Banks were forced to divert CSR funds to govt, AL programmes

- Update Time : Tuesday, August 20, 2024

TDS Desk:

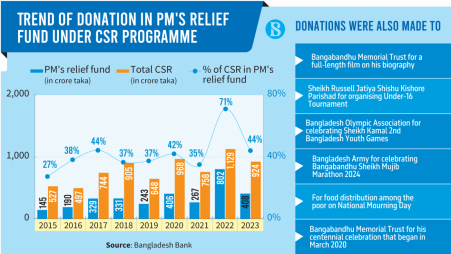

The country’s banking sector has donated over Tk3,000 crore to the Prime Minister’s Relief Fund under Corporate Social Responsibility (CSR) in the last nine years, up to 2023, according to Bangladesh Bank data.

During this period, banks spent Tk7,099 crore under CSR, 44% of which went to the PM’s relief fund as donations, disregarding the CSR guideline that sets a maximum limit of 20% for this purpose.

Banks were forced to make donations, with funds provided through pay-order cheques handed directly to then prime minister Sheikh Hasina. However, banks were unaware of the account into which these donations were deposited due to the nature of the cheques.

The largest contributions occurred in the two years leading up to the national election in January 2024, when Hasina secured her fourth term in power. During 2022 and 2023 alone, banks donated Tk1,200 crore, according to central bank data.

The donation in the PM’s fund was shown in the disaster management segment under the CSR guidelines, according to Bangladesh Bank’s CSR report published on its website.

Banks were also forced to donate for other programmes run in the name of the then prime minister and her family members and Awami League party activities under the CSR programme.

For instance, in 2023, banks spent Tk15 crore in the sport and entertainment category under the CSR programme.

The amount was donated to the Father of the Nation Bangabandhu Sheikh Mujibur Rahman Memorial Trust for producing a full-length film on his biography, to the Sheikh Russell Jatiya Shishu Kishore Parishad for organising an Under-16 Tournament, to the Bangladesh Olympic Association for celebrating the Sheikh Kamal 2nd Bangladesh Youth Games, and to the Bangladesh Army for celebrating the Bangabandhu Sheikh Mujib Marathon-2024 Tournament.

Additionally, donations were provided for the distribution of food items among the poor and marginalised communities as part of the observance of National Mourning Day on the death anniversary of Bangabandhu Sheikh Mujibur Rahman.

In the same year, banks spent Tk163.10 crore on the education sector and Tk288.97 crore on the health sector. A significant portion of these amounts was donated to the Prime Minister’s Education Assistance Trust and for the construction of a medical college named after Sheikh Hasina’s mother, Begum Fazilatunnesa Medical College.

Under the Environment and Climate category, banks spent Tk68 crore in 2023, with a significant portion donated to the Prime Minister’s Ashrayan Project, also known as the Ashrayan-2 Project, under which the Prime Minister’s Office was building homes for homeless and displaced people.

Additionally, banks were compelled to donate over Tk100 crore in 2020 and 2021 to the Bangabandhu Memorial Trust for the centennial celebration of Sheikh Mujibur Rahman, which began in March 2020.

These donations were made under the Sports and Entertainment category of the CSR programme, even as the entire country was grappling with the Covid-19 pandemic.

Ahsan H Mansur, the current Bangladesh Bank governor under the interim government, told that the government should investigate whether the relief fund has been properly utilised.

Recalling his own experience, he said, “I also went to hand over a cheque of Tk25 crore to the prime minister for the relief fund from a bank; that was the reality then.”

Mansur, who was previously the chairman of BRAC Bank, mentioned that the initiative was led by Bangladesh Association of Banks Chairman Nazrul Islam Mazumder.

He added that banks were required to donate to the relief fund every two to three months.

He also emphasised that the Bangladesh Bank should investigate the CSR expenditures of banks to ensure that the funds were used for genuine CSR purposes.

When speaking with that, Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said, “We were forced to donate to the Prime Minister’s Relief Fund, various football tournaments, the centenary celebration of Mujibur Rahman’s birth, and the housing programme under the Prime Minister’s Office.

“We would receive letters from the Bangladesh Association of Banks requesting donations.”

Although banks received a tax waiver for donations to the relief fund, other contributions were considered taxable income as they were not classified as CSR items by the National Board of Revenue.

He said banks were not only pressured to donate to football tournaments but were also asked to provide an extra month’s salary to all bank staff, from the managing director to the lowest level, for participating in the tournaments.

“No one should be forced into such things. However, Nazrul Islam Mazumder would announce such incentives in front of the prime minister and ask us to honour his words,” he said.

He said this forced CSR spending eroded banks’ profits, depriving shareholders. “We could not comply with CSR spending requirements in education and health because all allocations would go to the relief fund and other programmes related to tournaments.”

When the Bangladesh Bank enquired about why banks were not spending on health and education as per CSR guidelines, they would respond that the majority of the CSR allocation was directed to the relief fund.

Sharing his experience, a former managing director of a private bank said he faced difficulties after refusing to donate to the relief fund during his tenure a few years ago.

He said banks would receive donation requests from the Bangladesh Association of Banks multiple times a year.

“When I received another letter just two months after a previous donation to the relief fund, I reacted and refused to contribute further. As a result, a complaint was made to the Prime Minister’s Office and then to the governor by the BAB, which led to significant trouble for me,” he added.

How BAB chairman forced banks to pay donation

Nazrul Islam Mazumder, who led the BAB for the last 15 years, was the key figure behind forcing banks to donate to the PM’s relief fund and other programmes related to the then prime minister and her family.

He would send letters to banks stating, “We have agreed to donate to the relief fund, and you are requested to contribute.”

These letters would also specify the donation amount, with large banks being asked to contribute over Tk10 crore and smaller banks around Tk5 crore each time. Banks receive such requests multiple times a year.

Speaking with that, a senior banker, who wished to remain anonymous, said when a bank was asked to donate to the relief fund, no one wanted to be identified as refusing the request.

“No one had the courage to deny the donation under those circumstances,” he said.

Another top banker commented that someone should ask Mazumder how many donation letters he has issued to banks over the past decade. He added, “Mazumder was taking credit from the prime minister using other banks’ money.”

When contacted by phone, he could not be reached.

CSR guideline

In 2014, the Bangladesh Bank issued a circular instructing banks to allocate a maximum of 30% of their CSR budget to education and 20% to the health sector. Banks were to spend CSR funds from their net profit.

However, starting in 2015, banks began directing the largest portion of their CSR spending to the PM’s relief fund. Subsequently, CSR categories were gradually expanded to allow a maximum of 20% spending on disaster management, which included donations to the relief fund.

The objective of CSR is to achieve Sustainable Development Goals and incorporate social responsibilities into business practices.

From January 2022, banks and financial institutions are required to allocate 30% of their total CSR budget to the education sector, 30% to the health sector, 20% to environmental and climate change mitigation and adaptation, and the remaining 20% to other sectors, including income-generating activities, disaster management, infrastructure development, tourism, and culture.

Additionally, to increase the size of the PM’s Educational Assistance Trust Fund, a November 2022 circular mandates that grants to this fund be made at a rate of 5% of the annual CSR allocation by scheduled banks and financial institutions.

How banks overspent on relief funds, ignoring guidelines

Islami Bank, which was taken over by S Alam Group in 2017, was the highest CSR spender among banks in the last two years. In 2023, despite facing a severe liquidity crisis, the bank allocated Tk100 crore for CSR, with Tk64 crore (64.32%) going to the PM’s relief fund and related programmes, exceeding the 20% CSR guideline limit.

The bank also sourced CSR funds from other income streams, such as compensation-realised A/C, doubtful income, and the zakat fund, rather than from net profit.

In 2022, the bank spent Tk327.36 crore on CSR, with Tk319.89 crore (97.72%) directed to the relief fund and associated programmes, all funded from non-p rofit sources, according to central bank data.