Bangladesh expects budget support from World Bank this year: Salehuddin

- Update Time : Tuesday, September 17, 2024

UNB, Dhaka:

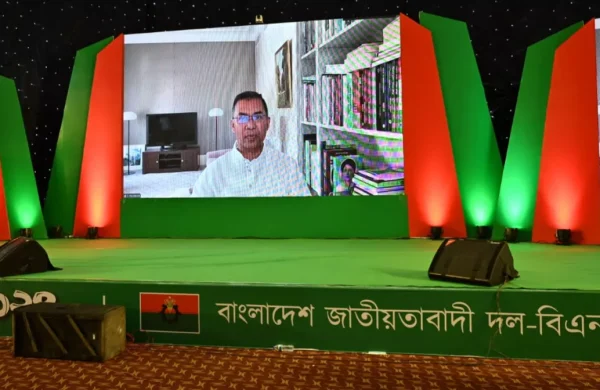

Bangladesh is anticipating budget support from the World Bank before the year ends, according to Finance and Commerce Adviser Dr. Salehuddin Ahmed. The adviser made this announcement following a meeting with a World Bank delegation led by Regional Director Mathew A. Verghis at the Finance Division of the Bangladesh Secretariat on Tuesday.

Dr. Salehuddin stressed the importance of swift financial assistance from the World Bank, highlighting the need for urgent reforms in the country’s banking and financial sectors. “Since the World Bank is our largest multilateral development partner, we need special support in the form of financial and technical assistance,” he stated.

The World Bank has responded positively, Dr. Salehuddin said, noting that further detailed discussions will focus on the implementation of these reforms. “They have been assured, and more detailed discussions will be held, mainly on how to carry out the reforms,” he added.

When questioned about reports that Bangladesh has requested $2 billion in fresh funding, Dr. Salehuddin did not specify the amount, stating that the figure would be finalized later. However, officials from the Finance Ministry indicated that the World Bank is likely to provide a $1 billion loan, with $750 million earmarked specifically for policy reforms.

This financial support is conditional on several key reforms aimed at strengthening Bangladesh’s banking system. The conditions include:

1 Establishing a framework for asset management companies to recover non-performing loans from banks and financial institutions.

2 Formulating policies to identify the actual beneficiaries of loans.

3 Defining the scope of forensic audits for banks and financial institutions.

4 Creating a separate department within Bangladesh Bank dedicated to regulatory enforcement.

Sources reveal that Bangladesh Bank expects to receive this assistance by December, which will be crucial for implementing these reforms.

Dr. Salehuddin emphasized the importance of ensuring that these reforms are practical and implementable. “The reforms will have to be implementable; otherwise, we won’t be able to execute them, and the donors won’t lend us their support,” he said.

A recent meeting between World Bank officials and Bangladesh Bank Governor Ahsan H. Mansur further underscored the focus on reforming the country’s financial infrastructure. The loan, once secured, is expected to bolster these efforts significantly.