Digital platforms boost microfinance since Covid, Yunus tells Bernama

- Update Time : Sunday, August 17, 2025

TDS Desk:

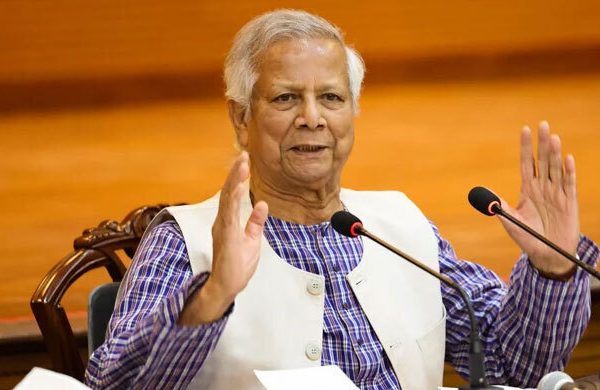

The adoption of digital platforms has not only sustained but also expanded microfinance operations since the COVID-19 pandemic, said Professor Dr Muhammad Yunus, Chief Adviser and founder of Grameen Bank.

In an interview with Malaysian news agency Bernama at the end of his three-day official visit to the country, Yunus said the shift to digital systems was an unplanned but was a response to pandemic-related restrictions.

Grameen Bank’s weekly in-person gatherings for loan payments, applications, and group support became impossible due to the pandemic.

“It was not planned that way. COVID-19 forced us to move online. Borrowers began using phones and digital transfers for repayments, while weekly group discussions shifted to Zoom,” he said.

The interview was conducted by Bernama Editor-in-Chief Arul Rajoo Durar Raj, along with International News Service Editor Voon Miaw Ping and Assistant Editor of the Economic Service Kisho Kumari Sucedaram.

The Nobel Peace Prize laureate was in Malaysia from Aug 11 to 13 at the invitation of Prime Minister Anwar Ibrahim.

The shift worked so well that even after the pandemic ended, borrowers and staff did not return fully to physical meetings, said Yunus.

He cited discovering how a Grameen staff member responsible for loan collections was based in Norway, yet continued to work seamlessly through online platforms.

“It amazed me that everything was done virtually, but still very complete and effective,” he said.

Founded in 1983, Grameen Bank pioneered collateral-free microcredit to empower the poor, particularly women, and on Sunday serves more than nine million borrowers in Bangladesh. Its digital adoption, Yunus noted, is now inspiring other microcredit programmes worldwide.

Malaysia was among the first to adopt the Grameen model through Amanah Ikhtiar Malaysia (AIM) in 1987, which continues to provide small-scale financing to low-income households.

“It (digitalisation) came to us automatically, imposed by nature and now other programmes in microcredit are adopting what has been done,” the 85-year-old economist and social entrepreneur added.