10 Banks in Crisis, culprits remain out of reach

- Update Time : Wednesday, December 25, 2024

TDS Desk

The banking sector in Bangladesh is grappling with severe turmoil, plagued by a series of irregularities, including loan scams, defaults, and currency laundering. Among the institutions most affected, 10 banks are in particularly fragile conditions, with the culprits behind these financial crimes still elusive.

Despite efforts by the interim government to stabilize the sector, the masterminds behind large-scale loan scams, defaults, and illicit currency transactions remain out of reach. The criminal network involved in looting customer deposits, which includes bank officials such as managing directors, deputy managing directors, and branch heads, as well as regulators who turned a blind eye, appears to have gone underground.

A recent report by the White Paper Committee reveals that over $240 billion has been siphoned out of Bangladesh in the past 15 years through money laundering. However, despite these alarming figures, no significant legal actions have been taken against those responsible for facilitating these activities.

The only notable arrest was that of former IFIC Bank Chairman Salman F. Rahman. Meanwhile, prominent figures like S Alam, Nazrul Islam Majumder, Saifuzzaman Chowdhury Jabed, and AHM Mustafa Kamal remain unaccounted for, adding to the growing frustration over the lack of accountability in the sector.

The associates of these money launders are still serving as managing directors, deputy managing directors, assistant managing directors and GMs. Even the three former governors who were in charge when the banking sector suffered the most losses have not been taken to court.

Apart from the dismissal of some low-level officials, no action has been taken against senior officials. On August 19, 250 officials of Islami Bank and on October 31, 579 officials of Social Islami Bank were dismissed. They were accused of using fake documents and not following the recruitment process properly.

Union Bank dismissed 262 officials on November 18. In addition, Bangladesh Bank has suspended the promotion of 219 officials of Bangladesh Commerce Bank. Because there were allegations of irregularities against them with the regulatory body. Those who are the main beneficiaries of the big loan scam, have not been punished much.

A member of the banking task force formed to reform the banking sector said, “Whatever is happening in the banking sector is creating an image crisis. The wrong message is being sent abroad. Through this, our country is being harmed. Neighboring countries are benefiting. We are trying to reduce import dependence.”

Meanwhile, in addition to the liquidity crisis in banks, panic has also spread due to exaggerated propaganda through various media, including social media. As a result, customers started withdrawing money unnecessarily. Although certain banks could not return the money to customers, deposits in comparatively better banks increased. That is, panicked customers withdrew money from one bank and kept it in another bank. Concerned people believe that media trials create a negative impact on the normal functioning of banks.

As well as the factory owners being affected by this, there is a possibility of a negative impact on the country’s export earnings in the long term. Information said that Bangladesh’s ready-made garment exports to the US market, which is important for Bangladeshi exports, have declined. Therefore, first of all, it is necessary to bring the conspirators and collaborators in smuggling under the law.

Analysts said that these reasons are causing exports to decline in the United States. From January to October this year, Bangladesh’s garment exports to the country decreased by 3.33 percent. In contrast, garment imports from India, Pakistan, Vietnam and Cambodia have increased significantly. From April to October last year, India’s garment exports increased by 35 percent compared to the previous year.

Meanwhile, customers’ trust in 10 banks, which are victims of unlimited irregularities and corruption, has plummeted to the bottom. The banks are unable to return deposits as required. As a result, they are having to borrow from other banks and seek support from the central bank.

Those concerned said that a group including S Alam has been wreaking havoc in the banking sector. The unrest has increased since the Bangladesh Bank announced 10 weak banks without taking security measures.

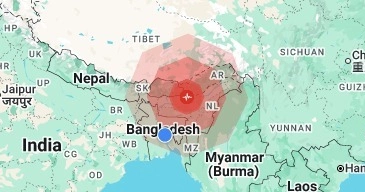

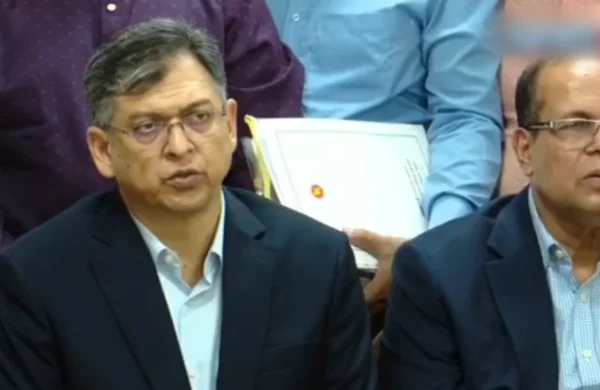

Bangladesh Bank Governor Ahsan H Mansur said in a press conference on September 8 that 10 banks in the country are insolvent. However, he also said that Bangladesh Bank will provide technical, advisory and liquidity facilities to the banks that are insolvent to turn around.

As part of this, 10 relatively strong banks have lent a total of Tk 6,850 crore to weak banks in the last one month. In addition, Bangladesh Bank has provided liquidity support exceeding Tk 22,500 crore. In total, the banks have received Tk 29,350 crore in assistance to overcome the crisis.

The banking sector crisis has emerged in the White Paper Committee report. The report says, “Politically influenced lending practices have deepened the banking sector crisis. The country’s banking sector has now become a ‘black hole’ due to political interference, fraud and various financial scams.”

Exim Bank Chairman Nazrul Islam Swapan said, “Depositors were panicked for various reasons. But we have been able to restore their confidence to a large extent. Now, no one is returning deposits worth lakhs of taka. Hopefully, we will be able to return deposits worth crores of taka by next January.”

An official of the financial intelligence agency BFIU said that suspicious transactions of Tk 1.5 lakh crore of S Alam Group have been identified in Islami Bank alone. But the entire investigation of that bank is not yet complete. It is initially believed that S Alam has laundered more than Tk 3 lakh crore through Islami Bank and other banks (Social Islamic, First Security, Union, Global, National, etc.).

The government is working to identify and recover money laundering from not only S Alam but also Beximco, NASA, Gemcon, Summit, Sikder Group and some other business groups. The real information will be known once the ongoing audit work in the banks is completed.

Bangladesh Bank Governor Ahsan H Mansur said that audit works in the banks are ongoing. However, we cannot disclose the audit findings right now. We are doing everything we can to protect the interests of our customers.

Bangladesh Bank has formed a task force to reform the banking sector. A member of the task force said, “The central bank will conduct a forensic audit of the banks in crisis in January. It will be a specialized audit, where emphasis will be placed on not only the banks’ loan assets, but also on their intangible assets.”

Regarding the turnaround of weak banks, senior banker and chairman of Agrani Bank, Syed Abu Naser Bakhtiar said, “Among the banks that have been affected by corruption, the sooner the customer trust in the bank is restored, the sooner that bank will recover. However, examples of a weak bank recovering through assistance are rare in Bangladesh. We have the shining proof of this in front of us: Padma, BDBL, Bangladesh Commerce Bank.”

Bangladesh’s credit quality has declined due to increased political risks and reduced growth prospects. A recently published rating report by credit rating agency Moody’s has stated this information. The meaning of this credit rating downgrade is that the country’s banking sector has become weaker. As a result, the country’s economic environment is likely to become more difficult, and this increases the risk for investors.