Janata Bank in severe crisis for providing loans to AL-aligned businesspersons

- Update Time : Thursday, December 12, 2024

TDS Desk

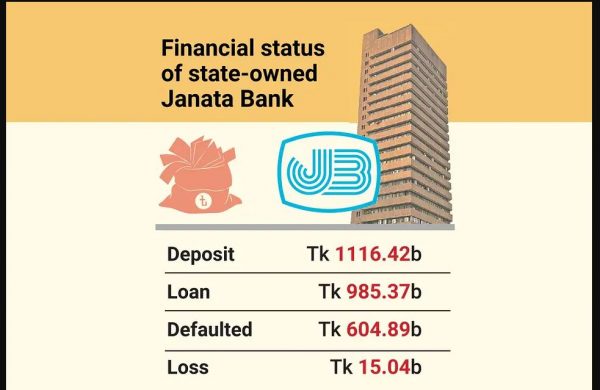

State-owned Janata Bank has incurred significant losses due to loans granted to businesspersons closely associated with the previous Awami League government. Around 55 per cent of the bank’s loans have been distributed among just 10 industrial groups.

As these influential clients failed to repay their loans on time, 61 per cent of the bank’s loans are now in default. This has resulted in a loss of Tk 15.04 billion in the first nine months of this year (January-September).

In a recent letter to the government, Janata Bank Chairman Fazlur Rahman stated that such a fragile situation has never occurred in the bank’s history. The bank is now facing a severe crisis. The gravity of the situation was also highlighted in a recent meeting with Bangladesh Bank Governor Ahsan H. Mansur.

According to sources within the bank, no decision has yet been made regarding how to address the current situation. Following the political upheaval on 5 August, many of the bank’s major customers are either in prison, in hiding, or have fled the country.

After the change in government, Mujibur Rahman assumed the role of Managing Director (MD) of the bank.

He told this correspondent, “We are doing everything we can. A roadmap for recovering defaulted loans has been finalised. Most of our clients are large businesspersons, so we will need the government’s assistance to recover these loans. Bangladesh Bank and the government have already assured us of the necessary support.”

ALMOST ALL OF THE INFLUENTIAL BUSINESSMEN ARE DEFAULTER

Nine of the top 10 customers of Janata Bank are now in default. Among them is the Beximco Group, owned by Salman F. Rahman, the former Prime Minister’s private industry and investment adviser.

The group first took a loan from Janata Bank in 1978, and since then, the volume of loan has been increasing. Beximco Group and its owner, Salman F. Rahman, have used Janata Bank loans to open new companies one after another.

However, they have not repaid the loans in a similar manner. With Salman F Rahman currently in prison, there is uncertainty regarding the recovery of the loan.

According to relevant sources, Beximco Group aggressively took loans from the bank before the 2024 parliamentary elections. In 2021, Beximco’s loan to Janata Bank was Tk 141.53 billion, which has now increased to Tk 244.82 billion, with most of this loan in default.

The group is now seeking new loans from the bank to pay workers’ salaries. However, it has failed to bring back more than 10 billion taka in export income to the country.

During the meeting, the bank’s chairman highlighted the delicate state of affairs, and central bank officials, including the governor, expressed deep concern

The central bank has appointed Ruhul Amin, Executive Director of Bangladesh Bank, as receiver for the Beximco Group following a court order. Regarding the loan, he told this correspondent that the factories were closed, and work had now started under subcontract. As a result, rent is being received, but export orders are not coming in because the bank could not open letters of credit.

He added that once transactions at the bank normalise, production could begin in full swing, and efforts would be made to repay the loan.

In addition to Beximco, other major defaulting customers of the bank include Saiful Alam, chairman of the S Alam Group, a business group close to ousted Prime Minister Sheikh Hasina.

The S Alam Group owes Janata Bank Tk 101 billion, which is now in default. The bank has already auctioned some of S Alam’s mortgaged properties, but the group has deposited very little amount of money in Janata Bank to regularise the loan.

Another major defaulter is the AnonTex Group, with a default of Tk 77.38 billion. The group’s chairman, Yunus Badal, secured a loan of about Tk 8 billion from Islami Bank even after defaulting on Janata Bank. At that time, the chairman of Islami Bank was Ahsanul Alam, the son of S Alam Group chairman Saiful Alam.

The controversial Crescent Group, operating in the leather sector, also owes Janata Bank Tk 37.89 billion. The group, headed by Abdul Quader and his brother, film director Abdul Aziz, emerged during the Awami League government and received significant loans from the bank.

Bashundhara Group, another industrial conglomerate with close ties to the Sheikh Hasina government, began borrowing from Janata Bank in 1995. As of 2021, Bashundhara’s debt to the bank was Tk 5.07 billion, which increased to Tk 25.73 billion by 2023. Most of these loans are now in default.

Additionally, the bank has a defaulted loan of Tk 18.98 billion from Thermex Group. Although the loan is in default, the bank is unable to register it as a defaulter due to a court order.

Other major defaulted loans include Tk 16.33 billion from Ranka Group, Tk 12.27 billion from Ratanpur Group, and Tk 8.29 billion from Sikder Group. Among the larger customers, the bank has regular loans from Orion Group.

Moreover, the bank has defaulted loans of Tk 8 billion from Globe Janakantha Shilpa Family, a business entity with close ties to the fallen Bangladesh Awami League. Of this, Tk 2.25 billion was granted on the special recommendation of Salman F. Rahman.

Janata Bank Chairman Fazlur Rahman stated in a recent letter to the government, “Loans have been distributed to a few customers in an uncontrolled manner. However, these loans have not been properly recovered. Now, if Janata Bank is to survive, there is no alternative but to recover the loans from these big customers.”

Meanwhile, top officials from AnonTex, S Alam Group, Crescent, Thermex Group, and Ratanpur Group, among the major defaulting customers, were contacted on their mobile phones to inquire about the defaulted loans, but no one answered.

However, Nurul Huda, the head of the finance department at Bashundhara Group, told this correspondent, “We have deposited money to regularise the loans. The credit committee has approved it. The loans will be regularised only if they are approved in the bank’s next board of directors meeting.”

BANK FACES HUGE LOSS

Janata Bank was once regarded as one of the most reputable banks in the country. Many industrialists became successful entrepreneurs with the bank’s financing. However, the bank is now at the top of the list for defaulted loans.

Over the last 15 years, the bank has experienced major loan irregularities and fraud, with some of its officers and directors being implicated in these issues.

As of last September, the bank’s deposits amounted to Tk 1.11 trillion, and loans totaled Tk 985.37 billion.

Of this, defaulted loans reached Tk 604.89 billion, accounting for 61 per cent of the total loans. At the end of September, the bank reported a net loss of Tk 15.04 billion.

Although it was required to maintain a security reserve of Tk 446.36 billion against these defaulted loans, the bank was only able to set aside Tk 55.50 billion due to a liquidity crisis.

As a result, Janata Bank’s capital deficit grew to Tk 339.21 billion by the end of September. The bank estimates that defaulted loans will rise to Tk 680 billion by the end of December, which will push the loss to Tk 26 billion by year’s end.

A memorandum from the bank’s board of directors reveals that a meeting was held with the governor on 1 December to discuss the overall situation of Janata Bank.

During the meeting, the bank’s chairman highlighted the delicate state of affairs, and central bank officials, including the governor, expressed deep concern.

The chairman noted that, in the current situation, the bank is forced to borrow between Tk 180 to 200 billion every day just to maintain regular operations.

Mustafa K. Mujeri, former chief economist of Bangladesh Bank, told this correspondent that the money deposited by ordinary citizens in the bank has been misappropriated.

He stressed that those responsible for defaulting on loans should be held accountable under the law, and steps should be taken to recover the funds. At the same time, the bank should continue its normal operations, with a special focus on recovering the defaulted loans.