What Bangladesh stands to gain if Trump lifts sanctions on Russia

- Update Time : Friday, April 18, 2025

TDS Desk:

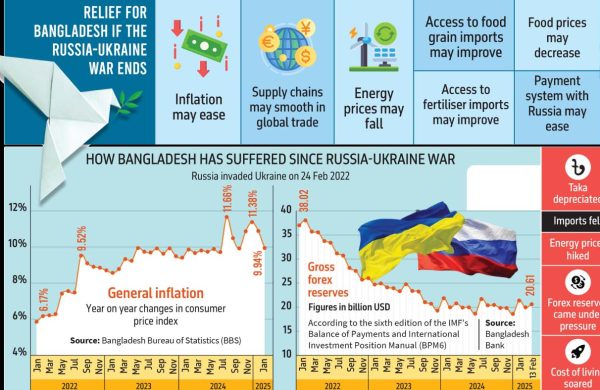

Bangladesh holds its breath as Russia and Ukraine, under US mediation, reach a tentative deal on 25 March 2025 to halt attacks in the Black Sea — a key global trade route. However, its implementation hinges on the US first accepting key Russian demands. If enacted, the deal could resolve complex issues like Rooppur loan repayments for Bangladesh, as well as lower food, fertiliser, and fuel prices.

Experts said the Black Sea ceasefire would ease Bangladesh’s trade with the warring nations, cutting freight costs. With both sides agreeing in principle to spare each other’s energy infrastructure, fuel prices are expected to drop, dragging down LNG, coal, food, and fertiliser prices — saving foreign currency and boosting Bangladesh’s economy.

The Kremlin demands a pause in Black Sea fighting, contingent on lifting sanctions on Rosselkhozbank and other financial institutions involved in global food trade, including fish and fertilisers, and reconnecting them to SWIFT. All restrictions on food, fertilisers, ships, and agricultural machinery must also be lifted. Following Russia’s invasion of Ukraine, the US and allies imposed extensive sanctions to hinder Moscow’s war efforts. As President Trump seeks to end the conflict, his administration hints at easing sanctions but also threatens new measures. While Trump can lift most US sanctions independently, Congress approval is needed for the severest restrictions, and international sanctions require global cooperation.

The Russia-Ukraine war has disrupted Black Sea trade since 2022. The deal aims to stop the use of force and the military use of commercial vessels on this route. Efforts to secure a ceasefire in the region, with mediation attempts involving various global players, have yet to yield results.

“The ceasefire would be a very positive initiative. This conflict created uncertainty and insecurity in international maritime routes. Avoiding the Black Sea led to increased shipping costs and higher product prices, especially in fuel oil and wheat,” Professor Mustafizur Rahman, an honorary fellow at the Centre for Policy Dialogue (CPD).

Bangladesh imports several products from both Russia and Ukraine, such as crude oil, food grains, fertilisers, metals, and chemicals.

“If this ceasefire deal takes effect, prices of these products will decline. This will have a positive impact globally and equally benefit Bangladesh,” he added.

A COMPLEX DEAL TO BE MADE

While the current mediator, the US, is hopeful about the deal’s materialisation, it has become more complex with conflicting demands from the Kremlin and the EU.

After peace talks with the Trump administration in Riyadh, the Kremlin put forward certain demands, including lifting US and EU sanctions on Russian institutions involved in trade, restoring their SWIFT access, and removing all restrictions on food, fertilisers, ships, and agricultural machinery.

But the European Union (EU) said the withdrawal of all Russian forces from Ukraine would be one of the main conditions to lift or amend EU sanctions on Russia.

US Secretary of State Marco Rubio yesterday said the US will evaluate demands made by Russia, while Ukrainian President Volodymyr Zelensky said he hopes the US will “stand strong” in the face of Russian demands to lift sanctions. He met with Russian Foreign Minister Sergei Lavrov on 18 February in Riyadh.

UK Prime Minister Keir Starmer accused Russian President Vladimir Putin of making “hollow promises” on the ceasefire deal.

Experts believe that the US will comply with Russia’s conditions gradually, if not all at once.

They said this deal will have a ripple effect on Bangladesh’s economy — government subsidies on electricity and fuel will decrease, transportation costs in the private sector will fall, and it will strengthen Bangladesh’s forex reserves while stabilising the exchange rate.

HOW BLACK SEA UNREST AND US SANCTIONS IMPACTED BANGLADESH:

The Black Sea links key countries — Russia, Ukraine, Turkey, Bulgaria, and Romania — to major maritime routes in Europe, the Mediterranean, and the Middle East, serving as a vital transit route for goods like oil, gas, and agricultural products.

The Russia-Ukraine war disrupted Bangladesh’s imports, particularly wheat and fertilisers, which led to high prices.

US sanctions on Russian banks further complicated transactions for the $12 billion Rooppur Nuclear Power Plant, 90% of which is financed by Russia.

Bangladesh now owes Russia over $1 billion in interest and fees, delaying the project. Recent payment attempts through Sonali Bank were blocked by Standard Chartered Bank in New York.

An official from the Economic Relations Division (ERD) said that the Rooppur loan transaction complications would be resolved if the US withdrew sanctions on Russian institutions.

A senior official from Sonali Bank, on condition of anonymity, “If the SWIFT transaction ban on Russia is lifted, payments for Rooppur can begin. Although some obstacles may remain, if the US lifts sanctions on Rosatom, transactions can proceed smoothly.”

Rosatom, Russia’s State Atomic Energy Corporation, is implementing the Rooppur power project.

IMPACT ON RMG

Bangladesh’s garment exports were also significantly impacted due to the war.

Apparel makers have said nearly 4% of Bangladesh’s garment export market is in Russia. Due to the Black Sea crisis, goods were rerouted through other countries to reach Russia, raising costs and reducing export volumes.

Rakibul Alam Chowdhury, former vice president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), “If the Black Sea issue is resolved, the struggling export market in Russia will revive, and garment exports will increase.”

Khairul Alam Suzan, vice president of the Bangladesh Freight Forwarders Association (Baffa), “If the US lifts sanctions on Russia, Bangladesh’s RMG sector will benefit significantly. In recent years, new markets for garment exports were emerging in Russia, but the war has put those prospects at risk.”

“Also, we import a large quantity of food products from Russia and Ukraine. Importing from alternative countries has significantly increased prices, creating a food crisis. If the Black Sea becomes safe again, the additional costs will decrease, and imports and exports will return to normal,” he added.

IMPACT ON FUEL OIL

Zahid Hossain, former lead economist of the World Bank’s Dhaka office, “Before the Ukraine-Russia war, the price of crude oil was below $50 per barrel. During the war, it rose to $130, and now it is around $70-72.”

“If sanctions on Russian oil exports are lifted and the US increases oil production as promised, oil prices in the international market could return to pre-war levels. This would greatly benefit Bangladesh,” he said.

“If oil prices fall in the international market, LNG and coal prices will follow suit. Both the government and private sector in Bangladesh will significantly benefit. This will lead to lower energy and transportation costs for the private sector,” he added.

Echoing Zahid Hussain, Md Aminul Ahsan, chairman of the Bangladesh Petroleum Corporation (BPC), said, “The Black Sea deal will have a significant impact on the global energy market and Bangladesh will benefit as well, since the country is fully dependent on imports for both refined and unrefined petroleum products.