Insurance sector faces multiple crises

- Update Time : Monday, October 27, 2025

TDS Desk:

The country’s insurance sector faces a surge in policy lapses, with over 300,000 policyholders dropping coverage from April to June 2025, per the Insurance Development and Regulatory Authority (IDRA).

This surge signals a deepening crisis of confidence, as financial hardship, low awareness, and misleading agent information drive policy lapses.

Experts warn that this trend erodes public trust in insurance and strains companies financially.

Policy lapses rob customers of benefits and cripple insurers with revenue losses and dwindling liquidity, experts further cautioned.

SM Ziaul Haque, former CEO of Chartered Life Insurance, said, “Policy lapses reflect a lack of trust.”

He noted that many start policies for financial security but stop due to financial constraints and low awareness.

“Agents often mislead clients when selling policies, creating a gap between expectations and reality. Negative experiences shared by customers deter others from insurance,” he noted.

IDRA data reveals 325,266 life insurance policy lapses in Q2 2025, led by Sonali Life (73,267) and National Life (46,763). Overall, lapses totalled 1.54 million in 2023 and 1.7 million in 2024.

SM Ibrahim Hossain, former director of the Bangladesh Insurance Academy, stated that policylapses harm both customers and companies.

“A lapsed policy deprives customers of benefits and causes financial and revenue losses forinsurers,” he explained.

SM Nuruzzaman, acting general secretary of the Bangladesh Insurance Forum, labelled policylapses a “cancer” for the insurance sector.

“Lapses hurt both customers, who get nothing, and companies, which lose their first-yearinvestment,” he said.

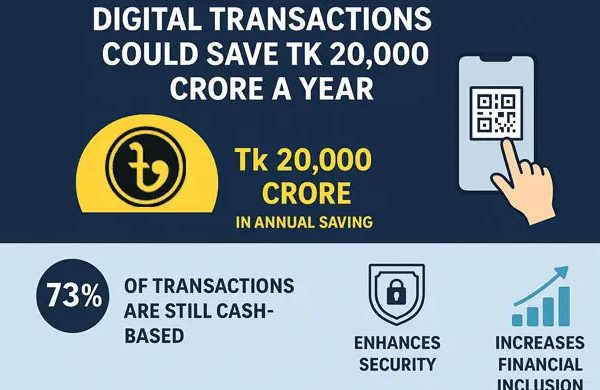

He recommended regular client communication, tailored policies during financial hardship, and premium payments via banks or mobile banking to curb lapses.

Mentionable, Delta Life ranked third in policy lapses with 27,376, followed by MetLife Bangladesh with 20,278.

According to IDRA, over 26 lakh life insurance policies have been cancelled or lapsed between2009 and 2023.

The total number of active life insurance policies declined from 11.2 million in 2009 to 8.59 million in 2023.

According to the latest figures, only 37% of life insurance claims have received payment, leaving 67% unresolved. More than 60% of claims in the general insurance sector remain unsettled.

IDRA’s latest report reveals that 36 life insurance companies faced total customer claims worth Tk5,448 crore, of which only Tk2,558 crore (37.5%) was paid.

In contrast, 46 general insurance companies received total claims worth Tk3,127 crore but settled only Tk312 crore, leaving Tk2,212 crore unpaid.

The IDRA report shows that life insurers settled only 35% of total claims in the second quarter of 2025, leaving 65% unresolved.

At the end of June 2025, total life insurance claims amounted to Tk5,574.9 crore, of which Tk1,946.66 crore was paid.