Brac Bank is in deep crisis over Coronavirus pandemic

- Update Time : Sunday, October 11, 2020

FBD Desk:

Country’s most modern private sector bank Brac Bank is facing acute crisis generated from mostly cornavirus pandemic, strict implementation of 9 (nine) per cent interest rate and subsidiaries that runs on technology.

BRAC Bank’s net profit fell 62 percent in the first half of this year due to the Corona epidemic, sources said adding that despite the increase in assets, the net profit picture was more disappointing this year.

BRAC Bank’s earnings per share (EPS), earnings against assets (ROA) and earnings against equity (ROE) declined as profit growth slowed. The decline in these three basic indices has also had an adverse effect on BRAC Bank’s share price. Last Thursday, BRAC Bank’s share price on the Dhaka Stock Exchange (DSE) was Tk 38.90. However, in December last year, the bank’s share price was more than Tk 80.

However, BRAC Bank is facing problems at the moment due to the 9 per cent interest obligation on loans, said Selim RF Hussain, the bank’s top executive. He told that there is a lot of liquidity in the market at the moment due to various reasons including big growth in remittances and incentive package discounts. It has been possible to reduce the cost of funds by 2-3 percent. In the situation of our cost of funds, there is no problem in investing in SMEs and retail at 9 percent interest.

BRAC Bank used to charge 15-30 percent interest on these large loans given to SMEs and retailers. The bulk of the bank’s profits also came from loans in these two sectors. But the government and Bangladesh Bank have imposed an interest rate of 9 percent on all loans except credit cards. As of April 1, BRAC Bank’s net profit fell 72 percent.

Investment in the SME sector is considered to be the biggest strength of BRAC Bank. The SME sector accounts for 45 per cent of the bank’s loan portfolio. At the end of June this year, BRAC Bank’s debt to the SME sector was Tk 11,605 crore. The bank has given this loan to a total of 3 lakh 29 thousand 399 SME customers. 17% of the loans disbursed by BRAC Bank are in retail. The amount of small loans like credit card, car-home loan is 4 thousand 606 crore rupees. BRAC Bank has 9 lakh 82 thousand 17 retail customers.

MFS organization ‘Bikash’ is seen as a great success of BRAC Bank. But the continued losses of this company are putting BRAC Bank in the face of challenges. Bikash has incurred a net loss of Tk 72 crore in 2019. Although the company had a net profit of Tk 20 crore in 2016. In the first half of this year, the scale of development losses has become heavier. Till June, the company has incurred a net loss of Tk 36 crore. BRAC Bank’s continued loss of business success is raising concerns.

Like Bikash, the other three subsidiaries of BRAC Bank are also in the circle of losses. In the first half of this year, BRAC EPL Investment Limited has recorded a net loss of Tk 13 crore, BRAC EPL Stock Brokerage Limited Tk 6 crore and BRAC Sajan Exchange Limited Tk 1 crore. In 2019, BRAC EPL Investment Limited had a loss of Tk 37 crore and BRAC EPL Stock Brokerage Limited had a loss of Tk 6 crore.

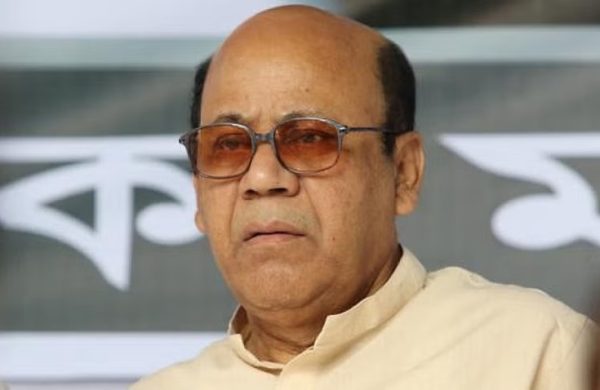

Why is a successful organization like Bikasha giving losses? In response to such a question, BRAC Bank Chairman Ahsan H Mansoor said that technology based companies are at a loss at the beginning of their operations. The same is happening in the case of development till now. So far, bKash has been focusing on expanding activities, adding new services and attracting customers.

However, several officials of BRAC Bank do not think that the profit crisis will be resolved soon. They say SMEs are at the top of the list of sectors most affected by the economic disaster caused by the coronavirus. Although the situation is somewhat normal, it will take a long time for SME entrepreneurs to turn around. Most of the entrepreneurs of BRAC Bank will be forced to default. In this situation, BRAC Bank will have to struggle to save its reserves against defaulted loans. (Source: Online)