4 state banks in trouble as 90pc of classified loans turn bad

- Update Time : Thursday, September 11, 2025

Staff Correspondent:

When the central bank and the finance ministry are busy stitching together a rescue plan for half a dozen weak private lenders, the state-owned ones are crumbling from within.

The latest Bangladesh Bank data shows that the four state-owned commercial banks saw their classified loans swell by 10% in just six months, reaching a staggering Tk146,362 crore in June this year. Of this mountain of defaulted credit, Tk132,499 crore or over 90% has been categorised as bad or loss money with minimal chance of recovery.

But bad loans are only part of the rot. These banks are choking under severe capital shortfalls, meagre allocations against risk-weighted assets, provisioning gaps, and shrinking profits. The capital cushions that are supposed to absorb shocks are nearly threadbare.

According to banking experts, the issue is no longer about profitability but about the very survival of these banks. They warn that unless the central bank intervenes decisively through restructuring or mergers, the country’s largest state lenders may soon be too weak to support the economy they were designed to serve.

‘LOOTING OF PAST 15 YEARS’

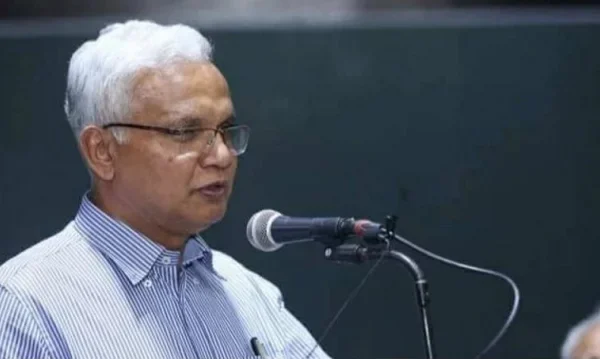

Syed Abu Naser Bukhtear Ahmed, chairman of state-owned Agrani Bank PLC, stated that the sudden increase in non-performing loans is primarily due to the fact that bad loans from the past few years were not accurately reported as such.

“We need to focus more on recovery rather than just deposit mobilisation and new lending.”

According to Bukhtear, establishing proper corporate governance – including integrity, transparency, and accountability – is essential for the banks’ survival. He added that overcoming the impact of “the looting of the past 15 years” will take more than a year or two, and filling the current provision gap from net profits will take time.

Speaking specifically about Agrani Bank, he said, “Many state-owned banks have received capital support from the government from time to time. However, our bank does not need a new capital injection. Instead, if the bank can recover its outstanding dues from government institutions, its financial indicators will turn around.”

JANATA BANK’S 76% OF LOANS IN DEFAULT

Janata Bank remains the weakest of the four, with 76% of its loans in default as of June 2025. Its non-performing loans stood at Tk72,107 crore, up from Tk67,884 crore in December. Of this, 93% is already classed as bad or loss.

Its capital adequacy is deeply negative, at -3.25%, against the mandatory 12.5% requirement with the Capital Conservation Buffer. Losses continued, though narrowed: Janata posted a net loss of Tk2,071 crore in the first half of 2025, compared to Tk3,070 crore in the previous six months.

SONALI BANK: AN EXCEPTION

Among its peers, Sonali Bank is a relative outlier. Its classified loans are at a comparably lower 20% of its total loans in June 2025, up from 18.20% in December 2024. Crucially, the bank has successfully met its capital preservation requirements, with its capital adequacy ratio standing at 10.10%, which is above the minimum 10% requirement. Sonali Bank also recorded a net profit of Tk591 crore in the first half of 2025.

40% OF AGRANI BANK’S LOANS IN DEFAULT

Agrani Bank reported defaults on 40.5% of its loans, amounting to Tk32,257 crore. Of these, 87% are bad or loss loans. Its capital adequacy ratio stood at just 1.97%, far short of the regulatory minimum.

The bank did, however, return to profitability, posting a net profit of Tk114 crore in the first half of 2025, compared to a Tk936 crore loss in the preceding six months.

RUPALI BANK SLIPPING FURTHER

Rupali Bank saw its default loans rise to Tk22,179 crore in June, 44% of its total loan book, up from 41.5% in December. Of these, 91% are bad or loss loans.

Its capital adequacy ratio stood at 2.86%, well below the 12.5% requirement. Its net profit fell sharply to Tk8.34 crore in the first half of 2025, compared to Tk64.49 crore in the preceding half-year.