation method will provide a more accurate picture.”

“Once the work begins, it will take at least six months to produce the first output, as the process requires starting from earlier data,” he added.

Bangladesh has been grappling with high inflation, which has remained in around double digits for over two years. Recent data show that inflation reached 10.87% in October, marking the highest in recent months, with food inflation surging to 12.66%. Despite multiple policy rate hikes by the Bangladesh Bank, inflation remains beyond control.

According to sources, in Bangladesh, rice has the greatest impact on food inflation, followed by fish. Even a slight increase in the prices of these items significantly drives up food inflation.

In his assessment, Khondaker Golam Moazzem, research director at the CPD, said, “Core inflation is used in many countries around the world. Bangladesh has been late in adopting such a calculation method.

“Our inflation basket includes many items that are used only occasionally or once or twice a year. Therefore, calculating core inflation is logical. This will provide a clearer picture of the items that people use more frequently,” he added.

Mustafa K Mujeri, former director general of the Bangladesh Institute of Development Studies (BIDS), told that, “Core inflation is a concept used to measure how monetary policy should be shaped. This calculation excludes items like fuel and many others.

“On the other hand, CPI reflects the true picture. It helps us understand how much of people’s income is spent, and what the standard of living is like. This cannot be understood from core inflation,” he said.

However, officials at BBS believe that a Special CPI should be implemented instead of the Core Inflation method. A Special CPI calculates inflation based on the price fluctuations of items that are predominantly consumed by low-income people.

A senior BBS official, on condition of anonymity, told that, “A Special CPI will help identify which prices are increasing, allowing the government to take necessary action to stabilise the prices of those items.”

Experts have repeatedly stated that inflation in Bangladesh is mostly not driven by demand but by supply-side issues. Inflation occurs owing to frequent changes in the supply chain, market manipulation, extortion and syndication. To address this problem, they believe political decisions are more crucial than policy initiatives.

Recently, the committee formed to prepare a white paper on the Bangladesh economy alleged that the previous government had manipulated inflation data to serve its own interests.