Red signal for business and investment

- Update Time : Wednesday, November 5, 2025

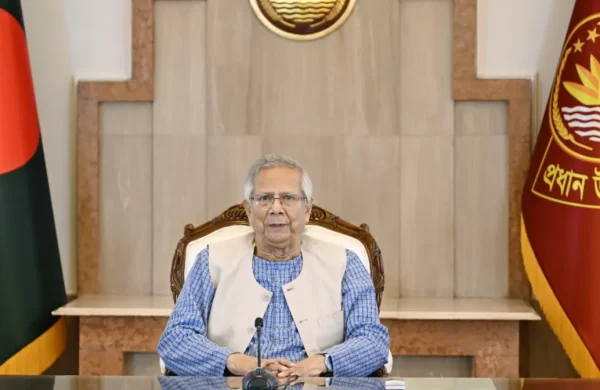

—Mostofa Kamal—

The phrase “green signal” may be old, but lately it has dominated political talk. In the race for election nominations, it has become a common expression — getting rejected means a red light. Yet party leaders are assuring those left out that they will be “compensated” somehow — perhaps with a party or state post that brings them a taste of green.

While politicians chase these “greens,” businesspeople across Bangladesh are staring at red lights everywhere. From small traders selling betel leaves to major shipping companies, nearly every level of business has endured over a year of unrelenting losses and hardship. Forget recovery — for many, survival itself has become a struggle. Each month passes with uncertainty about the next.

In the past year alone, 258 export-oriented garment factories have shut down, with many more on the brink. Naturally, thousands have lost their jobs, and hundreds of investment projects have stalled.

Though local business leaders rarely speak up, the situation hasn’t gone unnoticed abroad. Allegations of money laundering, tax evasion, land grabbing, loan fraud, embezzlement, and illegal wealth have become a form of trial by media.

Even before any legal proceedings, reputations are being destroyed — often extending to family members. If the authorities had solid evidence, they could seize assets through due process. But instead, this one-sided witch-hunt has crushed investment confidence and destroyed social standing.

As a result, reports of factory and business closures have become routine. The smaller ones often don’t make it to the media. Rising unemployment barely gets any attention, even though the jobless rate is already alarming.

Political uncertainty and the ongoing gas and power crises have further worsened the situation. Many apparel exporters have failed to meet buyers’ deadlines, losing orders to other countries. The only bright spot has been remittance inflow, which surged after the interim government took office.

Monthly remittance earnings have risen steadily, partly due to the 2.5 percent cash incentive. However, the International Monetary Fund (IMF) has reportedly urged the government to impose taxes on remittances — something Dhaka has so far ignored. But the IMF rarely drops a proposal once it’s made; it merely waits for the right moment to enforce it.

The government is pushing to increase labour exports, but results have been poor. In the first half of 2025, labour migration fell 23 percent year-on-year. Attempts to open new markets in Japan, South Korea, Romania, Croatia and Poland have stalled or even regressed.

The stock market is also flashing red. Once called the “mirror” of a nation’s economy, it now reflects deep economic fragility. All 21 listed sectors are in decline. Even when a few show brief signs of recovery, they fail to sustain momentum. Repeated market shocks have wiped out the savings of over 1.6 million investors, many of whom now describe themselves as “living corpses.”

Bangladesh’s overall economy is struggling, with business closures, job losses and declining investor confidence. Amid this, law and order has deteriorated. Protests block roads almost daily.

While many hope stability will return after the next elected government takes office, others fear the economic drought has already taken root.

As power brokers push their demands and secure quick results, ordinary workers and small business owners face police batons. Traders and investors are caught in the middle — unable to protest or to sustain their enterprises.

For many long-time entrepreneurs, it feels like living death. Years of labour and investment are eroding under constant loss, harassment and humiliation.

Some prominent business figures say the dual policy of praising them as “real heroes” on one hand while treating them as “villains” on the other has crippled confidence. How can investment thrive when the state simultaneously calls for it and crushes it?

Businesspeople insist they only want to operate without political interference. They agree that anyone guilty of serious crimes should face trial, but not at the cost of destroying industries, shutting down production, or stripping people of their dignity.

What’s happening instead is economic persecution and social humiliation. Many can no longer even show their faces in public.

Since the fall of the Awami League government on August 5, several factories have closed while many others have failed to recover for lack of funds.

Rising interest rates, limited credit support and financing shortages have further deepened the crisis. No global investor wants to operate under such uncertainty — much less amid public humiliation.

The environment that sustains business, investment and job creation is simply absent. Yet the government’s ability to generate revenue and attract budgetary support ultimately depends on reviving these very sectors.

A vibrant private sector can strengthen domestic resources and reduce reliance on the World Bank and ADB for budget aid. Both local and foreign investors measure the same risks — high interest rates, energy costs, transport expenses, and political instability.

As Bangladesh’s industrialists struggle to keep factories open, buy raw materials, or pay utility bills, workers live in constant fear of losing their jobs.

Neighbouring Nepal and Sri Lanka have also seen political transitions in recent years, but unlike Bangladesh, their business communities weren’t subjected to such public humiliation or contradictory policies.

Bangladesh’s entrepreneurs — the people who drive the economy’s heartbeat — now face a bleak horizon of uncertainty, mistrust and fear. Unless the state restores confidence, ensures justice through due process, and protects investment rather than punishes it, the red light over the country’s economy will keep flashing brighter.

————————————————————

Author: journalist-columnist; Deputy Head of News, Bangla Vision