Adani deal: Govt body for renegotiating tax rebate, surcharge, coal price

- Update Time : Sunday, March 9, 2025

- 42 Time View

Staff Correspondent:

A government review committee will recommend renegotiating key clauses in the Adani Power deal, citing “one-sided” terms that favour the Indian conglomerate. The 2017 agreement, facilitating electricity exports from India, is under scrutiny for contentious provisions regarding tax rebates, excessive late payment surcharges, and skewed coal pricing.

The committee, formed by a High Court directive, found that tax exemption clauses disproportionately benefit Adani, while late payment surcharges reach an exorbitant 27% annually. Coal pricing, based on volatile Indonesian indices, also favours Adani, with discrepancies in index usage and discount application.

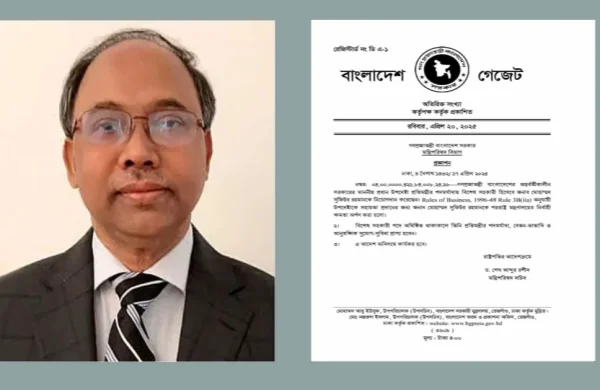

Committee members, including former World Bank economist Zahid Hussain, criticise the deal as detrimental to Bangladesh’s national interest. They will advise the Bangladesh Power Development Board (BPDB) to initiate renegotiations with Adani Power Jharkhand Limited (APJL) to lower tariffs and revise the problematic clauses.

If Adani refuses to renegotiate, the committee will recommend pursuing legal action at the Singapore International Arbitration Centre (SIAC). The committee is also investigating potential corruption linked to the deal, aiming to strengthen its legal position. They plan to interrogate officials involved in the agreement and conduct forensic analysis of communications.

The committee highlights that the Adani deal could drain Bangladesh’s economy for 25 years, with electricity costs significantly higher than other power plants. They are considering hiring international legal expertise to handle potential arbitration.

The committee has also been tasked with reviewing 11 power agreements, including Adani’s, signed under the Speedy Increase of Power and Energy Supply (Special Provisions) Act, 2010, during the Awami League’s tenure.

TAX CUT BENEFITS

The tax exemption clause in the agreement is structured in a way that favours Adani. If the Indian government imposes new taxes on the power plant, BPDB must bear the additional costs.

However, if taxes are waived, the Bangladesh government must formally request India’s approval for the benefits to be passed on.

“If anything adverse happens, we bear the cost, but if it’s favourable, Adani benefits – unless the Indian government instructs otherwise,” said Zahid Hussain, a review committee member.

In 2019, the Modi government amended Special Economic Zone (SEZ) rules to designate the Godda Adani power plant as an SEZ, granting it substantial tax cuts and import duty exemptions on machinery and coal, amounting to billions of dollars. The plant also received exemptions on Goods and Services Tax.

Deal documents show that SEZ status granted Adani nearly $1 billion in carbon tax reductions over 25 years, plus 100% income tax exemption for five years, 50% for the next five, and 50% on ploughed-back export profits for another five.

Sources within Adani’s Bangladesh chapter, the review committee, and BPDB confirmed that APJL is passing on carbon tax benefits to BPDB. However, other tax exemptions on goods, services, and income remain up for bargain.

BPDB raised the tax benefit issue with Adani three times in 2024: First on 17 September, then on 22 October, and again on 4 December.

In response, Adani claimed in a 5 February 2025 letter that from March 2023 to December 2024, it had shared $94.5 million in coal-related tax benefits with BPDB.

Adani also forwarded a document from India’s Income Tax Department stating that APJL is not eligible for any additional income tax benefits under SEZ status. The letter further asserted that Adani does not receive blanket tax benefits from the Indian government due to its failure to bring the plant online by 2021.

Adani Power Limited began commercial operations in Bangladesh on 7 April 2023, exporting 750MW of electricity.

To address the unresolved issue, BPDB and Adani representatives held a virtual meeting on 11 February 2025, where the BPDB pressed again but nothing conclusive came from the Adani side.

When asked about the tax benefit dispute, BPDB Chairman Md Rezaul Karim “We have asked them to submit documents proving that they do not receive tax benefits from the Indian government.”

‘STUNNING REVERSAL’

The review committee found that after multiple discussions, BPDB and APJL had agreed that if the Indian government waived taxes on the Godda power plant, Bangladesh would receive the benefits.

Adani also referenced these tax benefits in the project proposal and the letter of intent issued by BPDB. However, when the Power Purchase Agreement (PPA) and Implementation Agreement (IA) were finalised, the provision was very differently stated.

The PPA and IA were ultimately signed with those very different wordings in the agreements, making the tax benefits very unlikely, and the review committee considers these changes without explanation “deeply concerning”.

Committee member Ali Ashfaq, an audit and taxation expert and a member of the Institute of Chartered Accountants in England & Wales, described the change as a “stunning reversal”.

As Adani finalised preparations for electricity exports, Bangladesh raised concerns over the high electricity price due to steep coal costs.

HIGHEST INTEREST RATE

The situation worsened for Bangladesh when it came to paying electricity import bills, which remain unpaid due to a liquidity crisis.

Adani imposes a steep 2% monthly interest rate as a late payment surcharge on the total outstanding bill, which compounds to an annual rate of around 27%, according to a review committee member.

For comparison, interest rates of 4%-5% per annum are considered high in international borrowing, with China charging similar rates in some regions, which many global economists have labelled a “debt trap”.

Ali Ashfaq pointed out, “A 2% monthly surcharge for due payment is excessive. We will seek renegotiation of this clause.”

Zahid Hussain criticised the deal, calling it “asymmetric” and said, “This agreement should never have been signed.”

An APJL official on condition of anonymity said Adani charged BPDB a massive $50 million in surcharges from 7 April 2023 to 31 December 2024.

However, Adani has offered no to impose new surcharges if BPDB clears all dues by June 2025, according to sources.

SKEWED COAL PRICING

The review committee found that the coal pricing in the Adani deal unfairly favors Adani. The agreement uses specific coal price indexes, but Adani deviates from these, leading to inflated costs. Experts say these indexes are volatile and inappropriate for this type of deal. Adani also fails to apply available discounts.

Additionally, sourcing coal from Australia, instead of closer locations like China, significantly increases freight costs and makes the electricity more expensive for Bangladesh. Despite promises of lower costs, Adani’s electricity price has proven higher than other comparable power plants in the country.

As Adani finalised preparations for electricity imports, Bangladesh raised concerns over the high electricity price due to steep coal costs. In response, Adani Power visited BPDB in 2023, assuring that its electricity price would be lower than that of Payra and Rampal power plants.

However, the reality differed: in FY24, Adani’s per-unit cost was around Tk14.87, compared to Tk11.83 for Payra.

TBS contacted Yousuf Shahriar, president of Adani Group Bangladesh, and the Godda power plant’s media team, but received no response.

LEGAL ACTION ON TABLE

The review committee will advise the BPDB to pursue legal action through the Singapore International Arbitration Centre.

To give the BPDB’s legal persuasion a solid foundation, the review committee is trying to find any corrupt practices that Adani might have resorted to in the deal.

Given Adani’s alleged history of bribing officials in the US, Kenya, and Sri Lanka to secure project approvals, the committee suspects that similar practices may have occurred in Bangladesh.

Ali Ashfaq said, “Arbitration is a contingency plan, not our first choice, but we must be prepared for all options. We are exploring weaknesses in Adani’s contract and possible wrongdoings in Bangladesh.”

Zahid Hussain noted, “If corruption or similar issues arise during the contract process, it will provide us significant leverage in renegotiations.”

To fight the legal battle, the committee is considering hiring an international legal firm with expertise in the power sector.

“We cannot identify any Bangladeshi lawyer capable of handling the high-calibre legal teams from the Adani Group in Singapore. We are still deliberating whether to hire a law firm or a renowned arbitration expert in the power sector,” Ali Ashfaq said.

Given Adani’s history of corrupt dealings, the review committee is confident it can uncover a similar link in Bangladesh.

The committee plans to interrogate officials from the PMO, Ministry of Power, and BPDB involved in the deal, including Tawfiq-e-Elahi Chowdhury, former energy adviser to Hasina, and Abul Kalam Azad, former principal secretary.

A committee member said they will conduct forensic analysis of their communications and email exchanges.