Govt pushes drive to modernise NBR with new tech to augment revenue collection

- Update Time : Monday, February 10, 2025

Staff Correspondent:

The interim government is pushing for further technological advancements at the National Board of Revenue (NBR), finding there is much ground that Bangladesh needs to make up within this specific field, even on its regional peers.

It also provides the added advantage of widening the tax net, a perpetual target for tax authorities, without having to chase new taxpayers. The newest technologies are able to capture eligible payers under each category with minimum human intervention.

The revenue collecting authority has taken a number of moves already to upgrade its systems, which would ultimately enhance tax collection.

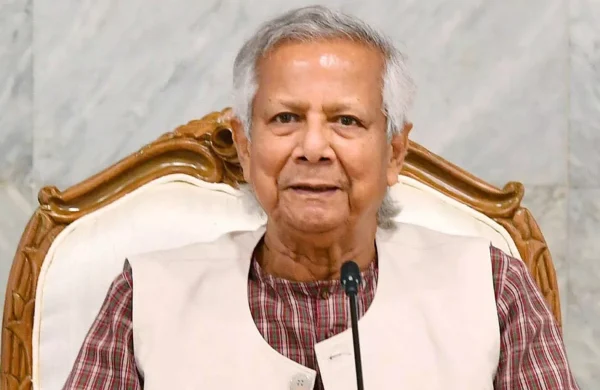

Finance Adviser Dr Salehuddin Ahmed, while visiting the NBR offices recently, said that revenue collection and revenue expenditure are almost satisfactory given the context of Bangladesh.

“But we are still far behind regarding technological and systematic aspects,” he said. He also mentioned that the government is feeling the matter currently.

“But we do not have much time (in our hands),” he added.

The finance adviser mentioned that there is no other option to step into the modern era of revenue collection. “We have to use modern technology,” he added.

In a move towards modernising tax administration, the NBR has taken a comprehensive plan to integrate advanced technological solutions into its operations.

This initiative aims to enhance efficiency, transparency, and taxpayer convenience, aligning with the government’s broader vision of a ‘Smart Bangladesh’.

The NBR’s technological inclusion strategy encompasses several key components designed to streamline processes and improve service delivery.

AUTOMATED TAX FILING SYSTEM: The introduction of an automated online tax filing system will enable taxpayers to submit returns electronically, reducing paperwork and processing time. By this system, the NBR is hoping to get more than 14 lakhs of income tax return submissions this time.

E-PAYMENT PLATFORMS: Collaborations with mobile financial service providers, such as bKash, will facilitate electronic tax payments, making the process more accessible and user-friendly.

DATA ANALYTICS AND AI: The adoption of data analytics and artificial intelligence will assist in identifying tax evasion and improving compliance through predictive analysis.

DIGITAL RECORD MANAGEMENT: Transitioning to a digital record-keeping system will ensure secure storage and easy retrieval of tax records, enhancing operational efficiency.

By the Alignment with National Digital Initiatives, the NBR is in line with Bangladesh’s ongoing efforts to bridge the digital divide and promote inclusive innovation. The government’s ‘Zero Digital Divide’ campaign, launched in 2022 with the establishment of the e-Quality Centre for Inclusive Innovation, aims to eradicate digital exclusion and promote the transfer of digital public infrastructure solutions to other developing countries.

The integration of mobile financial services into the tax payment system is expected to significantly enhance financial inclusion. Platforms like bKash have already revolutionised financial transactions in Bangladesh, providing services such as money transfers, bill payments, and mobile recharges. By enabling tax payments through such platforms, the NBR aims to make tax compliance more accessible, especially for individuals in remote areas.

While the NBR’s technological inclusion initiative marks a significant step forward, it also presents challenges, including the need for robust cybersecurity measures, taxpayer education, and infrastructure development.

Addressing digital inequality remains crucial, as disparities in access to technology can hinder the effectiveness of such initiatives.

A senior official of the revenue collecting authority said that the NBR is committed to overcoming these challenges through capacity building, public awareness campaigns, and partnerships with stakeholders.

“By embracing technological inclusion, the NBR aims to create a more efficient, transparent, and taxpayer-friendly environment, contributing to the nation’s economic growth.”

The International Monetary Fund (IMF) has set a revised target for Bangladesh to increase its tax-GDP ratio by 0.6-percentage points for the current fiscal year. Under the government’s commitment to the IMF, the tax-GDP ratio is expected to increase by 0.5 percentage points each fiscal year.

Currently, the tax-GDP ratio of the country is one of the lowest in the world, and it is yet to reach double digits. Bangladesh’s tax-to-GDP ratio currently stands at just 7.9 per cent—significantly lower than neighbouring countries. India’s ratio is 12 per cent, Nepal’s is 17.5 per cent, Bhutan’s is 12.3 per cent, and Pakistan’s is 7.5 per cent.