Islamic banks fall behind in remittance race

- Update Time : Tuesday, July 29, 2025

Staff Correspondent:

Bangladeshi nationals living abroad sent more money home in the twelve months to March this year compared with the same period a year earlier.

But many chose to avoid Shariah-based banks—once key players in channelling these funds—due to the institutions’ fragile financial health, a severe liquidity crisis, and media reports of massive lending irregularities and mismanagement.

As a result, conventional banks, which had a greater need for US dollars and consequently offered more competitive remittance deals to expatriates, saw a steady inflow of funds, according to senior bankers.

According to Bangladesh Bank’s Islamic Banking and Finance Statistics published last week, Shariah-compliant lenders handled just 22 percent of total remittances in March 2025, down from 38 percent in early 2024.

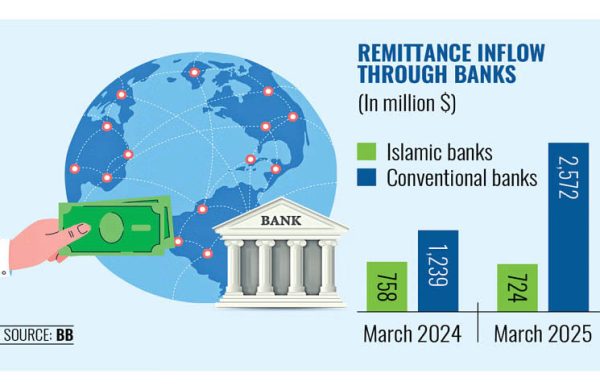

In absolute terms, remittances received through Islamic banks fell from $758 million in March 2024 to $724 million in March 2025. By contrast, conventional banks more than doubled their receipts from $1.24 billion to $2.57 billion, cementing their dominance.

In the report, the central bank noted that despite occasional upticks, remittance flows through Islamic banks remained mostly stagnant or declined.

Total remittances through all banks hit $3.29 billion in March 2025, the highest monthly inflow of the year. While Islamic and conventional banks both contributed, it was the latter that consistently captured the largest share, especially after the political changeover in August 2024.

The central bank report attributed the shift partly to declining confidence in Islamic banks among migrant workers, reportedly due to concerns over mismanagement.

This perception gap enabled conventional banks to capitalise on the opportunity by positioning themselves as more stable and efficient channels for remitting foreign earnings.

The fallout from the political changeover in August 2024, when irregularities in several Islamic lenders began to come to light, appears to have deepened the crisis for the Shariah-based lenders while creating opportunities for the conventional ones.

As per the BB report, Islamic banks now manage just over one-fifth of total remittances, compared with nearly two-fifths previously.

“This is because of their [conventional banks’] efforts to clear overdue import bills of state enterprises. Private banks also increased their efforts to attract remittances by offering new and better customer service,” said a private banker preferring not to be named.

The downward trend for Islamic banks was also reflected in their deposit base.

Total deposits in the banking industry rose from Tk 17.89 lakh crore in March 2024 to Tk 19.51 lakh crore in March 2025, an increase of 9.07 percent. Islamic banks saw only a moderate 4.61 percent rise in deposits, from Tk 4.19 lakh crore to Tk 4.39 lakh crore.

In contrast, deposits in conventional banks grew from Tk 13.69 lakh crore to Tk 15.12 lakh crore, registering a 10.44 percent increase.

The market share of deposits for Islamic banks declined from 23.44 percent in March 2024 to 22.48 percent in March 2025, the BB report states.

The report pointed to mismanagement uncovered in the aftermath of the July 2024 unrest as a possible reason for depositors’ waning trust in Islamic banks.

“This may be due to mismanagement by Islamic banks, which was detected in the aftermath of the July uprising. Consequently, depositors lost their trust in Islamic banks and thereby withdrew their deposits, which helped conventional banks’ deposit base to grow,” it states.

A similar pattern was observed in investments. Total banking sector investments rose from Tk 19.86 lakh crore in March 2024 to Tk 22.12 lakh crore in March 2025, registering an 11.39 percent growth.

Islamic banks increased their investments from Tk 4.94 lakh crore to Tk 5.53 lakh crore, marking a 12.01 percent growth, while conventional banks grew from Tk 14.92 lakh crore to Tk 16.59 lakh crore, marking an 11.19 percent rise.

However, the Shariah-based lenders’ share of total banking sector investments declined. Conventional banks now account for around 75 percent of all such investments.

According to the BB report, while both banking segments expanded their investment activities, conventional banks played a more dominant role in supporting the economy.