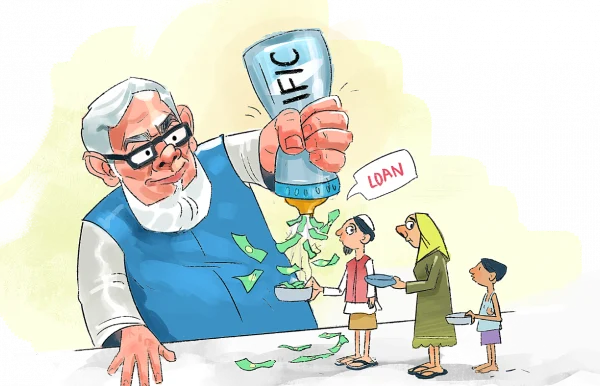

A company with a table, 2 chairs even got crores of loan: How IFIC was fleeced of Tk7,129cr

- Update Time : Sunday, December 8, 2024

TDS Desk

Northstone Engineering Ltd got registered with the Registrar of Joint Stock Company in November 2019. Within five days it opened an account with IFIC Bank’s Gulshan branch and two days later, it got a Tk807 crore sub-contract for Dohazari-Cox’s Bazar rail line.

The next day it applied for Tk400 crore in overdraft loan and got it sanctioned by the IFIC Bank board in two weeks.

And in next 12 working days, it withdrew all the amount in cash against an undated cheque and a piece of land in Narayanganj, whose mortgage deed was not yet done.

From company registration to getting Tk400 crore loan in hand, it took one-and-half months for Northstone with just Tk10 lakh in paid-up capital.

This was one of 14 companies that enjoyed the private lender’s such generosity as they were granted loans totalling Tk7,129 crore from its principal and Gulshan and other branches between 2020 and 2023, according to the central bank’s inspection reports, obtained by this correspondent.

After the interim government took over on August 8, many such reports keep surfacing as the authorities strive to bring the banking sector back on track.

Serve Construction was another company which got Tk435 crore overdraft loan in a similar haste. It opened an account with the bank’s principal branch on the same day it got a sub-contract for Khulna 200-300 MW dual-fuel power plant on 12 December 2020 and got loan approval on 17 January 2021. It took most of the amount in cash, instead of pay order as per the agreed terms, in the next eight working days.

These two firms obtained loan approvals without proper verification by the bank’s board within a month of their registration as companies, noted a special inspection team of the central bank’s Financial Integrity and Customer Services Department in April 2023, wondering how firms of Tk10 lakh paid-up capital each qualified for Tk835 crore in loans.

Some of the firms were luckier than others, with even faster loan processing despite having no office at the given address — forget about collateral, creditworthiness or business viability checks. Bangladesh Bank’s Department of Off-site Supervision spotted “immense pressure” from Salman F Rahman, the then-chairman of the IFIC Bank board, and Shah Alam, the former managing director (later adviser to the bank), on loan approvals for shell companies without due diligence.

TK470CR LOAN FOR ONE-ROOM FIRM

This correspondent visited at least four such addresses but failed to locate any firm’s office or executive.

This correspondent searched for Skymark International at its registered address on the 3rd floor of House 251, Block A, Bashundhara Residential Area.

In an unusually generous move, IFIC Bank issued an overdraft loan of Tk145 crore to Skymark just seven days after the company’s registration on 26 July 2022.

Subsequently, the bank’s principal branch increased the loan by an additional Tk400 crore, raising the total to Tk545 crore for the company, which claimed to be involved in import-export, freight forwarding, and wholesale retailing.

The bank did not secure any collateral for this loan and granted a six-month deferral on the requirement for collateral.

But no such entity was there at the given address where a new multistoried building was seen. Murad Ali, the building’s caretaker, stated that all the apartments in the building were rented out to families, and he had never heard of Skymark or its listed owners.

The company listed Abdullah Al-Manjour as the managing director and Ishrat Jahan Laizu as the director, with both showing a shareholding of Tk5 lakh each.

THE BANK’S GENEROSITY EXTENDED FURTHER

Vista International, a company operating from an office with a monthly rent of just Tk5,000, furnished with only two chairs and a small table, managed to secure a loan of Tk470 crore from the same branch of the bank.

When this correspondent visited the address listed with the Registrar of Joint Stock Companies and Firms (RJSC) at 796 Haji Tower, West Kazipara, Mirpur, the building owner revealed that the company had claimed it would provide internet services for the area from the office.

However, when registering with the RJSC on 15 September 2022, the company stated that it was involved in import, export trade, and distribution.

When an on-site inspection was conducted at the registered address of Vista International in Kazipara, no sign for the company was found.

This correspondent met the building owner, Mazharul Islam, on the fourth floor. He explained, “About a year ago, they (Vista International) rented a small room in my building for Tk5,000. They said they would manage internet services for the Kazipara area from this office.”

Mazharul Islam added, “They rented the office for seven or eight months. Inside, there were just two chairs and a small table. Over those months, the room was opened about 14 times, with only a couple of people coming in and out. Just before the July protests, they shut the office down and left.”

Mazharul Islam also mentioned, “Some bank representatives recently came here asking about them. I assumed they might have taken a loan of Tk1-2 crore. But now I hear it’s Tk470 crore! This is why our country is in this state – because of fraudsters like them.”

Vista International showed Mohammad Jahangir Alam, from Mukim Bazar, Bangshal Road, as the managing director, while Bibi Morium Misty, from BRAC Market, Azampur, as a director.

Similarly, Glowing Construction & Engineering Limited, which also obtained loans from IFIC Bank’s principal branch, was registered with the RJSC on 12 December 2022.

The company is listed as being involved in construction, engineering, and real estate. Currently, it owes Tk620 crore to the bank. The registered address is 129 Green Landmark Tower, Lake Circus, Kalabagan.

An on-site inspection found a multi-story building near Kalabagan-New Market Road. The building’s security guard Mohammad Mia and manager Rakib confirmed that no company by the name of Glowing Construction & Engineering Limited operated there.

After checking every floor of the building, it was clear that no such company existed. Another construction company was found in the building, but they had never heard of Glowing Construction & Engineering Limited.

Alpha Enterprise Limited secured a loan of Tk425 crore from IFIC Bank. The company was registered on 7 June 2022. Just 13 days after its registration, it received a loan of Tk85 crore from the bank.

The company’s registered address is Wapda Road, Rampura, Dhaka, but no physical presence could be found during an on-site visit.

An official from the RJSC told THIS CORRESPONDENT, “Anyone can register a company by paying the required fees and submitting the necessary documents. We don’t conduct on-site checks to verify if the company actually exists. That is not within our authority.”

SANCTIONING LOANS: IFIC STYLE

The central bank reports reveal several irregularities in the loan issuance process, including granting loans to shell companies set up to embezzle large sums of money. These companies bypassed essential loan regulations, such as checks on location, machinery, activities, stock reports, collateral, and staff.

Additionally, there were no prior transactions in their loan accounts, and the loan limits were extended without proper analysis.

Salman F Rahman had served as the chairman of IFIC Bank since 2015, while his son, Ahmed Shayan Fazlur Rahman, held the position of vice chairman.

The government owns a 32.75% share in IFIC Bank, whereas Salman F Rahman and his son jointly held a 4.11% stake in the bank.

Following the fall of the Awami League government on 5 August, the Bangladesh Bank dissolved the IFIC Bank Board of Directors and formed a new board in early September. As a result, Salman has lost control of the bank. He is currently in prison facing charges, including allegations of money laundering.

Other companies implicated in similar fraudulent loan activities at IFIC Bank, as highlighted in Bangladesh Bank reports, include Glowing Construction & Engineering Limited, which secured Tk620 crore, and Everest Enterprise, which obtained Tk550 crore in loans from the principal branch.

From the Gulshan branch, Blue Moon Trading received Tk600 crore, and Axis Business Limited obtained Tk582 crore.

Additionally, Northstone Engineering and Construction Limited took Tk438 crore, Serve Construction and Engineering Limited secured Tk444 crore, and Cosmos Commodities Limited obtained Tk612 crore.

Far East Business was granted Tk614 crore, Sunstar Business Tk615 crore, Brightstar Business Limited Tk165 crore, Eltron Trading Limited Tk449 crore, and Alpha Enterprise Limited Tk425 crore.

According to the Bangladesh Bank’s report, IFIC Bank’s Gulshan branch approved a Tk600 crore term overdraft loan for Blue Moon Trading Limited, based on a work order worth Tk1,267 crore.

The bank approved a six-month deferral to mortgage 8.5 acres of land in the Dhonua Mouza area of Bhaluka upazila, Mymensingh, valued at Tk25.5 crore, as collateral for the loan.

Despite unsatisfactory financial statements, repayment capacity, and financial indicators, IFIC Bank approved the loan without thoroughly verifying the accuracy of the company’s financial details.

The central bank report finds that Cosmos Commodities Limited, FarEast Business Limited, and Sunstar Business Limited together secured a total loan amount of Tk1,841 crore from IFIC Bank.

All of the companies were registered in June 2022 and offered third-party-owned properties in Gazipur Sadar and Sripur as collateral for the loan. However, these mortgage procedures have not been completed to date, the reports say.

The business addresses provided for these three companies were listed as the RS Building in Motijheel.

IFIC’S STATEMENT ON THE LOANS

At the time of distributing loans to six fraudulent companies, the chief manager of IFIC Bank’s principal branch was Hossain Shah Ali, who still holds the same position at the branch.

During the initial loan distribution, Syed Mansur Mustafa was the deputy managing director and chief credit officer. In the second round of loans to these companies, he was serving as the managing director. Despite changes to the bank’s board on 5 August, he remains the managing director.

When the correspondent visited the bank to inquire about these loans, he was unable to meet with the managing director or the manager of the principal branch.

Md Rafiqul Islam, deputy managing director and chief of branch business, IFIC Bank, who spoke on behalf of the bank, told this correspondent, “Bangladesh Bank is investigating the issue and will conduct further inspections. They have already taken information from us. We cannot disclose who received the loans until the investigation is complete.”

He added, “The individuals who approved these loans are still working in the relevant departments. If the central bank’s report recommends that they be removed, they will certainly be dismissed.”

Rafiqul Islam also said, “The loans have already been disbursed, and the investigation is ongoing. I cannot confirm whether Salman F Rahman was involved in these loans.”