How sugar corporation’s money mess drags 5 state-owned banks into trouble

- Update Time : Friday, January 17, 2025

TDS Desk

When it comes to financial mismanagement, the Bangladesh Sugar and Food Industries Corporation (BSFIC) serves as a glaring example of how a single government organisation can jeopardise the stability of five state-owned banks.

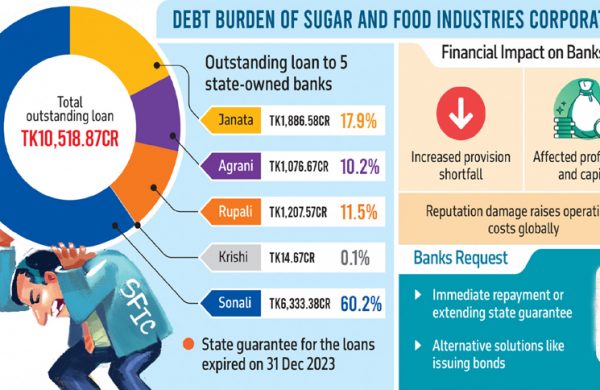

The BSFIC owes a staggering Tk10,518 crore to Sonali, Janata, Agrani, Rupali, and Krishi banks. For years, these loans remained unclassified thanks to a state guarantee. But that guarantee expired on 31 December 2023. Despite this, the banks have continued to show the loans as unclassified, bringing the Bangladesh Bank, the country’s central bank, into the spotlight.

The BB has now demanded explanations from these banks: why have they not classified the loans as non-performing despite the absence of the state guarantee for over a year? The answer lies in the devastating impact such a move would have on the financial health of these banks.

If the Tk10,518 crore loans are classified as non-performing loans (NPLs), the banks would be required to make massive provisions – something that is far beyond their capacity. Consider this: in 2023, the combined profits of Sonali, Janata, Agrani, and Rupali banks stood at Tk974 crore. To make adequate provisions for the BSFIC loans, it would take these banks more than 11 years of profits, leaving them unable to lend to clients in the interim.

The situation becomes even grimmer when Bangladesh Krishi Bank is included in the equation. Krishi Bank suffered a net loss of over Tk2,300 crore in FY2023-24. Factoring in its losses, the combined profits of these five state-owned banks turn negative, highlighting the dire consequences of classifying the BSFIC loans as NPLs.

Insiders in these banks said this is why these banks have resisted labelling the BSFIC as a defaulter. But without a renewed state guarantee, the BB has little choice but to press for answers, creating a showdown that could reshape the financial positions for these banks.

For now, the standoff remains. But experts said the deeper issue lies in a systemic flaw – one where state-owned entities burden state-owned banks, threatening the stability of the country’s financial system. They say even if bonds are issued or guarantees are provided, the enormous debt burden of the BSFIC remains with the government.

“Providing assistance in this manner is like a bottomless basket. The mills are being kept on life support, and there is no sense in continuing this way,” Dr Zahid Hussain, former chief economist of the World Bank’s Dhaka office, told this correspondent. “The sugar mills should either be liquidated or sold to the private sector.”

He said while the model of the state-owned mills has been changed to a corporation, there has been no change in the management culture.

“The corporations are still being run by retired military officers or civil servants, just as they were before, resulting in no improvement in their performance,” he added.

Zahid Hussain suggests that similar to the compensation packages given to workers when Adamjee Jute Mills was closed, a similar package could be provided to the workers of the sugar mills.

According to the budget documents for FY2024-25, the BSFIC operates 15 sugar mills, most of which are currently inactive. The corporation has been incurring continuous losses as production costs exceed selling prices, primarily due to outdated machinery and significant irregularities in the procurement and sale of sugarcane.

In FY24, the BSFIC reported an operational loss of Tk571 crore, with estimated losses projected to be Tk290 crore in the current fiscal year. Furthermore, the corporation’s debt-to-equity ratio stood at 180:80 in FY24, indicating that for every Tk80 of equity, the BSFIC has Tk180 of debt. This high ratio underscores the corporation’s heavy reliance on debt to finance its operations.

WHAT STATE BANKS’ LETTERS TO BSFIC SAY

Over the past three weeks, top executives of the lending banks have separately written to the chairman of the BSFIC, highlighting their concerns over the outstanding loans.

In the letters, the CEOs and managing directors of the banks stated that despite multiple requests to extend or renew the expired state guarantee or settle the outstanding loans, no payments have been made, nor has the guarantee been extended.

During this period, the banks also repeatedly appealed to the Ministry of Finance to issue bonds to address the situation, but no response has been received, as per the letters.

Banks said non-payment of these loans have increased their provision shortfall, negatively impacted profitability, and worsened capital deficits. Additionally, the reputational damage in the international arena has raised their operational costs in global transactions, the letters say.

In the letters, the banks have requested the immediate repayment of the loans, including interest. If this is not possible, they have asked for either an extension of the state guarantee for the loans, the issuance of bonds, or any alternative method to settle the banks’ liabilities.

WHAT BSFIC SAYS

After receiving the letters from the banks, BSFIC Chairman Lipika Bhadra, on 23 December last year, wrote to the Ministry of Industry, Ministry of Finance, and the Governor of Bangladesh Bank, requesting the issuance of treasury bills against the banks’ loans.

She also requested the issuance of a state guarantee until 2025 to protect the banks from provision shortfalls and capital deficits until the treasury bonds are issued.

In the past, the government issued treasury bonds to settle outstanding loans for entities like the Bangladesh Petroleum Corporation and the Bangladesh Jute Mills Corporation. Similarly, Lipika Bhadra has urged the government to issue bonds against the debts of the BSFIC to settle the banks’ liabilities.

According to officials from the Ministry of Finance and the Financial Institutions Division, the Division sent a letter to the Finance Secretary on 31 December, requesting the issuance of treasury bonds against the outstanding dues owed by the state-owned banks to the BSFIC, as well as the extension of the state guarantee until 2025.

WHY ARE STATE-OWNED SUGAR MILLS IN CONTINUOUS LOSSES?

In her letter, Lipika wrote that the various loans of the BSFIC and its affiliated sugar mills have been ongoing for a long time. Initially, the principal and interest were paid regularly, but due to the government’s failure to provide timely trade gap and subsidy funds, the corporation has been unable to repay the loans for an extended period due to financial difficulties.

She noted that because the production costs exceed the selling price, the sugar mills are incurring continuous losses. As the loans from banks accumulate with compound interest, the losses have been increasing year by year. With such a heavy debt burden, the mills are unable to become profitable.

According to sources, the production cost of sugar in government-owned mills exceeds Tk300 per kg, which is far higher than the market price of Tk140.

In 2015, former Finance Minister Abul Maal Abdul Muhith sent a letter to then-Industry Minister Amir Hossain Amu, recommending the closure of state-owned loss-making factories, including the sugar mills, instead of continuing to operate them.

In the letter, Muhith stated that none of the industrial enterprises that had been revived with government assistance had turned profitable. Instead, they continued to survive solely on government support, resulting in the waste of public funds.

He further emphasised that if any plans were made to reopen closed industries, the Ministry of Finance would not provide any assistance.