Overcoming economic crisis now big challenge

- Update Time : Wednesday, August 21, 2024

TDS Desk:

Businesses in Bangladesh are grappling with an array of economic challenges, including a significant decline in imports, due to a severe dollar shortage, gas and electricity crises, instability in the banking sector, high inflation, a volatile currency market, and a scarcity of loans.

These combined issues have created a perfect storm, leaving many industries at a standstill and pushing the economy toward a precarious situation.

The persistent dollar shortage has exacerbated the situation, with many industries unable to import the necessary products, leading to a near halt in the opening of new letters of credit (LCs).

Importers are struggling to pay off existing debts, and the devaluation of the Taka has compounded their losses.

This has further tightened liquidity in the banking sector, linking it directly to the ongoing dollar crisis.

Entrepreneurs across various sectors are struggling to maintain operations due to a lack of loans.

Although the interim government, led by Nobel laureate Dr Muhammad Yunus, has made some improvements in law and order, business activities remain stagnant.

Entrepreneurs argue that the economy has stalled due to curfews and violent incidents related to student protests, disrupting the normal supply of food products and raw materials.

The protests severely disrupted vehicular movement for an extended period, and at one point, even the internet was shut down, which led to a stagnation in business and trade, with negative impacts across the board.

Business leaders warn that if the situation does not improve, loan defaults will increase, further destabilising the country’s banking sector.

Shams Mahmud, president of the Bangladesh Thai Chamber of Commerce and Industry, told that businesses have been under pressure since July, and immediate short-term measures are needed.

He pointed out theft in the gas sector and called for action to stop illegal gas connections. “If illegal connections are eliminated, we might get some relief.”

Mahmud also stressed the need for low-cost loans for the next six months and suggested that even if there are overdue bills, gas and electricity connections should not be cut off for at least three months.

He added that while reforms in the banking sector will be challenging, raising interest rates could help reduce inflation in the long run, potentially aiding recovery.

Rizwan Rahman, former president of the Dhaka Chamber of Commerce and Industry, said that the country’s situation has not yet normalised, and problems persist.

He believes the new government should be given time to help the country recover, but highlighted the difficulties in doing business when the situation is not stable. “It is almost impossible to open LCs, and investors are hesitant to make new investments.”

He urged the new government to create opportunities for businesses to operate and ensure that foreign trade is not disrupted.

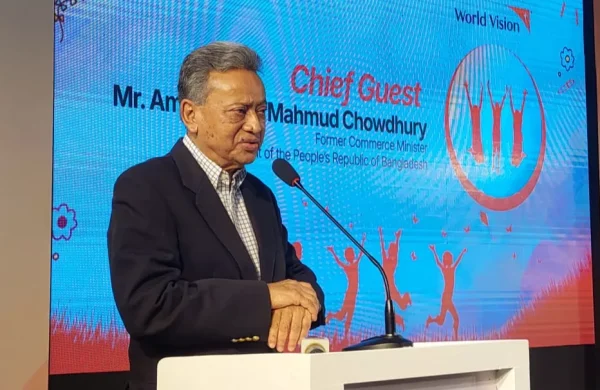

Dr Zahid Hussain, former lead economist at the World Bank’s Dhaka office, said that the scarcity of foreign currency and the financial sector crisis pose significant challenges to the overall economy.

He hoped that the new economic managers would address these issues. For the Ministry of Finance, the major challenges include reducing inflation, increasing foreign currency supply, boosting reserves, and resolving financial sector problems.

Hussain also called for efforts to reduce corruption, emphasising the need for accountability without collapsing institutions.

Import plummets

The country’s entrepreneurs imported various goods worth $60.73 billion in the 11 months (July 23-May 24) of FY24. It was around $70 billion, or 13% higher, during the same period of the previous fiscal.

According to the Bangladesh Bank data, In FY24, the opening and settling LCs for capital machinery imports fell by 10.97% and 23.86%, respectively.

During that period, opening and settling LCs for intermediate industrial goods fell by 17.96% and 12%, respectively.

In the same period, opening LCs for importing industrial raw materials increased by 1.79% and settling LCs for that purpose dropped by 15.90%.

Industrial production is down

Political instability is causing a worrying decline in industrial production in the country, which will have adverse effects on investment, employment, and the overall economy.

According to the latest data from the Bangladesh Bureau of Statistics, the growth rate of industrial production has dropped to 6.66% in FY24, the lowest since the COVID-19 pandemic began. In FY23, the growth rate was 8.37%. In the two fiscal years before FY’22 and FY’21, the growth rates were 9.86% and 10.29%, respectively. This indicates a significant decline in the fiscal year’s growth.

The statistics show that after an 11.63% growth in the 2018-19 fiscal year, industrial growth fell to 3.61% due to prolonged lockdowns caused by the pandemic. After recovering with a 10.29% growth in the 2020-21 fiscal year, the growth rate has been decreasing since then.

A source from the central bank indicates that under normal circumstances, LCs were opened daily for an average of $350 million or more. On some days, LCs amounting to $1 billion were even issued. However, the number of LCs being opened started to decrease significantly due to the unrest triggered by student protests. On 1 August, businesses opened LCs worth $623 million.

After that, there were two days of holidays. On 4 August, LCs worth $191 million were opened, on 6 August, $164 million, and on 7 August, $167 million.

The dollar market is in chaos again

Due to a lack of dollars, banks have been refusing to open LCs not only for luxury goods but also for essential ones. This is seriously obstructing the imports of different sorts of products ranging from industrial raw materials to essential goods, said traders. Apart from banks, this US currency is not available in the open market.

Money exchange houses in different places, including Dilkusha and Gulshan, are a kind of stagnation prevailing. Most signboards display the dollar price as buying at Tk118.5 and selling at Tk119.5. However, no exchange house has any dollars available. If they are familiar with the customer, they are willing to sell dollars at Tk121.

MS Zaman, president of the Money Changers Association of Bangladesh, said the situation for buying and selling dollars in the open market is very poor. As long as the current situation in the country does not normalise, this condition is expected to persist. The remittance flow was completely halted for a few days due to the student protests over quota reforms, and travel abroad has also decreased. Consequently, the supply of dollars in the open market is almost non-existent. However, with the expected increase in remittance flows, it is hoped that the situation will improve soon.