Carew shines for years on robust liquor sales

- Update Time : Wednesday, November 6, 2024

TDS Desk:

When over a dozen firms under the Bangladesh Sugar and Food Industries Corporation have largely turned into white elephants, Carew & Company stands out as an outlier with a steady growth trajectory in its distillery business for years.

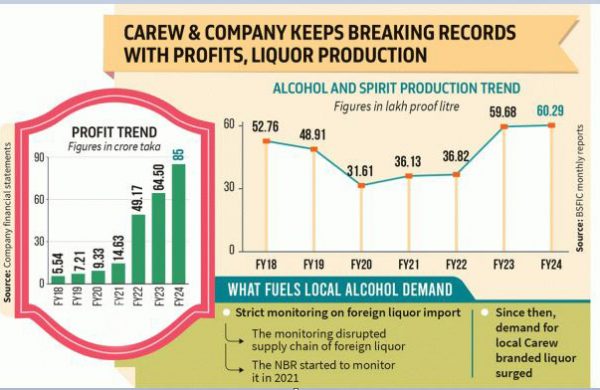

The state-owned liquor producer achieved a record profit of over Tk85 crore in fiscal 2023-24, reflecting a 32% year-on-year growth.

Officials say around Tk150 crore in profit came from the distillery business alone, but total profitability was reduced to below Tk100 crore due to a substantial loss of around Tk60 crore incurred by its sugar unit.

The profit mainly rose due to an increase in prices, though the company reported a slight revenue decline to Tk459 crore from Tk475 crore last year.

Md Rabbik Hasan, managing director of Carew, told that, “Demand for locally produced liquor increased significantly due to the limited availability of foreign liquor, following tighter import monitoring by the National Board of Revenue (NBR).”

In 2021, the NBR initiated strict monitoring of foreign liquor imports, which disrupted the supply chain and led to a decline in imports, thereby boosting Carew’s sales, according to officials at the state-owned entity.

By June 2024, Carew witnessed a slight growth in spirit and alcohol production, reaching 60 lakh proof litres, up from 59 lakh in FY23, according to data provided by officials working in its distillery unit. The term “proof” is used to measure the alcohol content of an alcoholic beverage.

This level of spirit and alcohol production is the highest since the inception of Carew and Company (Bangladesh) Ltd, the only licensed distillery producing alcohol from sugar molasses in Chuadanga’s Darshana, amid growing demand, as noted in the latest annual reports.

“Carew has never seen such profits since its inception. Liquor production grew slightly as demand surged over the past few years,” said Rabbik Hasan.

“Before corporate taxation, profits exceeded Tk115 crore; after taxes, the net profit was Tk85 crore, which is a significant increase from Tk64 crore in the previous fiscal year.”

According to Rabbik Hasan, in the first four months of FY25, Carew experienced a slight decline in spirit and alcohol production due to a mass uprising and change in the political power structure.

He expressed optimism that this slight decline would be offset as the distillery unit is now operating at full capacity to meet demand.

SUGAR UNIT CONTINUES TO INCUR LOSSES

Carew & Company, one of the oldest sugar manufacturers, was established in 1938. After the country’s liberation in 1971, the government nationalised the distillery in 1973.

Like other state-owned sugar firms, its sugar unit has been incurring losses, posting a loss of Tk61 crore in FY23.

Regarding the continuous losses in the sugar unit, Rabbik Hasan said, “Due to a shortage of raw materials, it is not possible to keep the factory running for many days. In the last fiscal year, the sugar unit operated for only 50–52 days, processing sugarcane.”

“For FY25, the target for sugarcane production has been increased. To motivate farmers, the price of sugarcane has been raised. Overall, there is a plan to keep the mill running for 65 days this year, as the target for sugarcane cultivation has been increased,” he added.

HOW DO OTHER SUGAR MILLS UNDER BSFIC FARE?

The Bangladesh Sugar and Food Industries Corporation (BSFIC), under the Ministry of Industries, controls over a dozen firms, mostly sugar mills. Losses of the sugar mills for FY24 exceeded Tk600 crore, with Carew being the only profitable entity.

The ministry published the FY24 annual report on 3 October, which included financial information on the firms operating under various corporations.

According to the report, the total accumulated losses of the 15 sugar mills under the BSFIC stood at Tk656.84 crore, with Joypurhat Sugar Mills incurring the highest loss of Tk78 crore.

The report cited several reasons for these losses, including reduced sugarcane cultivation, rising raw material prices, a sugar selling price significantly below production costs, and increased loan expenses.

CAREW’S DISTILLERY UNIT

The main product of Carew & Co is sugar. But, after sugar is extracted from sugarcane, various by-products are also produced, including liquor, vinegar, spirits and organic fertilisers.

The company manufactures country spirit, rectified spirit, and denatured spirit, along with two types of vinegar: malt vinegar and white vinegar.

The combined annual production capacity of its plants is 1.35 crore proof litres.

Carew liquor brands include Yellow Label Malted Whisky, Gold Ribbon Gin, Fine Brandy, Cherry Brandy, Imperial Whisky, Sarina Vodka, Rosa Rum and Old Rum.

The company sells liquor in 180-ml, 365-ml, and 750-ml bottles. All designated warehouses have recently experienced increased demand, with those in Dhaka and Srimangal leading in orders.

According to officials, each case contains 12 bottles of 750 ml, 24 bottles of 365 ml, or 48 bottles of 180 ml of liquor.