BD looks at higher rates on some WB loans from July

- Update Time : Tuesday, June 17, 2025

Staff Correspondent:

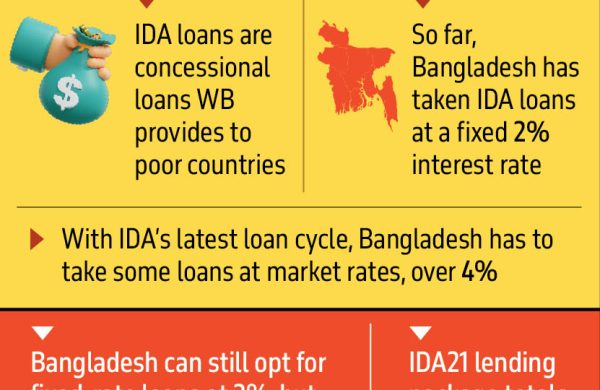

Bangladesh is set to see a change in its World Bank loan terms as a part of its concessional loans from the International Development Association (IDA) shift from fixed low rates to market-based floating interest rates.

The IDA, World Bank’s concessional lending arm, is designed to support the world’s poorest countries through low- or zero-interest loans. Its latest lending package, IDA21, will go into effect from July 2025 and will run through June 2028.

Starting next month, Bangladesh will be required to borrow 15% of its allocation from the World Bank’s IDA21 cycle at a floating interest rate, exceeding 4%.

This marks the first time that Bangladesh will need to take part in its core IDA loans at a market-based floating rate, as until now such loans carried a fixed interest rate of 2%.

However, the floating rate will be capped at 5%, and an additional 0.75% operational charge – currently termed as a service charge – will also apply.

According to a draft report of the World Bank’s IDA21 package, although countries like Bangladesh may still opt for fixed-rate loans under this arrangement, they will receive 15% less allocation compared to the floating-rate option.

In previous IDA lending cycles, Bangladesh received core IDA loans with a 1.25% interest rate, along with a 0.75% service charge. Under the current IDA20 cycle, Bangladesh was allocated $3.505 billion in core IDA funding.

Under the IDA21 lending cycle (2025-2028), the proposed loan terms for Bangladesh include a 25-year tenure with a 5-year grace period. A portion of the loans will carry a floating interest rate, calculated as the IBRD Group A rate minus 250 basis points (2.5%), capped at a maximum of 5%. Alternatively, Bangladesh may opt for a fixed interest rate of 1.5%, though this would result in a reduced allocation. In both cases, an additional 0.75% operational cost will apply on top of the interest rate.

The final country allocations under IDA21 are expected to be announced soon.

This shift toward higher and market-linked interest rates reflects a broader trend in global development financing, potentially increasing Bangladesh’s future debt servicing burden.

A review by the Economic Relations Division (ERD) offers an example of how interest rates could apply under the IDA21 cycle. It notes that under the floating rate structure, as of 17 March 2025, the interest rate for Bangladesh would be calculated as follows: Secured Overnight Financing Rate (SOFR) of 4.32%, plus a spread of 1.44%, minus 250 basis points (2.5%), plus an operational cost of 0.75%, resulting in an effective rate of 4.01%.

Since 2016, Bangladesh has been receiving loans from the World Bank’s Scale-Up Window (SUW), which come with market-based interest rates. Similarly, around 70% of the loans Bangladesh takes from the Asian Development Bank (ADB) also carry market-based interest. In the case of the Asian Infrastructure Investment Bank (AIIB), 100% of its loans to Bangladesh are provided at market-based rates.

The World Bank’s IDA21 package totals $100 billion, which is divided among five funding windows: $67.2 billion for Country Allocations, $15.9 billion for the Global and Regional Opportunities Window (GROW), $10 billion for the Scale-Up Window (SUW), $3.7 billion for the Crisis Response Window (CRW), and $3.2 billion for the Private Sector Window (PSW).

Management retains the authority to reallocate up to 10% of funds between these windows as needed. According to ERD sources, Bangladesh is eligible to access financing from all five windows under IDA21.

ERD officials stated that under the IDA20 cycle, Bangladesh did not receive any allocation from the Private Sector Window (PSW) as it was classified as a Gap Country (not poor enough for full concessional support). However, for the IDA21 cycle, funding opportunities from the PSW have been made available for all Gap and Blend countries, including Bangladesh.

According to World Bank documents, financing from the Window for Host Community and Refugee (WHR) sub-window will be split evenly between loans and grants, with 50% as loans and 50% as grants. The previous obligation under the IDA20 cycle, requiring an additional 10% loan from the country allocation for the 50% loan portion, has been relaxed.

Additionally, the Regional Window existing in IDA20 has been merged into the Crisis Response Window (CRW) in IDA21.

The strategic theme of the IDA21 package is “Ending poverty on a livable planet: delivering impact with urgency and ambition.” Priority will be given to investing IDA resources and undertaking activities that align with this strategic theme.

To ensure the effective results of IDA resources, the World Bank will introduce a new project tracking, monitoring, and reporting tool called the New World Bank Group Scorecard (Flag-C).