Experts urge market reforms, fair pricing to tame inflation

- Update Time : Monday, February 3, 2025

TDS Desk:

Stakeholders at a policy conclave stressed the need for digitised integrated value chain, fair pricing and lower interest rates to ensure reasonable prices of essential commodities.

The event titled ‘Fair Prices of Food Commodities: Exploring Strategies for Market Supervision’ was held at a city hotel organised by the daily Bonik Barta on Sunday. The event was moderated by the daily’s Editor Dewan Hanif Mahmud while Research Director of the Center for Policy Dialogue (CPD) Dr Khandaker Golam Moazzem delivered the keynote address.

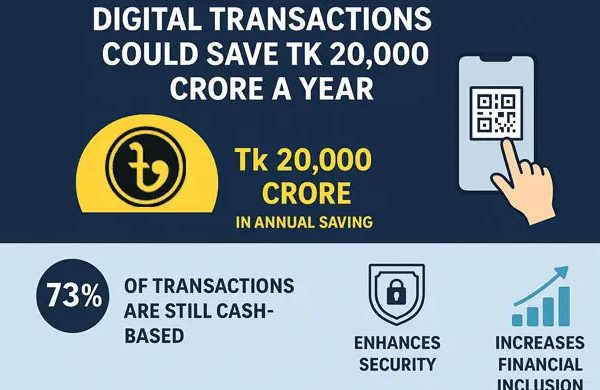

Dr Khondker Golam Moazzem presented a paper titled “Integration of food supply chains in Bangladesh: digitalisation for efficiency, transparency, traceability, legal culpability and accessibility” which emphasises the need for ensuring business licenses and highlights that the Competition Commission lacks adequate data, which leads businesses to view it as ineffective.

He discussed the establishment of an integrated food value chain and permanent setups. He noted that India has had a commission since 1965, focusing on agricultural responsibilities, operational reforms, and bank accounts.

He mentioned the issue of shell companies, where one individual owns 25-30 shells, and stressed the need to regulate these entities to prevent oligarchy.

He advocated for IT-based expertise in managing markets for locally produced goods like rice, potatoes, import-dependent essentials like sugar, edible oil and products like onion which is both locally produced and imported. He predicted that implementing digital transformation could take 3-5 years, making it a long-term process.

Speaking on the occasion, Commerce Adviser SK Bashir Uddin said that the previous government faced economic challenges due to fixed lending rates.

He mentioned that rice procurement has 12 layers of pricing and added that he will hold meeting with CPD (Centre for Policy Dialogue) to address the issue.

He said that during Hasina’s tenure, a criminal nexus existed in all sectors, which people have witnessed. He claimed that all institutions were destroyed and emphasised the need for a level playing field and effort-based tax collection system.

He called for tax justice, sector-specific approaches, and uniformity, emphasising that VAT should be implemented sensitively. He commented that the top ten industries, under political influence, have involved themselves everywhere, increasing their own problems, which needs to be addressed.

The commerce adviser slammed the banking sector, stating that banks were turned into criminal institutions. He cited an example of an individual withdrawing over Tk 1.0 trillion from a single bank, with 90 per cent of the bank’s loans being non-performing. He insisted that these people must be held accountable.

In his speech, economist Prof Anu Muhammad said there is no open-market economy in the country but rather an oligopoly. To fight oligopoly, institutionalisation is needed, he added. He lambasted the government for prioritising IMF conditions over consumers, saying that it raised energy prices to secure $4.0 billion loan, which has affected businesses and exports.

He called for greater transparency in loan utilisation, adding that the same outdated policies for acquiring loans from the IMF and World Bank remain in place.

NBR Chairman Abdur Rahman Khan said that Western countries have a tax-to-GDP ratio of 45 per cent, whereas Bangladesh’s stands at only 7.9%. He said that the tax net should have been wider, but it did not happen.

He pointed out that two-thirds of the taxes come from the poor. There are 1.1 million taxpayers, but 60 per cent don’t file tax returns, he said, adding that those who comply are under more pressure and measures are now being taken against those who don’t pay. He further said that the VAT situation remains unchanged, with businesses paying the government and consumers bearing the burden. Vice President of CAB SM Nazer Hossain said that rice prices have been rising throughout the year due to low government stocks, with prices increasing before Ramadan despite tariff reductions on 31 products. He questioned whether businesses can keep their promises during the Ramadan. He also mentioned that farmers do not receive fair prices for vegetables in the North Bengal, but consumers pay higher prices.

President of Karwan Bazar 2 No Aratdar Merchant Association Farid Ahmed Russel discussed the rise in potato prices, attributing it to government pressure and the absence of receipts from wholesalers and cold storage operators. Sabir Hasan Nasir, managing director of Swapno chain, claimed that there is no syndicate, calling it imaginary. He said the prices of paddy have risen by 34 per cent, but rice prices have increased by only 22 per cent.

Formalisation and digitalisation are essential, but Bangladesh lags behind Sri Lanka (43 per cent) and Thailand (64 per cent) with only 2.0 per cent in digitalisation, he added.

Rice miller Abdul Khalek from Desh Agro Industries in Kushtia said that 80 per cent of mills in Kushtia has gone bankrupt due to uneven competition with oligarchs having large capital.

Kazi Zahin Hasan, director of Kazi Farms, attributed the high ingredient prices to the Ukraine-Russia war and the previous government’s increased money supply. He called for a balanced economic policy with lower interest rates and an open market system based on supply and demand.

Sarjis Alam from the Anti-Discrimination Student Movement (ADSM) said key political party representatives should attend such programmes as it is crucial to express opinions openly. He blamed political personalities for the ongoing extortion.

He claimed that big companies are not competitors, but have divided markets and territories like animals in the jungle while the Competition Commission did nothing about it, making it one of the most failed institutes in the last 16 years.

He stressed the need for policy implementation to prevent oligarchy and called for the decentralisation of imports to enhance market competition.

Umama Fatima from ADSM reflected on market monitoring efforts and the need for a win-win mechanism for producers and consumers. She questioned the government policies on Ramadan-related products like dates, chickpeas, and soybean oil, as well as higher taxes on fruits.

Managing Director and CEO of Mutual Trust Bank Ltd Mahbubur Rahman discussed the banking challenges, including low lending capacity, high non-performing loans, and liquidity issues. He said that 11 banks cannot lend now amid their NPLs. He also highlighted the impact of rising utility costs on customers.

Chairman of Islami Bank Bangladesh Ltd Md Obayedullah Al Masud outlined the bank’s presence in 32,000 villages and planned to expand to 64,000 villages in three years. He emphasised the importance of value chains and defended the role middlemen as supply chain service providers, blaming extortion on price issues.

Mostofa Haider Chowdhury, director of TK Group, discussed the government’s right to intervene in food prices under the Essential Food Act and called for a comprehensive supply chain strategy. He noted that developed countries regulate prices through tariff management and strategic reserves.