MCCI urges NBR to abolish cash transaction in company tax

- Update Time : Tuesday, March 4, 2025

Staff Correspondent:

The Metropolitan Chamber of Commerce and Industry (MCCI) on Tuesday urged the National Board of Revenue (NBR) to consider abolishing the cash transaction condition in the company tax rate.

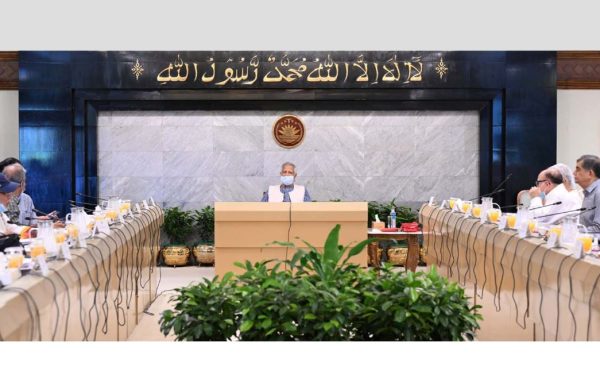

The appeal came during a pre-budget meeting MCCI leaders held with the NBR at NBR Confrence room, according to a media release.

They said that there is an opportunity to reduce tax evasion and increase revenue by improving tax administration and introducing automated digitalisation.

In the proposal they said that although the corporate tax rate has been reduced conditionally in the past fiscal years, no one was able to enjoy this benefit due to the cash transaction conditions as per the Finance Act, 2024.

MCCI president Kamran T Rahman read out the proposals where he mentioned that Bangladesh’s economy is 80% informal, where banking dependence is not complete. As a result, it is very difficult for large and medium companies to comply with this condition.

In addition, the effective tax rate is extremely high, which reaches 40-50% in some cases due to tax deduction at source and unauthorized expenses. In addition to reducing the corporate tax rate to the actual rate, the advance income tax and turnover tax policy need to be reformed so that the tax is based on income and not on turnover.

The MCCI said that the current tax administration and policy-making framework are being run under the same umbrella, which is hampering transparency, accountability and effectiveness.

“MCCI believes that by separating tax policy and tax administration, it will be possible to formulate independent and transparent policies, which will be business and investment friendly.”

It said that waste and harassment in tax collection activities will be reduced and businessmen will get an easier and faster tax payment system. It will be possible to reduce the interference of the administration on the regulatory agencies, thereby increasing the effectiveness of the tax system. Long-term planning will be easier by establishing an independent board to determine tax policy.

“The inclusion of the business community in determining policy is very necessary,” MCCI added.

The MCCI president welcomed the efforts of the NBR chairman in completely popularising the online system by making it mandatory for all government officials and employees, officials of six multinational companies, and all scheduled bank officials to submit tax returns online in a very short time. However, MCCI believed that this system will gain more popularity if it gets the facility of attaching documents online.

“The VAT management software system is not fully automated. MCCI believes that this automation system will be accelerated through E-Invoicing. Also, MCCI believes that the automation of the rebate system will be fully automated subject to changes in the law, which used to consider all elements related to the business as goods or services.”

Keeping in mind the needs of the time, the MCCI mentioned that it is very important to introduce provisions for online hearings by making necessary amendments to the existing laws at the tax assessment system, appeal, tribunal, alternative dispute resolution (ADR) stage.

“It is also very important to make the systems of issuing notices to taxpayers, taxpayers’ attendance at hearings, etc. online through amendments to the law.”

As a result of this system, business expenses including wastage of money and time of traders will be reduced.

MCCI believed that launching a centralized online portal will make tax-related services easier, the payment process will be faster and the need for direct presence at the tax office will be reduced.

As per the Income Tax Act 2023, filing of Proof of Filing of Income Tax Return (PSR) has been made mandatory in 45 cases under Section 264, which is reducing the efficiency of business as well as hampering the state’s initiative to facilitate business.

The accounting system is becoming complicated for the PSR collector. It makes it unreasonable to collect tax-sensitive information, the MCCI said in this budget proposal.

Moreover, despite the deadline for filing the return, the provision for filing the updated PSR is observed to be contradictory and unrealistic.

Also, it is not morally acceptable to punish the payer for the failure of the provider of goods or services. The provision of 50% more tax deduction at source has been introduced for failure to file PSR, so the provision of a fine of Tk 10 lakh for the person responsible for tax deduction at source is not reasonable.

Consequently, MCCI urged to limit the scope of this provision by realistically considering the areas.

The Income Tax Act 2023 stated that wealth for a period of more than 06 (six) years shall be considered for the 6th year. In reality, it is very difficult to preserve the accounts of the aforementioned years for the 6th year. Without keeping any boundary for a period of more than 6 years, the enacted law is inconsistent with the real situation of Bangladesh.

MCCI president requested the chairman to introduce this provision in the new Income Tax Act, 2023 in line with the aforementioned law.

According to the Finance Act, 2024, tax has been imposed on provident funds, approved old age funds, approved provident funds and workers’ welfare funds of private institutions. On the other hand, there is no provision for imposing any tax on the said funds of government institutions. In this case, the boundary between government and private institutions is legally blurred.

In this situation, MCCI requested the NBR to take measures to refrain from taxing funds.

On the issue of the special tax benefits for the Small and Medium Enterprises (SME) sector, the MCCI president said that It is necessary to set a separate tax rate for the development of the SME sector. If the turnover tax is reduced, SME traders will be encouraged to come under the tax.

“It is necessary to reduce VAT and customs duties on raw materials to encourage the domestic manufacturing sector. If the input tax credit facility of VAT is provided to the Small and Medium Enterprises (SME) sector, this industry will develop and the government’s revenue will increase. This input tax credit system needs to be introduced in all rates of VAT.”

The MCCI president said that the responsibility of the National Board of Revenue is not only to collect revenue, but also to create a tax structure that is business-friendly, investment-friendly and accelerates socio-economic development.

“We hope that the NBR will take more effective initiatives in this regard,” he said.