Banks see rise in cash withdrawals, fall in crore-taka accounts

- Update Time : Thursday, June 13, 2024

TDS DESK:

Banks are again experiencing an increased level of cash withdrawals from the customers’ accounts amid various crises in Bangladesh’s banking sector.

Not only the small deposit accounts but also the crores-taka ones have been going through this situation, the central bank data showed.

According to the Bangladesh Bank data, the number of accounts holding Tk1 crore or more decreased by 1,018 in the first quarter (January-March) of 2024.

At the end of March 2024, the number stood at 1,15,890, down from 1,16,908 in December 2023.

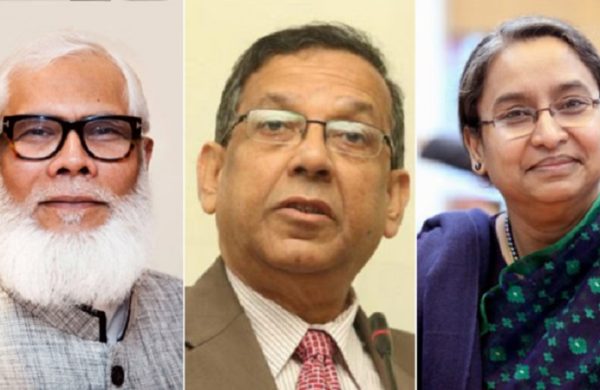

Dr Salehuddin Ahmed, a former governor of the Bangladesh Bank, told the Daily Sun that declining crore-taka accounts means that “these funds are going to other sectors.”

“Due to high inflation, people are withdrawing money from banks and spending (to buy essentials).

Inflation is not likely to ease in the near future. Many people are withdrawing money from banks due to this uncertainty,” he said.

He added, “Because the situation of some banks has worsened, some financial institutions are unable to refund customers. In this situation, many people are withdrawing money from banks and investing in

land and flats as the price of land or flat usually does not decrease, rather it keeps increasing. Besides, many people are buying dollars.”

Dr Salehuddin said, “Economic development has become limited to a single group. The rich are getting richer and the incomes of the lower-middle and middle-income people are shrinking. Such a situation is not a good sign for the economy.”

In March 2024, the total deposits in banks amounted to more than Tk17.62 lakh crore, with around Tk7.40 lakh crore of the deposits held in crore-taka accounts. Currently, such accounts own 41.99% of

total deposits in the country’s banking sector, the central bank data suggests. According to Bangladesh Bureau of Statistics (BBS) data, many low- and middle-income people are in crisis due to high inflation, which exceeded 9% in March 2023.

As their income has not increased, they are bearing the brunt of high inflation. Banks’ small amount accounts and savings certificates are already down.

The net sales of national saving certificates dropped to 1,254 crore in January-March of this year as people opted for encashing their savings amid inflationary pressure.

Dr Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), said the situation of the banking sector is becoming weaker and weaker, with many depositors complaining that they cannot withdraw their money.

“In recent times the banking sector is at extreme risk due to irregularities, corruption and mismanagement,” she said, adding that the situation has increased the tendency of customers withdrawing their money from banks.

The central bank officials said that an account of crore-taka does not mean an account of a millionaire person because there are many institutional accounts apart from individual accounts.

There is no specific limit to how many bank accounts an individual or an organisation can open. As a result, one organisation or an individual has multiple accounts, said Bangladesh Bank officials.

The accounts with Tk1 crore or more do not belong only to the individuals and many institutions can also own some of them, they said.

How much deposit in which account?

According to Bangladesh Bank data, at the end of March, the account holding deposits from Tk1 crore-5 crore stood at 91,623. The total deposit in these accounts stood at more than Tk1.94 lakh crore.

The number of accounts holding Tk50 crore or above totalled 1,826 with deposits reaching Tk2.53 lakh crore.

There are 12,446 accounts holding deposits between Tk5 crore and Tk10 crore and the amount of deposits in these accounts totaled Tk88,568.98 crore. The amount of deposits in 4,396 accounts between Tk10 crore and Tk15 crore is Tk54,364.76 crore.

According to the Bangladesh Bureau of Statistics (BBS), after the country’s independence, the number of crore-taka accounts increased from five in 1972 to 47 in 1975.

In 1980, the number of such account holders reached 98 and then in 1990, it grew to 943.

By 1996, the number increased to 2,594 and then in five years, in 2001, the number rose to 5,162, Bangladesh Bank data showed. The number of crore-take accounts continued to grow faster in the years that followed. It surged to 8,887 in 2006 and 19,163 in 2008.

At the end of December 2020, the number increased to 93,890 and exceeded the one lakh mark in December 2021, reaching 1 lakh and 1,976.