Currency paradox: Why is Bangladesh Bank buying dollars?

- Update Time : Wednesday, July 16, 2025

TDS Desk:

After years of depreciation that saw the taka lose nearly 30 percent of its value against the dollar since the COVID-19 pandemic, the local currency is finally showing signs of strength. However, in a surprising turn of events, the Bangladesh Bank has swiftly intervened to halt the dollar’s decline, raising questions about its exchange rate management.

The relentless rise of the dollar for years has been a primary driver of economic strain in Bangladesh. It has been a key factor behind soaring inflation, which has remained stubbornly above 9 percent since March 2023, causing hardship for consumers and importers. While inflation saw a slight dip to 8.48 percent in June, the pressure on household budgets remains immense.

For months, economists and policymakers have pointed to the high exchange rate as a major culprit for the persistent inflation. Businesses, especially those reliant on imports, have borne the brunt of the powerful dollar, while exporters and remitters have benefited.

Now, with the taka finally gaining ground to some extent, the central bank stepped in. In just two days, the Bangladesh Bank purchased $484 million from commercial banks as the exchange rate fell by more than Tk 2 in five days, dropping to Tk 120 against the dollar. Following this intervention, the interbank selling rate climbed back to Tk 121.20 on Wednesday.

This prompts a crucial question: why is the central bank seemingly preventing the taka from strengthening?

One explanation lies in the central bank’s managed exchange rate system. Despite adopting a more flexible regime in May as part of a $5.5 billion loan agreement with the International Monetary Fund, the system is not entirely market-driven. The Bangladesh Bank maintains an exchange rate band and intervenes when the currency moves outside its desired range.

An exchange rate band is a system where a country’s central bank sets a target value for its currency against a foreign currency (or a basket of currencies) and allows the exchange rate to fluctuate within a specific range, or “band,” around that target.

This approach falls between a completely fixed exchange rate, where the currency’s value is pegged and does not fluctuate, and a purely floating exchange rate, where market forces of supply and demand determine the rate without any central bank intervention.

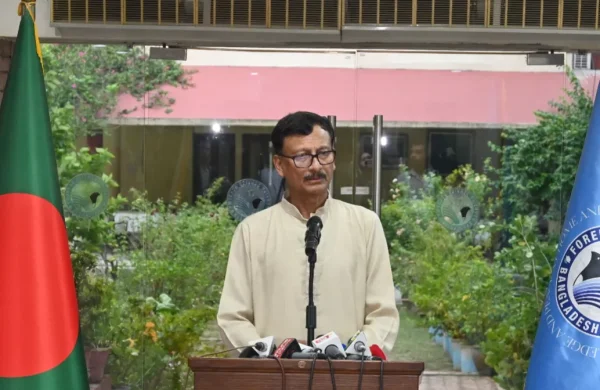

Areif Hussain Khan, the executive director and spokesperson for the central bank, defended the intervention, saying the regulator’s goal is to prevent excessive volatility.

“We want to keep the forex market stable because neither a big rise nor a steep fall is a good indicator. If the dollar weakens too much, exporters and remitters feel discouraged and suffer losses.”