Tk trillions embezzled from stock market alone: White Paper

- Update Time : Monday, December 2, 2024

UNB

The White Paper on Bangladesh’s economy has revealed that trillions of takas were embezzled from the stock market through fraud, manipulation and deceit, particularly in placement shares and IPO processes.

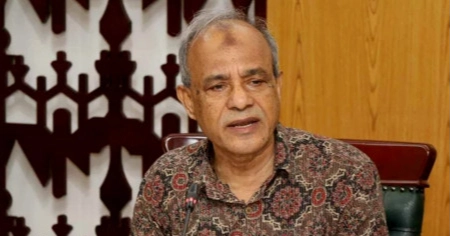

The committee, led by economist Dr Debapriya Bhattacharya, presented the findings at a press conference in the NEC conference room in the capital on Sunday.

Excessive government tutelage held back market development and constrained responsible institutions from carrying out their mandates.

This, combined with strong vested interest, resulted in an entrenched status quo of gambling and swindling, said the report.

Laws, rules, and regulations were deliberately deficient in their implementation. Weak and substandard companies came into the market through IPOs.205.

A major manipulation network involving influential entrepreneurs, issue managers, auditors, and a certain class of investors emerged.

In many cases, officials of the regulatory body themselves played a role as accomplices by exploiting legal loopholes or providing concessions.

Equity market growth is dragged by poor market infrastructure and unwieldy processing cycle for initial public offerings (IPOs). Current market systems are not supportive of a well-functioning market.

IPO valuations give the sponsors an upper hand over the general investors in the secondary market. Settlement delays raise the investors’ interest rate and price fluctuation risks. Liquidity is affected by the lengthy IPO cycle.

Absence of central counterparty clearing, interoperable information technology infrastructure and adequate trading platforms constrain brokers and clearing houses from transparent market making and trading.

Stunted investor confidence: Public perception of the stock market is impaired by the memories of manipulators facing no legal action based on the reports produced by the investigating committees.

The Centre for Policy Dialogue (CPD) a study 206of 71 businessmen in 2023 found 50 per cent of businessmen believe the prevalence of suspicious trading in the secondary market,

53.1 percent thought BSEC’s regulatory enforcement is weak, 50 per cent found financial reporting anomalous, and 56.3 percent believed poor companies enter the capital market through initial public offerings (IPOs). The same issues topped the list in 2022.

Market rigging is endemic. Several powerful investors and institutions artificially inflate the share prices through a series of trades, mostly among themselves, violating securities laws.203

They execute circular trades in targeted company shares, where some investors sell shares and others, related to them, buy shares in a series of trades to create the appearance of active trading.

The book-building process is manipulated to the extent that it no longer effectively determines the true valuation of a company’s shares. Anomalies in IPO valuations (mostly underpricing) give the sponsors an upper hand over the general investors in the secondary market.

Some big-ticket mutual funds were taken over by vested interests. Specifically, allegations of embezzlement of unit holders’ funds were made against the top two institutions in the closed- end mutual fund sector. BSEC looked the other way. The Khairul Commission extended the duration of all closed-end mutual funds by an additional ten years. Investor confidence plummeted.

The increase in the index prompted regulations to raise margin loan ratios, fueling the stock market surge.

The BSEC often maintained the index, disregarding rising stock prices, with regulatory action only taking place when prices began to fall. The controversial floor price system damaged the market’s international reputation, halting trading in strong companies while encouraging market manipulation due to low fines relative to potential profits.

After the Awami League government assumed power in 2009, the stock market surged within a year and a half before crashing suddenly in January 2011. The main Dhaka index fell by about half from its December 2010 all-time high.

The loss as of October 2012 was equivalent to 22% of GDP. It wiped out $27 billion in market capitalisation triggering a wave of social discontent.202 Some investors even committed suicide.

The ensuing liquidity crunch heightened solvency risks. Back in 1996, as in 2010, the index’s rise and decline resulted from collusive behaviour between institutional investors, high-net worth investors and brokerage firms, which together, drove the majority of the volume of shares traded. Retail investors suffered.

The government formed an investigation committee. Their probe flagged limited enforcement of regulation by the Bangladesh Securities and Exchange Commission (BSEC) and commercial banks’ excessive investment in stock markets.

The committee, led by a veteran banker Ibrahim Khaled, highlighted issues such as placement trading, irregularities in the IPO process, suspicious transactions under omnibus accounts, and the roles of influential businessmen, brokers, and market players. The report named companies whose share prices surged abnormally (300 to 900 per cent) in 2009 and 2010.