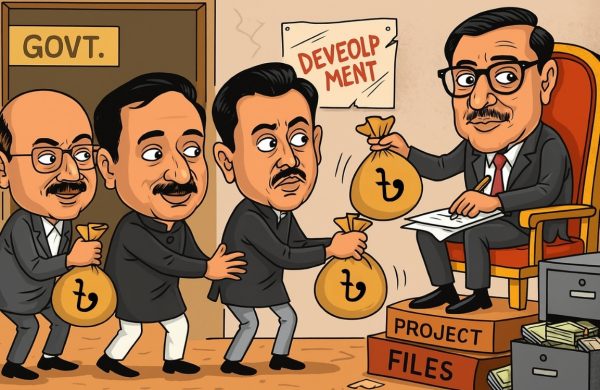

Power sector scam: 7 Star Group laundered billions

- Update Time : Tuesday, May 13, 2025

Staff Correspondent:

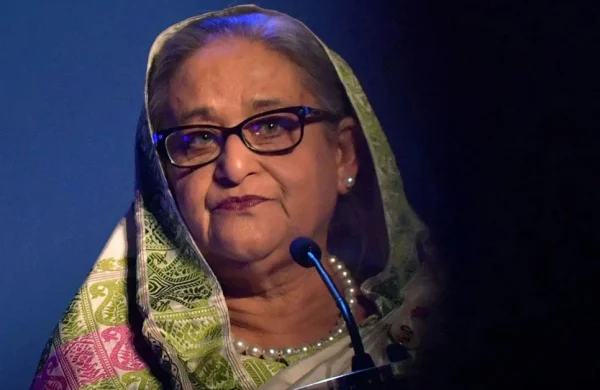

A staggering Tk28 lakh crore has been laundered out of Bangladesh during the over-15-year authoritarian rule under the ousted fascist prime minister Sheikh Hasina, according to the report submitted by the interim government’s White Paper Committee on the state of the country’s economy. Significant portions of this amount were siphoned off from the power sector, disguised as payments under the controversial “capacity charge” system.

Preliminary investigations have revealed that the entirety of the funds paid as capacity charges have been laundered abroad.

the Anti-Corruption Commission (ACC) sought information on 172 power plants allegedly involved in widespread irregularities and corruption in the power sector during the previous government.

The ACC has sent letters to various departments concerned, including the Power Development Board (PDB), ACC Deputy Director and Public Relations Officer Akhtarul Islam told journalists.

Meanwhile, early findings indicate that seven high-ranking individuals from the former regime were directly involved in laundering the money. These individuals, all considered VIP under the previous administration, are now being referred to as the “Seven Star Group”.

Investigators say they jointly looted and laundered public funds before relocating to foreign countries, where they are now living safely.

Those named in the group include Hasina’s sister Sheikh Rehana, Hasina’s son Sajeeb Wazed Joy; Rehana’s son Radwan Mujib Siddiq; former state minister for power Nasrul Hamid Bipu; former principal secretary and SDG coordinator Abul Kalam Azad; former principal secretary to Sheikh Hasina Ahmad Kaikaus, and Summit Group owner Aziz Khan.

Those involved in laundering funds from the power sector reportedly paid commissions to these seven individuals. Moreover, three former Bangladesh Bank governors have also been named in connection with the scandal. To facilitate the laundering, capacity charges were paid in US dollars rather than in Bangladeshi currency.

The prolonged dollar shortage and severe liquidity crisis affecting banks in Bangladesh is largely attributed to this money laundering. Despite significant remittance inflows, the dollar crunch in the power sector persists.

The unrestrained plundering, particularly through capacity charges, has become a stranglehold on the country’s economy. As a result, some banks have gone bankrupt, and the dollar crisis has worsened across the country. Even genuine businesspeople are struggling to buy dollars for their operations, and banks are struggling to open LCs, creating a broad economic crisis.

Money laundering through the capacity charge system has left the economy hollow, a crisis that the current government is now addressing.

Transparency International Bangladesh (TIB) Executive Director Dr Iftekharuzzaman commented, “Over the past 15 years, the power sector has seen the worst corruption under the guise of capacity charges. Special laws prevented open competition. The irregularities and corruption in this sector are no secret. We all know there must be accountability for this.”

Several officials from the Power Division revealed that owners of rental and quick rental power plants sold their plants multiple times to the government and collected thousands of crores in capacity charges.

From 2008-09 to 2021-22 fiscal years, Tk89,740 crore was paid in capacity charges to rental, quick rental, and IPP (independent power producer) power plants.

A report from the Implementation Monitoring and Evaluation Division released last July noted that Tk90,000 crore was spent in 14 years. According to PDB officials, if the figures from FY23 and FY24 are included, the total exceeds Tk1 lakh crore, all of which was laundered.

PDB data show that in the FY09 fiscal year, capacity charges amounted to Tk1,507 crore, which rose to Tk1,790 crore in FY10, Tk2,784 crore in FY11 and reached Tk5,000 crore in FY12. From FY13 to FY18, capacity charges remained between Tk5,000 crore and Tk6,000 crore annually.

In FY19, the figure jumped to nearly Tk9,000 crore, rising further to Tk11,000 crore in FY20 and over Tk13,000 crore in FY21. In FY22, the amount climbed to Tk13,700 crore.

The following fiscal year saw a sharp increase of over 25%, with Tk17,155.85 crore paid in capacity charges.

Despite this steep rise in payments, the power output from private rental and IPP plants declined during this period. Yet, similar amounts continued to be paid over the next two fiscal years. All these payments were made in US dollars, which investigators now identify as a key reason behind the country’s worsening dollar shortage.

According to available information, around Tk10,623 crore – approximately 12 % of the total expenditure – was paid in capacity charges to the influential Summit Group during this period. Summit’s rise to dominance in the power sector is widely attributed to its chief patron, Sajeeb Wazed Joy, son of Sheikh Hasina.

In second place is the UK-based company Aggreko International, which received Tk7,932 crore. The company allegedly operated in Bangladesh’s power sector under the patronage of Ridwan Mujib Siddiq Bobby. A significant portion of the funds Aggreko received is said to have gone to Bobby, with S Alam Group reportedly acting as Aggreko’s proxy in Bangladesh.

Third on the list is the Chinese company Erda Power Holdings, which was paid Tk7,523 crore. Erda’s unofficial local agent was reportedly Abul Kalam Azad. The fourth-highest recipient, United Group, received Tk6,575 crore, while Rural Power Company Limited ranked fifth with Tk5,117 crore.

Under the guise of capacity charges, Bangla CAT Group collected Tk5,067 crore. The Payra coal-fired power plant – set up just three years ago as a joint venture between Bangladesh and China – was paid Tk4,550 crore. Another group received Tk4,525 crore, while Khulna Power Company Limited (KPCL) was given Tk4,054 crore. KPCL, a publicly listed firm, has 35% of its shares owned by Summit and another 35% by United Group. The remaining 30% are held by general investors, meaning a large share of KPCL’s capacity charge payments ended up with Summit and United.

Among local companies, Hosaf Group received Tk2,699 crore, Mohammadi Group Tk2,544 crore, Doreen Group Tk2,183 crore, and Max Group Tk2,154 crore. US-based APR Energy was paid Tk2,087 crore, and Singapore’s Sembcorp received Tk2,057 crore. Shahjibazar Power Plant was allocated Tk1,968 crore, while Sikder Group received Tk1,842 crore and Confidence Group Tk1,574 crore. US-based New England Power Company’s NEPC consortium received Tk1,528 crore for its Haripur plant.

Sri Lankan firm Lakdhanavi & Associates received Tk1,401 crore, followed by Sinha Group with Tk1,391 crore, Anlima Group with Tk1,274 crore, Baraka Group with Tk1,247 crore, Regent Group with Tk1,037 crore, and Energypac with Tk1,027 crore. Several other power plants collected less than Tk1,000 crore each in capacity charges.

Additionally, Bangladesh paid about Tk11,015 crore in capacity charges for electricity imports from India over the past nine years. Imports began in the 2013–14 fiscal year, with that year’s capacity charge amounting to Tk501 crore. The charge increased to Tk922 crore in 2014–15, dipped slightly to Tk840 crore in 2015–16, and rose again to Tk1,068 crore in 2016–17. It continued to climb, reaching Tk1,078 crore in 2017–18 and Tk1,553 crore in 2018–19 following new import agreements. The charges were Tk1,493 crore in 2019–20, Tk1,805 crore in 2020–21, and Tk1,724 crore in 2021–22. Combined, the capacity charges for the 2021–22, 2022–23, and 2023–24 fiscal years stood at around Tk4,000 crore.

Initially, rental and quick rental power plants were approved for three-year terms. However, these contracts were repeatedly extended, and in some cases, the same plant was reportedly sold to the government multiple times.

According to insiders, investors typically contributed only 25-30% of the total project cost, with the rest financed through bank loans. The government, via the PDB, repaid these loans with interest within three years as per contract terms.

Additionally, companies received profits on their equity investments. Even after recovering the construction costs, ownership of the plants remained with the private companies. When the contracts were extended, the government paid again – albeit slightly less – for the same plants.

This recurring payment scheme enabled widespread profiteering in the name of quick rentals. Many of the companies that received quick rental licences and secured bank loans have since defaulted. Experts argue that corruption in the power sector has severely damaged the country’s economy.