Encouraged to see advanced preparation in BD for post-LDC graduation era: ADB Vice President

- Update Time : Thursday, July 4, 2024

UNB, Dhaka:

Asian Development Bank (ADB) Vice President Yingming Yang has said he is encouraged to see Bangladesh’s advanced preparation for the post-LDC graduation era, including adequately dealing with the financing and market access challenges that will also be outlined in the next five-year plan.

“I have noticed a strong drive for meaningful reforms to address medium-term economic and development challenges,” he told UNB in an exclusive interview on Thursday before wrapping up his Bangladesh visit.The vice-president who is responsible for the management of the operations of ADB’s Central and West Asia Department and South Asia Department, said the sincerity of the government in building resilience to climate change, which will help mitigate macroeconomic and fiscal risks, is laudable.

Revenue-based fiscal consolidation, quality infrastructure and human capital development, diversification of trade, increasing foreign direct investment, lowering financial sector vulnerabilities along with the reduction of non-performing loans, enhancing investment climate, and strengthening governance are widely discussed and prioritised, Yang said.

“As a trusted development partner, ADB stands ready to support the government in these critical areas in unlocking the potential of the country,” he mentioned.

Recently, the ADB vice president said, the central bank enacted bold reforms aimed at liberalising the interest rate and exchange rate regime.

This was followed by a prudent fiscal management plan through revenue mobilisation and expenditure prioritisation in FY2025 budget.

Responding to a question on the country’s economic situation, he said the economy has shown signs of recovery with a gross domestic product growth rate averaging 6.6% over fiscal year (FY) 2021–2023 despite the challenging external environment. GDP per capita reached $2,643 in FY2023.

Despite making some progress on structural reforms, he said, Bangladesh continues to experience persistently high inflation and depleting foreign exchange (FX) reserves, due to the tightening of global financial conditions, and continued elevated international commodity and food prices.

More recently, Yang said, to stop depleting FX reserves and restore external resilience, the Bangladesh Bank has taken bold actions to adopt a crawling peg regime as a transitional step toward greater exchange rate flexibility.

To manage persistent high inflation, the Bangladesh Bank has further tightened monetary policy following the liberalisation of the interest rate.

“It stands ready to tighten monetary policy further should external and inflationary pressures intensify. Fiscal policy is expected to support these monetary tightening efforts through improved revenue mobilization,” said Yang who was appointed for three years in November last year.

With these important reforms, including those under the IMF Programme , he said they expect growth to pick up to 6.6% and inflation to moderate to 7.0% in FY2025 despite a challenging macroeconomic situation.

ADB vice president meets Environment Minister with aim to strengthen climate collaboration

The current account balance is expected to move into surplus thanks to a narrowing trade deficit and rising remittances, Yang said.

The medium-term macroeconomic challenges include low foreign exchange reserves, high inflation, low revenue mobilisation, low foreign direct investment, and banking sector vulnerabilities with high non-performing loans.

He said the government recognises the need to strengthen macroeconomic policies and expedite structural reforms to reduce future vulnerabilities.

CHALLENGES ARISING FROM LDC GRADUATION

Yang said as the economy grows, more complex challenges arise. Hence, he added, more transformative support will be provided under ADB’s New Operating Model.

PM HASINA URGES ADB TO HELP BANGLADESH IN IMPLEMENTING BLUE ECONOMY

“As the region’s climate bank, ADB will support Bangladesh’s bold actions on climate change, increasing our finance and capacity-building assistance. We will focus more on providing solutions through tailor-made knowledge and advisory services,” he said.

The ADB Vice President said they will help improve the business processes for faster delivery of quality programmes and enhance the catalytic role of private sector development through well-integrated and coordinated sovereign and non-sovereign operations.

Following the updating of ADB’s Capital Adequacy Framework, ADB will increase financing to support the upcoming 9th Five-Year Plan, whose key priorities will be reflected as key pillars in the new Country Partnership Strategy (CPS) 2025–2029, he said.

Yang mentioned that ADB remains committed to providing strong support in all key priority sectors. “ADB will support climate-resilient infrastructure such as rail, river restoration, water management, and transmission lines.”

For human and social development, he said, they will support next-generation primary and secondary education, higher education in computer science and agriculture, health, skills development, and social protection.

Policy reforms to support business climate improvements, revenue mobilisation, financial sector development, local currency bonds, and green logistics development will also be supported, he said.

MANAGING CLIMATE CHALLENGES

As the region’s climate bank, ADB supports Bangladesh’s bold and strong climate agenda, as reflected in the Delta Plan, the Mujib Prosperity Plan, and the National Adaptation Plan.

ADB appreciates the whole-of-government approach adopted to implement the climate agenda, particularly the government-led Bangladesh Climate and Development Partnership (BCDP).

“It will translate the government’s climate plans into investment projects, mobilise financing from the public and private sectors, address policy gaps, develop knowledge solutions, and strengthen capacity,” Yang said.

He said they are also keen to support Bangladesh with river restoration and management programs in coordination with the World Bank and other development partners.

ADB will increase the 2024 concessional ordinary capital resources lending (COL) allocation for Bangladesh from $37.75 million to $1,005.20 million, which will preferably be allocated to climate change and social sector projects.

IMPROVING BUSINESS CLIMATE AND LOGISTICS

Yang said the logistics costs in Bangladesh could be as high as 48 percent for some export commodities, which is much higher than those in neighboring and competing countries.

“Bangladesh could enhance its export earnings through concerted short- and medium-term reforms aimed at streamlining import-export procedures and reducing logistics costs,” he said.

Yang appreciated the approval of the National Logistics Policy in April 2024 and said it will pave the way for a coordinated whole-of-government approach to reduce high logistics costs, which is key to maintaining Bangladesh’s export competitiveness after LDC graduation.

“ADB is supporting the government’s logistic reform agenda under its LDC graduation policy-based loan, which will be processed this year,” he said.

REGIONAL COOPERATION IN SOUTH ASIA

Yang said they appreciate Bangladesh’s leadership and active participation in regional cooperation, especially in the South Asia Subregional Economic Cooperation (SASEC).

“ADB remains committed to promoting better road, rail, air, and water connectivity with the neighboring countries and improving trade facilitation through the SASEC platform,” he said.

Yang also said they will support Bangladesh in reducing trade costs and gaining greater access to the regional markets.

ADB will provide continued support to regional cooperation through the SASEC, BBIN, and BIMSTEC, and push for making further progress in the Bangladesh-Bhutan-India and Nepal Motor Vehicle Agreement, and regional energy trade with the neighboring countries.

PROMOTE SOUND ECONOMIC DEVELOPMENT

As Bangladesh graduates from its LDC status in 2026, it is imperative to augment its tax-GDP ratio, which is one of the lowest in the world.

“Raising tax revenue is key to maintaining sound fiscal management in the post-LDC era when concessional resources and market access will be limited,” Yang said.

Fundamental hurdles in augmenting tax revenue arise from weaknesses in both policy and administration fronts.

Estimates suggest that only about 47% of registered taxpayers file tax returns, while less than 3% of the population pays income tax, he said.

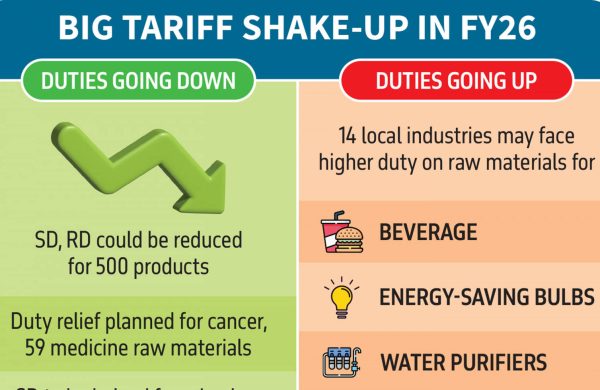

“I understand the National Board of Revenue (NBR) is implementing strong policy measures in line with the 2023 Tax Law, including rationalization of tax expenditure, modernization and/or digitalization of the tax system, and expansion of the tax base,” Yang said, adding that these reforms will be coordinated with the new National Tariff Policy and Customs Act.

“As part of the broader policies to support the LDC graduation, the Cabinet has passed the new Logistics Policy,” he added.

Yang said ADB remains committed to assisting Bangladesh with technical assistance, budget support, and sector development programs to modernize the tax administration and effectively implement tax policies through enhanced automation, digitization, and risk-based auditing.

PRIVATE SECTOR DEVELOPMENT

Yang said a vibrant private sector is the engine of growth, particularly when Bangladesh is graduating from the LDC status in 2026 and aspiring to become a middle-income country by 2031.

Under ADB’s New Operating Model, he said, ADB will promote the synergy of sovereign, nonsovereign, and public-private partnerships in its operations.

“Some areas that could demonstrate this synergy include climate change (renewable energy), green logistics, health, and education. In this context, ADB stands ready to support the government in issuing local currency bonds,” Yang said.

ADB aims to support the private sector through policy reforms to improve the enabling environment, advisory for preparing bankable projects, and increased non-sovereign financing.

To improve the enabling environment for the private sector, Yang said, ADB will support key reforms to address investment climate constraints, improve logistics, deepen the financial sector, and improve the public investment decision framework, among others.

On the advisory front, he said, ADB has been supporting the identification and preparation of PPP projects in the transport sector and aims to expand assistance in energy, social, and urban sectors.

On the non-sovereign operations front, key areas of focus will include renewable energy, digital infrastructure, agro-processing, green logistics, textiles and garments, health, and education.

ADB’s Trade and Supply Chain Finance Program works with 16 banks to reduce financing gaps faced by small- and medium-sized enterprises to help them become part of the global trading system.

ADB Venture has been taking an equity stake in sustainable ventures in transport, agriculture, and other sectors.

To further promote the private sector development, Yang said, Bangladesh needs to accelerate reforms on several fronts, including in monetary and exchange rate policy, domestic resource mobilization, public financial management (PFM), state-owned enterprise (SOE), public-private partnerships (PPP) financial sector, investment, trade, and logistics, and social protection.