Bangladesh faces growing risk of an energy crisis

- Update Time : Sunday, January 11, 2026

TDS Desk:

Gas shortages in power plants, fertiliser factories, and industries began under the now-ousted Awami League government. That administration relied on imports rather than investing in domestic energy exploration, a strategy which, coupled with chronic budget deficits, led to repeated fuel price hikes. Those decisions are now raising growing concerns, with escalating international geopolitical tension further straining Bangladesh’s energy security. Large sums of state revenue are being diverted to fuel purchases, even as global disruptions repeatedly affect supply chains. An LPG shortage has already surfaced, and any disruption in the LNG supply chain would put the broader economy at serious risk.

National gas demand stands at 3.8 billion cubic feet a day, compared with a supply of just 2.58 billion, leaving a shortfall of 1.22 billion cubic feet. Meanwhile, the current gas supply is 1.76 billion cubic feet lower than at the same time last year (January 10, 2025), when the national grid received 27.5 billion cubic feet.

Production has declined over the past year at four of the five companies involved in domestic gas extraction. To cover the gap, the government has turned increasingly to liquefied natural gas, committing heavy spending on imports. For FY 2025–26, the Energy Division has already moved to bring in 115 LNG cargoes at a cost of at least BDT 515 billion. Yet the reliability of this supply route remains in doubt, with energy specialists and business leaders warning of a deepening crisis should global fuel markets become entangled in strategic competition among major powers.

A sharp shortage of liquefied petroleum gas has already struck the country. U.S. sanctions on several entities and vessels have disrupted imports from international markets. Analysts say the current gas shortfall is not sudden but the result of long-standing structural problems dating back to the Awami League’s time in office. Hopes had rested on the interim government to roll out a swift and lasting fix for the energy sector, the backbone of the economy. The aim was to cut import dependence and lift domestic supply. Instead, the gas crunch has worsened, a trend energy experts say will leave any future elected government under heavy strain.

Specialists also point to an LNG import syndicate formed under the previous government, which they say choked off incentives for local gas exploration. At the same time, the interim administration has failed to take effective steps to raise domestic production and supply since assuming office. Had the measure been implemented, experts say, it would have significantly impacted government expenditure. As it stands, output is falling across most companies operating in the sector.

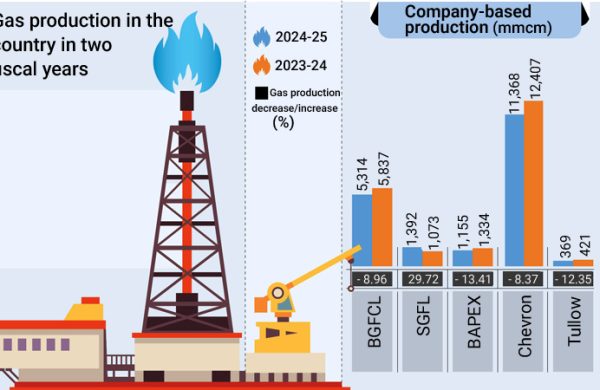

Five companies — three domestic and two foreign — are involved in gas extraction in the country, and a review of their output over the past year shows production fell at four of them.

Petrobangla figures show Bangladesh Gas Fields Company Limited produced 5,314 million cubic metres in FY 2024–25, down from 5,837 million cubic metres a year earlier, a fall of 523 million cubic metres. Sylhet Gas Fields Limited, by contrast, posted a modest increase, lifting output to 1,392 million cubic metres from 1,073 million cubic metres.

Production at BAPEX dropped by nearly 14 percent, sliding to 1,155 million cubic metres in FY 2024-25 from 1,334 million cubic metres the year prior. Chevron, the dominant foreign onshore producer and a U.S. multinational that supplies nearly half the national grid, also recorded a sharp decline. Output from its three fields fell to 11,368 million cubic metres, down 1,039 million cubic metres from 12,407 million cubic metres the previous year, according to Petrobangla data.

The other foreign operator, Tullow, likewise saw production fall. Its output slipped to 369 million cubic metres from 421 million cubic metres a year earlier.

Petrobangla says output from domestic producers is decreasing as local reserves are depleted, and even newly drilled wells tied into the grid have failed to lift supply in any meaningful way. Senior officials at the corporation say daily gas supply from the grid is falling by 150 million cubic feet, meaning new additions to the grid are failing to have any overall positive impact.

To plug the gap left by falling domestic production, the Energy Division has stepped up LNG imports. For FY 2025–26, it plans to bring in 115 LNG cargoes under long-term and spot contracts at an estimated cost of BDT 515.4 billion. Notably, BDT 407.52 billion worth of LNG was purchased in 2024–25.

Large-scale LNG imports were also pursued under the now-ousted Awami League government. Petrobangla officials cite spending of BDT 428.45 billion in 2023–24, BDT 352.74 billion in 2022–23, and BDT 405.63 billion in 2021–22. Importing the planned 115 cargoes this year would lift total LNG purchases since FY 2018–19 to over BDT 2.56 trillion.

In an effort to raise domestic gas output, the previous administration invited bids for offshore oil and gas exploration. Several foreign companies bought data packages, but none ultimately submitted bids. The current interim government has also made no progress on the tender.

Bangladesh’s two existing LNG terminals together can regasify 1 billion cubic feet a day. Little progress has been made under the interim administration on the infrastructure needed to accelerate LNG to ease the supply shortfall. The energy division says it has initiated plans for another floating terminal, but work has yet to begin on the ground.

Industry analysts say building the infrastructure for a floating LNG terminal takes at least three years. By the time an elected government completes such a project to expand supply, most of its term would already have elapsed.

The interim government has called for foreign investment, but international investors first demand energy security, which remains lacking. Even power plants built under the previous administration are now short of gas. Many industrial units have shut down due to gas shortages, while others operate most of the year under low pipeline pressure. Export earnings are taking a hit as a result, business leaders say.

Analysts argue that years of reliance on LNG imports have created serious risks for both the energy sector and the broader economy. The problem, they note, built up over time: domestic exploration slowed as imports climbed. A long-term fix was needed but never pursued by the former government, and the interim administration, in their assessment, has yet to deliver a decisive policy shift to break the pattern.

“The core reason behind the gas sector crisis is the lack of emphasis on exploration and extraction,” said Mortuza Ahmad Faruque Chisty, former managing director of BAPEX. Speaking to journalists, he added, “For over two decades, meaningful gas exploration has not occurred in the country. Investment in this sector carries unique risks unlike other industries. After the fall of the Awami League government, expectations for sector security rest with the interim government. However, foreign investors will not base decisions solely on them. Global investment firms avoid risking capital on an uncertain government; this depends on a political administration.”

Professor Badrul Imam, an energy expert and geologist, said there was no quick fix. “This sector needs investment and a clear strategy to move away from LNG imports within a defined timeframe. An economy cannot be sustained on expensive imported fuel,” he told journalists. Warning of growing volatility, he added, “With current interventions in global energy markets, countries like ours could face severe risk at any moment. This government must therefore set out a clear framework for the next administration to carry forward.”

Although plans exist to boost domestic gas supply, a significant share is expected to come from imports. The gas supply will be managed through both channels. Under the interim government’s integrated energy roadmap, the sector is to be restructured in three phases from 2026 to 2050, a programme expected to require $70–80 billion in investment.

“To overcome the gas crisis, the government will increase both imports and local extraction,” Energy Secretary Mohammad Saiful Islam told journalists, adding, “To boost supply, we have moved to build another floating LNG terminal and are progressing work on a land-based terminal. Meanwhile, BAPEX and other companies are exploring and extracting domestic gas. Two new rigs are being acquired, and deep drilling operations are underway.” He blamed earlier crises on fragmented policymaking, adding, “Previous plans were not part of any integrated effort.”

Pressed on how the government plans to resolve the crisis, the secretary pointed to the emphasis on domestic surveys in the integrated plan. “It sets out how energy security will be ensured. Drilling of 100 wells is already underway,” he said, adding that a decision had been taken to cut expensive spot LNG purchases in favour of three-year short-term contracts.

However, many of the country’s leading business figures remain unconvinced, saying the interim government has yet to roll out any permanent or swiftly effective measures. In their view, it has missed a chance to act decisively on a sector that underpins the entire economy.

Azam J Chowdhury, chairman of East Coast Group, told journalists, “The energy sector is the main driver of the country’s economy, with the gas sector in particular underpinning economic activity. Under the previous government, gas was the most neglected sector. When the interim government assumed office, its first priority should have been to establish a firm hold over energy supply management, but it failed to do so. More than one and a half years have passed. The period offered a prime opportunity to initiate construction of an LNG terminal at Deep Sea. Had gas reserves been properly managed, the country could have capitalised on cheaper supplies from international markets.”

He further said, “A shortage has now emerged in LPG. The government anticipated this crisis, yet no action was taken even after cargoes arrived from sanctioned countries. Authorities now cite the impact of international restrictions on shipments. The current state of supply management in the energy sector poses a major challenge to the next government’s economic growth.”

The Energy Division, however, says it has fully mobilised BAPEX to address long-term shortages, with plans to drill 100 wells by 2028. To foster competition, it has repealed the special act for power and energy. Other steps include shifting to short-term gas supply contracts to curb spot LNG purchases, buying two rigs for gas well drilling, updating production sharing contracts for onshore exploration by foreign firms, and pursuing several additional initiatives.