Govt arms up to face summer power crisis, goes for equal load-shedding in cities, villages

- Update Time : Thursday, April 24, 2025

Staff Correspondent:

As temperatures inch upward and the sun readies its summer assault, the government has begun laying out its battle plan to stave off an impending power crisis – this time with a more equitable approach than in years past.

Gone is the old playbook of funneling electricity into Dhaka’s arteries at the cost of dimming rural homes, officials say. The interim administration has drawn a line in the sand: this summer, villages will not be left to sweat in silence so that city lights and air conditioners (ACs) can stay on.

In a move emblematic of this fresh resolve, the Power Division is turning to heavy fuel oil (HFO)-based power plants, run by independent power producers (IPPs), to bolster the grid. These high-cost, high-output plants have often remained idle in peacetime, but the IPPs now say they are on standby – ready to fire up their turbines.

Money, often the weakest link in this chain, has been fast-tracked. The Finance Division has released Tk2,400 crore to secure imports of liquefied natural gas – a key fuel for power generation. In tandem, the government has quietly settled its outstanding dues with international energy partners, a gesture aimed at mending frayed ties and ensuring supply stability.

Chevron, which shoulders over 60% of the country’s natural gas demand, had been owed $532 million as recently as August last year. That bill has now been paid in full – a quiet but significant signal of fiscal intent.

“We did relatively well during Ramadan,” said Power and Energy Adviser Muhammad Fouzul Kabir Khan. “We didn’t face major load-shedding. But the summer is a different beast. We will sit down twice very soon to review the situation and re-strategise for Eid-ul-Adha and the remainder of the season.”

The numbers are daunting. Peak demand could surge to 17,000-17,500 megawatts if the mercury hits 42-43°C – levels not unlikely in a changing climate.

“To ensure a relatively smooth supply of power,” the adviser said, “we will have to rely more on oil-fired plants, even though their generation cost is high. That’s the trade-off.”

But perhaps the biggest shift is philosophical.

“This time,” he said firmly, “load-shedding will be shared equitably between cities and villages. We’ve rejected the Dhaka-first approach.”

KM Rezaul Hasanat, president of the Bangladesh Independent Power Producers’ Association (Bippa), pointed to the growing strain on private producers, who are being asked to step up amid rising fiscal headwinds.

“We are facing multiple challenges – from withheld payments to shrinking profit margins caused by the recent cut in service charges and the continuous depreciation of the taka against the dollar,” he said.

Yet, despite the pressure, Hasanat said the independent power producers stand ready.

“Our generation capacity from HFO-based plants alone is around 4,500MW. That’s available, if the government chooses to tap into it.”

Yet, Power Division officials feared that despite best effort and strategy, consumers would have to undergo light to moderate load-shedding of around 2,500-3,000MW if fortunate enough during summer, but otherwise load shed could go beyond 3,000MW.

WHY THIS BACKTRACKS

Asked what forced them to retreat from earlier decisions on HFO based power plants, PDB chairman Md. Rezaul Karim said, “These things are mainly due to the unavailability of sufficient gas to run power plants with full potential. Outdated transmission lines are also dampening our ability to run coal-based power plants.”

“When we lower the voltage from 400KV to 131KV, we face system loss in the process due to the outdated transmission system in areas like Cumilla, Mymensingh, Gazipur, and Kodda. We will operate coal-fired power plants at full capacity once the transmission system is fixed.”

PDB hopes that transmission line problems will be solved by next September.

HF-based and other power plants, their generation and capacity

PDB officials said, currently, oil-based plants are running from 5pm to 11pm, generating 3,000-3,500MW of electricity daily to compensate for the shortfall from gas and coal-fired plants.

The highest generation from oil-fired plants so far has reached 3,700-3,800MW and is expected to rise further in coming hot and sweltering temperatures.

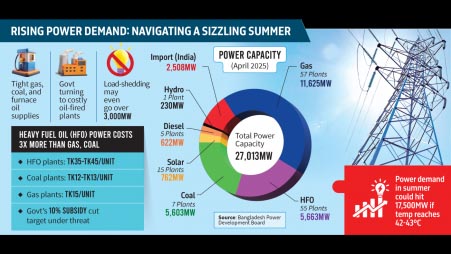

PDB’s latest data released on 15 April shows there are 140 power plants with combined generation capacity of 27,013MW and 55 HFO based power plants have 5,663MW and five diesel fired power plants have 622MW generation capacity.

On the other hand, 57 Gas fired power plants have 11,625MW, seven coal fired plants have 5,603MW, one Hydro plant has 230MW, 15 solar plants have 762MW capacity, and import from India contributes 2,508MW electricity.

DOWNSIDE RISK OF LEANING TO HFO-BASED POWER

A downside of this move is that it will derail the Power Division from its objective of reducing power subsidy by 10%, given the high cost of power produced at HFO based plants, which ranges from Tk35-45 per unit, which is three times costlier than gas and coal fired power plants.

But Bangladesh is currently under an International Monetary Fund (IMF) loan package worth $4.7 billion in seven installments, three of which Bangladesh has already received. Of the IMF’s sets of conditions, reducing subsidies in the power and energy sector is a strong condition.

As part of the plan of reducing subsidy, the power division resorted to a policy of shying away from expensive oil-based power plants and as part of that move it has reduced service charges from 9.04% to 5% given on the amount of total oil import cost.

It also raised the cargo size from 15,000 tonnes to 20,000 for private oil importers to feed power plants, which many private entrepreneurs say is a deliberate policy of throwing them in a straitjacket.

According to PDB, coal-based power plants cost Tk12-13 while gas-based plants cost Tk15 and oil-fired power plants cost Tk35-45 for each unit of power generation.