Costly SLF last resort for stressed banks as call-money market dries

- Update Time : Saturday, May 17, 2025

Staff Correspondent:

Well-off banks still shy away from putting stakes on the call-money market out of trust deficit on their peers and increasingly pitch their funds into secure sovereign securities, leaving the interbank credit operations rather depressed.

Giving a damn to various regulatory fillips to make the call-money market vibrant, the banks with surplus liquidity invest their money in the standing deposit facility (SDF) despite its low-rated yield.

The pivot results in continuous ballooning of the volume of cash deposits with the state-guaranteed SDF while the transactions on the interbank market are not gaining momentum, according to official statistics.

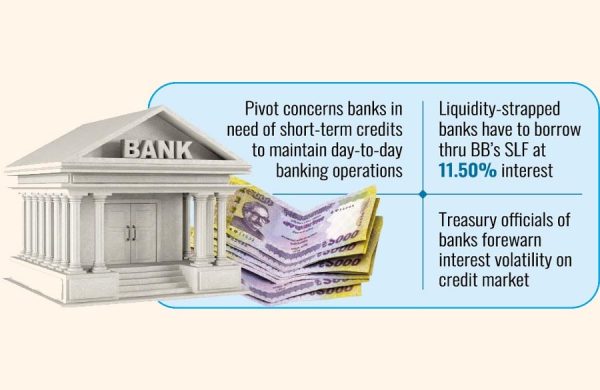

Such paradigm shift on the money market comes out as a matter of serious concern for the banks that need short-term credits to maintain their day-to-day banking operations, officials and bankers said.

They observe despite higher bets offered on the call money, the lenders feel comfortable in putting their un-invested money in the SDF or reverse repo of Bangladesh Bank (BB), although the rate is quite low on the sovereign instruments.

Although the transactions on the call-money market increased a bit in March 2025, the monthly deal amount is much lower than what was a couple of years ago.

According to money-market dynamics of the BB, the total turnover of call money was Tk 879 billion in March 2025, which was 10.46-percent higher than February transactions of Tk 796 billion.

The data showed the daily average transacted volume as Tk 46.28 billion in March last. Even a year ago, the daily call-money transactions were hovering in-between Tk 80 billion and 120 billion.

Seeking anonymity, a BB official said the central bank took various efforts only to bring vibrancy in the moribund interbank spot market. The daily repo-backed borrowing facility from the BB cut down to once a week.

Also, the official said, the banking regulator phased out 28-day repo facility and also decided to do the same in case of 14-day-tenure repo facility and ALS facility from July next.

“Despite such regulatory moves, we’re seeing different picture now as banks feel not comfortable over the call-money market. Trust deficit in the current context of banking operations could be the reason,” the central banker explains.

Instead of call money, the banks having enough surpluses feel comfort in keeping their funds in SDF despite having much lower gains.

The weighted average rate in March call-money transactions was 10.14 per cent while the rate of BB’s overnight deposit instrument or SDF was 8.50 per cent, according to BB’s data.

In March last, the affluent banks kept Tk 364 billion in SDF and the figure was higher from February’s total deposit of Tk 335 billion.

Banks usually choose emergency loans from the call-money market to fill their asset-liability mismatch, comply with the statutory CRR and SLR requirements and to meet any exigent demand for funds.

Bankers who are struggling to maintain regular banking affairs because of the liquidity tightness have said such tendency of the banks having surplus funds will undoubtedly put pressure on the cash-hunting lenders to go for costly borrowing from the central bank through SLF or standing liquidity facility, which will create volatility in the interest regime.

The treasury head of a private commercial bank, who prefers not to be quoted by name, says there are many banks not getting funds from interbank sources even after offering rates as high as over 10 per cent but the affluent banks feel comfort in keeping their uninvested credits in SDF where the rate is 8.50 per cent.

The fund shortage starts prompting the liquidity-strapped commercial lenders to go for costly borrowing from the BB through the SLF instrument where the rate is 11.50 per cent.

He feels the banking regulator needs to discourage growing usage of SDF immediately to bring vibrancy in the call-money market. “If the banks’ dependence on using costly funds is growing, it would create volatility in the interest regime,” the treasury executive alerts.