Liquidity crisis in Islamic banks as deposits decline

- Update Time : Friday, February 28, 2025

TDS Desk:

Bangladesh Bank data reveals that deposits at Shariah-compliant banks have declined. The sector insiders attribute this to a crisis of trust leading many customers to withdraw their deposits, with fewer new deposits replacing the outflow.

As a result, these banks have experienced a sharp decline in surplus liquidity. Despite this downturn in deposits, loan disbursement has continued to rise, further straining liquidity reserves.

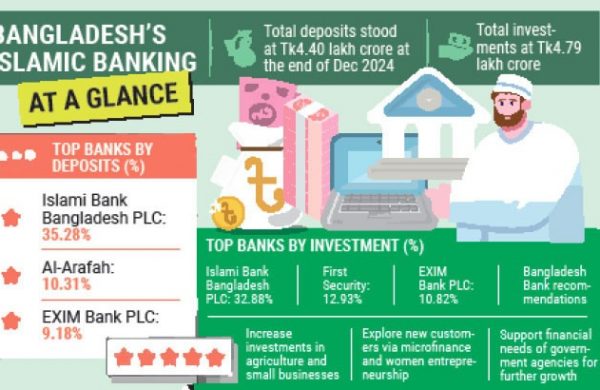

According to Bangladesh Bank data, at the end of December 2024, total deposits in Islamic banks stood at Tk439,758 crore, down from Tk443,403 crore in December 2023. This marks a decline of Tk3,645 crore or 0.82% in one year.

On the other hand, these banks’ total investments reached Tk479,310 crore at the same time, indicating that their investments exceeded deposits by Tk39,552 crore.

At present, the Islamic banking system accounts for more than 24% of total deposits and 28% of total investments in Bangladesh’s banking sector.

The data also revealed that excess liquidity in Islamic banks dropped by Tk1,672 crore, standing at Tk9,435 crore at the end of December 2024, down from Tk11,107 crore in December 2023.

This decline was primarily due to deposit shortfalls and increased withdrawals by customers.

Although deposits in the Islamic banking sector have been increasing, these banks have been experiencing a persistent liquidity crunch for several months due to rising loan disbursements and investments, sources at the banks said.

An official at Islami Bank Bangladesh Ltd stated that declining customer confidence stemmed from changes in ownership, as most Islamic banks are controlled by business groups.

“In the last five months of 2024, many clients withdrew their deposits following the exposure of irregularities within these banks,” he said.

Bangladesh Bank’s recommendations

In its report, Bangladesh Bank noted that while Islamic banking is expanding in Bangladesh, the number of rural branches of full-fledged Islamic banks has not kept pace with demand.

The central bank suggested that Islamic banks should invest more in socially beneficial industries, particularly in agriculture and small businesses.

Additionally, the report recommended that Islamic banks explore new customers in microfinance projects, support women entrepreneurs, and meet the financial needs of government agencies.

These measures could provide Islamic banks with a significant advantage for future growth.

In recent years, investment growth has outpaced deposit growth, primarily due to fund mismanagement by some banks and declining public confidence. This has resulted in a continuous liquidity crisis in the Islamic banking sector.

To address the situation, Bangladesh Bank has provided liquidity support to Islamic banks and recently reformed the governing bodies of major Islamic banks to restore public confidence following leadership changes.

As of December 2024, 10 full-fledged Islamic banks were operating in Bangladesh, with 1,697 branches out of a total of 11,361 branches in the country’s banking system.

Additionally, 34 Islamic banking branches of 16 conventional commercial banks and 825 Islamic banking windows of 20 conventional commercial banks are providing Islamic financial services.

Deposits and investments in Islamic banks

At the end of December 2024, total deposits in the Islamic banking system stood at Tk439,758 crore.

Of this, the 10 full-fledged Islamic banks held Tk388,507 crore, accounting for 88.34% of total Islamic banking deposits. Islamic banking branches and windows contributed 5.15% and 6.51%, respectively.

Among all Islamic banks, Islami Bank Bangladesh PLC received the highest share of deposits at 35.28%, followed by Al-Arafah (10.31%), EXIM Bank PLC (9.18%), First Security (8.82%), Social Islami (6.55%), Shahjalal Islami (6.49%), Standard Bank (4.58%), Union Bank (4.08%), Global Islami (2.80%), and ICB Islamic (0.25%).

Total investment (loans and advances) in the Islamic banking system reached Tk479,310 crore at the end of December 2024.

Among the 10 full-fledged Islamic banks, Islami Bank PLC made the highest investment at 32.88%, followed by First Security (12.93%), EXIM (10.82%), Al-Arafah (8.97%), Social Islami (7.99%), Union (5.90%), Shahjalal (5.61%), Standard (4.15%), Global (3.01%), and ICB Islamic (0.15%).

The trade and commerce sector received the highest investment share at 36.27%, followed by Large Industries (33.06%) and CMSMEs (Cottage, Micro, Small, and Medium Enterprises) at 8.49%.