BEXIMCO Sukuk investors worry over cash injected in Shariah-compliant bonds

- Update Time : Monday, March 3, 2025

- 39 Time View

Staff Correspondent:

The shutdown of textile units of BEXIMCO has worried Sukuk investors as it injected about 30 per cent of the proceeds of Shariah-compliant bonds in the textile division.

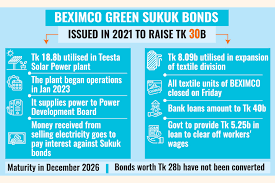

BEXIMCO, a flagship listed company of Beximco Group, is the first private enterprise to issue asset-backed Sukuk bonds worth Tk 30 billion in the country in 2021 to finance two solar power plants and expansion of its textile division.

Market experts say sukuk investors were likely to lose investment after the closure of the business units that used to generate 80 per cent of BEXIMCO’s revenue.

The company suffered a loss of Tk 358.79 million in FY24 while losses soared to Tk 3.56 billion in July-December last year. It is now struggling to pay off workers’ wages.

Sukuk holders have still been receiving interest against the bonds, paid out of the income from supplying power to the national grid from the 200MW Teesta Solar Power Plant, said an official of the Investment Corporation of Bangladesh (ICB), the trustee of the Sukuk bonds.

Another solar power project — Korotoa Solar Ltd with a capacity of 30 MW located at Tetulia, Panchagarh is yet to come into operation.

The debt-based securities will mature in December next year.

Several asset managers and merchant bankers, who invested in the bonds, that they fear the possibility of not getting the principal.

The bonds have allowed annual conversion of 20 per cent of investors’ holdings into shares of BEXIMCO. But investors facing a bearish secondary market have been reluctant to convert their assets into shares.

Hence, three years after the issuance of the instrument, bonds worth more than Tk 28 billion remained in the market.

Meanwhile, the government has been trying to facilitate the settlement of workers’ dues worth Tk 5.25 billion. The Finance Division will provide Tk 3.25 billion and the labour ministry Tk 2 billion in loan.

Labour and Employment Adviser Brig Gen (retd) M Sakhawat Hossain announced on February 27 that the payments to workers are set to begin on March 9.

While BEXIMCO will have little income to pay back the new loan from the government, it already has bank loans of Tk 40 billion, according to the latest financial statements.

Moreover, Beximco Group reportedly has borrowed more than Tk 400 billion from several banks. The value of all its assets is Tk 175 billion as of December last year.

“The company’s present situation does not hold out hope for shareholders and Sukuk unitholders,” said Md Ashequr Rahman, managing director of Midway Securities.

The government is only trying to help pay off workers’ wages, but operations of the company stalled in the absence of working capital. So, BEXIMCO’s financial situation will deteriorate further over time, added Mr Rahman.

The latest development came a month after the interim government announced its decision to sell shares of Beximco Group’s two profitable concerns — Beximco Pharmaceuticals and Shinepukur Ceramics — to pay the salaries of laid-off textile employees.

However, due to complications in the share sale, the government decided to pay the dues with public funds given in credit.

To facilitate the share sell-off, regulatory intervention is required. The securities regulator will have to provide a no-objection certificate in that case.

While BEXIMCO is already facing workers’ dues and repayment burden of bank loans, Sukuk holders are yet to feel the impact.

Mir Ariful Islam, managing director & CEO of Sandhani Asset Management, said he was worried over the payback of the principal of the Sukuk bonds.

Since the bonds are asset-backed, he said, the principal amounts should ideally be recoverable by selling assets.

However, BEXIMCO’s assets have not been transferred officially to the trustee of the bonds, according to an official of the ICB. Only the solar plant was transferred against the bonds.

Hence, banks and other institutional investors face high risk of defaults on the payment of the principal amounts.

Meanwhile, BEXIMCO Sukuk closed at Tk 44 each on the bourses on Sunday at a 60 per cent discount on the face value of Tk 100 each. Investors have increasingly been exerting selling pressure in the secondary market to liquidate the instrument since the fall of the Hasina-led government in August last year.

BOND INTEREST FROM REVENUE OF SOLAR PLANT

Of the Sukuk fund, Tk 18.82 billion was spent to build Teesta Solar Power Plant in Gaibandha, with a capacity of 200 MW. The plant began commercial operations in January 2023.

It has been supplying power to the national grid. The Bangladesh Power Development Board (BPDB) makes payments to the trustee, Investment Corporation of Bangladesh directly.

The trustee pays interest to Sukuk holders from the money received from the BPDB. “If the power project runs smoothly, there will be no problem in paying back interest,” said an ICB official.

However, if investors do not convert bonds into BEXIMCO shares before the bonds’ maturity, the principal amount will have to be paid by the issuer — BEXIMCO.

WHY IS BEXIMCO IN TROUBLE?

Salman F. Rahman, vice-chairman of Beximco Group, leveraged his political clout while being the industry advisor to former prime minister Sheikh Hasina when the company raised money in breach of the securities rules.

With Sheikh Hasina gone from the political landscape of Bangladesh since August 5, Mr Rahman finds himself behind bars. He was arrested in the capital city on August 13. A series of financial irregularities involving Mr Rahman and his business empire came to light.

The conglomerate started facing difficulties in securing letters of credit (LC) for raw material imports as banks refused to provide fresh funds. That resulted in the company facing a severe liquidity crunch, plummeting work orders and labour unrest over unpaid wages.