Banks’ un-invested cash wanes again after buildup

- Update Time : Sunday, February 16, 2025

Staff correspondent:

The volume of un-invested cash in the banking sector dropped again after a significant buildup following direct credit feeding by the central bank to revive the liquidity-starved commercial banks.

Commercial banks normally keep a portion of liquidity in their vaults to meet day-to-day financing needs of the depositors, which is being called un-invested cash.

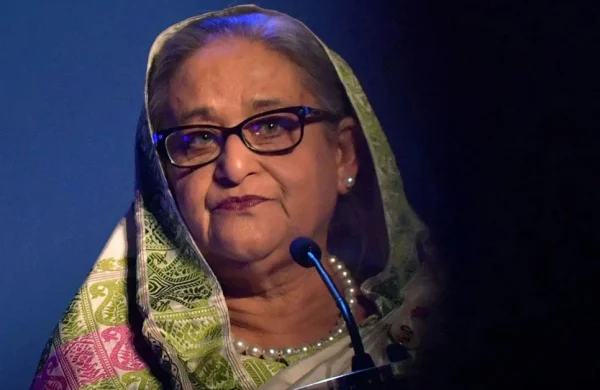

The banking industry saw a massive fall in such money stock after the July-August mass uprising that toppled Sheikh Hasina’s governing regime.

After the changeover in state power, massive loan-related irregularities in several commercial banks, mostly unconventional ones, came into media spotlight, triggering panic withdrawal of deposits. As a matter of fact, un-invested cash levels in the bank vaults came under extreme pressure.

According to data with the Bangladesh Bank (BB) uninvested excess cash in the banking system stood at Tk 193.29 billion at the end of June 2024.

The amount plummeted to Tk 57.08 billion by September and Tk 58.91 billion in October. But in November, such cash rebounded to Tk 192.37 billion. It dropped again in December with the figure reaching Tk 176.75 billion.

Seeking anonymity, a BB official said the excess cash in the bank vaults made a remarkable rise in November last largely riding on BB’s cash-feeding programme to facilitate the liquidity crisis-hit commercial lenders.

But in the following month when the tendency of panic withdrawal eased, the cash level dropped again probably because of the yearend CRR-maintaining pressure of the banks, according to the official.

Another possible reason could be the government securities market as some banks have intensified their investment drives to book treasury bills and bonds because a falling trend in the cutoff yields was observed from December, the central banker said.

“These two factors could be the reasons behind the fall in un-invested cash levels in banks,” the BB official said.

Managing director of Shahjalal Islami Bank PLC Mosleh Uddin Ahmed says commercial banks normally keep a portion of their liquidity in the vaults for day-to-day money requirements of the depositors. The volume normally varies from Tk 90 billion to Tk 110 billion.

“After the post-uprising period, the sector witnessed panic deposit withdrawals that hit hard the cash levels in September and October,” he explains the ups and downs.

But from November, the cash-strapped commercial banks started getting liquidity facility from the banking regulator and the affluent banks under the guarantee of the regulator, which results in excess cash buildup in banks, the experienced banker.