Fraud with investors by BEZA

- Update Time : Thursday, December 19, 2024

TDS Desk

Bangladesh Economic Zones Authority (BEZA) was established with the promise of providing all necessary facilities to investors to ease the process of setting up factories and conducting business. To fulfill this goal, BEZA initiated the creation of special economic zones and economic zones under a project launched in 2010. Despite the assurance of offering 125 types of services under a one-stop service system—such as land acquisition, land mutation, environmental clearance, construction approval, and utility connections like electricity, gas, and water—only 20 types of services are available in practice. Investors still face significant harassment at every step to obtain these services.

Although investing in economic zones was supposed to come with tax exemptions, after finalizing agreements for several zones, VAT laws were enacted. These VAT laws take precedence over other regulations and agreements, resulting in VAT being imposed on the land leased to entrepreneurs. Investors are being compelled to pay an additional 15% VAT on the value of leased land, despite expressing their inability to comply for a long time.

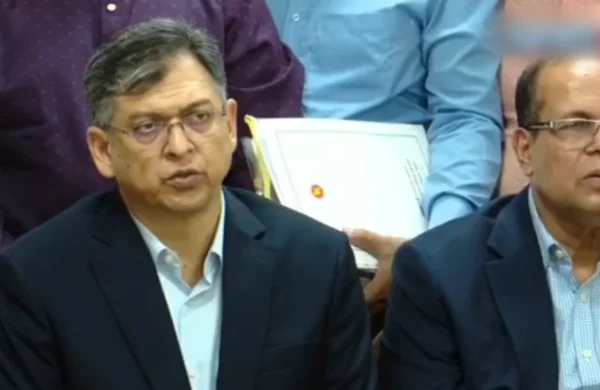

Recently, BEZA Executive Chairman Ashiq Chowdhury remarked at an event that there is no justification for establishing 100 special economic zones and that the government is moving away from this target. The focus will shift to ensuring utilities like electricity, gas, and infrastructure for five to ten economic zones that can be implemented quickly. A timeline will also be provided for ensuring infrastructure in these zones.

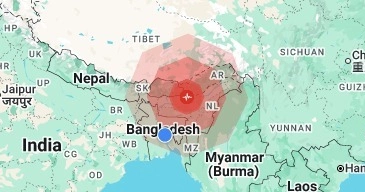

In 2010, the government announced the establishment of 100 economic zones across the country. However, 15 years later, questions remain about how many zones have been established in reality. Work towards this goal began in 2015, five years after the announcement. A decade later, progress on the plan has only reached 10%. Meanwhile, domestic and foreign investors were invited with great enthusiasm to these zones, but many were disappointed. After making initial investments, many investors failed to get utility connections for years, causing frustration among both domestic and foreign investors. While some foreign investors left, local investors faced challenges with VAT complexities and lack of promised services, preventing them from beginning production on time. Many entrepreneurs fear losses even before their factories are operational.

Among the country’s ten operational economic zones, two are government-run: Bangabandhu Sheikh Mujib Shilpa Nagar (BSMSN) in Chattogram and the Sreehatta Economic Zone in Sylhet. The remaining eight are operated by the private sector, including City Economic Zone, Meghna Industrial Economic Zone, Meghna Economic Zone, Hosendi Economic Zone, Abdul Monem Economic Zone, Bay Economic Zone, Aman Economic Zone, and East-West Economic Zone. According to BEZA records, 13 companies are already producing goods in the two government-run zones—11 in BSMSN and 2 in Sreehatta. However, despite approving 97 zones, only ten have become operational in the past decade. After the fall of the Hasina government on August 5, the fate of these zones remains uncertain.

Lutfe Siddique, Special Envoy to the Chief Adviser, mentioned the possibility of forming a Business Regulatory Reform Commission if necessary. He assured that there are no conflicts of interest at the highest levels of government, and changes to government procedures are being made to resolve issues swiftly through dialogue.

Javed Akhtar, President of FICCI, emphasized the need to boost credibility to attract foreign investments. He pointed out that foreign investments bring not just money but also knowledge and technology, which require robust policies for protection. Without such policies, investment will not flow in. He also criticized the practice of altering tax rates annually, which creates uncertainty for investors.

Anwar-ul-Alam Chowdhury Parvez, President of the Bangladesh Chamber of Industries, suggested that authorities should develop infrastructure in the zones before allocating plots to investors. Entrepreneurs reported that those who received plots still lack utility connections and have had to arrange water supply themselves.

Mashrur Riaz, Chairman of the Policy Exchange of Bangladesh, highlighted that a tax-friendly environment would significantly boost investment. Research shows that a 1% increase in tax rates leads to a 3.5% decrease in foreign investment, while a 20% reduction in tax burdens could increase foreign investment 14-fold and revenue more than six times. He emphasized the need for tax and tariff reforms.

Debabrata Roy Chowdhury, Head of Legal at Nestlé Bangladesh, shared an example: “In 2022, we invested $2.5 million based on then-prevailing tax rates. However, a change in tax rates within two years forced us to cancel subsequent investment plans, resulting in a loss of employment opportunities and revenue.”