Bangladesh among countries facing widest gender gap in mobile money use: Report

- Update Time : Sunday, March 9, 2025

Staff Correspondent:

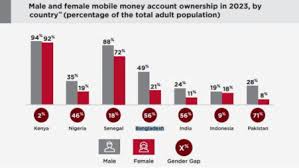

Bangladesh is among the countries facing the widest gender gap in terms of the use of mobile money.

With a 56% gap, Bangladesh trails behind Pakistan (71%) – which has the highest gap – and is on equal footing with India (51%), said a report titled The State of the Industry Report on Mobile Money 2024 released by GSMA, a global organisation unifying the mobile ecosystem.

The mobile money gender gap shows the difference in the use of mobile money between men and women who own the devices.

The report also says that awareness of mobile money improved for both women and men in 2023 in Bangladesh, India and Nigeria, albeit at variable levels.

In Bangladesh, women’s awareness of mobile money grew from 61% in 2022 to 72% in 2023; for men, awareness grew from 74% to 81% for men over the same period.

It notes, however, that women’s account ownership stagnated at 21% in Bangladesh, showing that the growth observed in women’s mobile money awareness did not translate into increased adoption.

The considerable gender gaps in mobile money account ownership was found in all countries surveyed except Kenya.

“Once women own a mobile money account, they are nearly as likely as men to have used it in the past 30 days, except in Bangladesh and Pakistan where women’s use is substantially lower,” the report said.

It also said only 1% of women who use mobile money in Bangladesh are likely to have paid for an insurance product, vs 8% of men

In Bangladesh, India and Nigeria, they are most likely to have been first taught by friends or family to use mobile money.

The report summarises the results of an econometric analysis carried out by GSMA Intelligence, commissioned by the GSMA Mobile Money Programme.