Govt moves to curb family control, protect policyholders in insurance sector

- Update Time : Sunday, June 22, 2025

TDS Desk:

The government is set to amend the Insurance Act to strengthen regulatory oversight, curb mismanagement and family control on board, and enhance protection for policyholders, following a series of scandals that have rocked the country’s insurance sector.

The proposed amendments introduce sweeping changes: stricter rules on director appointments, limits on family ownership, and provisions to liquidate assets of failing insurers to repay customers. The Ministry of Finance has already published a draft ordinance on the Financial Institutions Division’s website and invited public feedback. Officials said the ordinance will be finalised after consultations.

Enacted in 2010, the current Insurance Act lacks provisions to dissolve boards, remove senior executives, or appoint receivers to recover customer funds in cases of fraud or insolvency. Nor does it limit how many family members can serve as directors and how long.

REGULATORY GAPS EXPOSED BY RECENT FAILURES

Currently 82 insurance companies–- 36 life and 46 non-life–- operate in Bangladesh. But life insurance companies, which directly handle customer premiums, have been particularly vulnerable to fraud and mismanagement. Several firms have exploited loopholes in the law to divert policyholders’ funds under the guise of investments.

Six companies—Fareast Islami Life, Golden Life, Sunlife, Baira Life, Padma Islami Life, and Sunflower Life Insurance—are unable to pay Tk3,736 crore in claims. Some directors have either absconded or been jailed following investigations by the Anti-Corruption Commission.

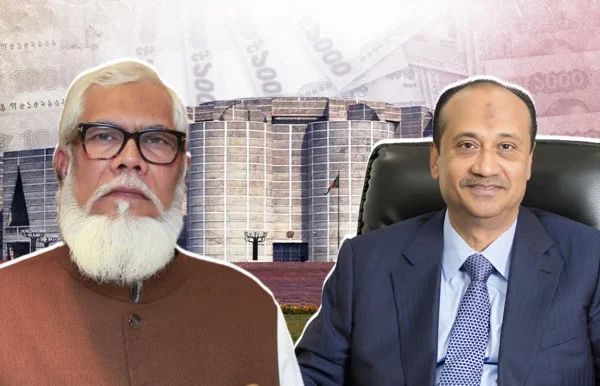

“The directors of these companies embezzled customers’ money in the name of investment. The companies are now on the verge of bankruptcy,” said M Aslam Alam, chairman of the Insurance Development and Regulatory Authority (IDRA).

“We are amending the law to establish good governance and protect policyholders’ interests.”

A key feature of the draft ordinance allows the appointment of a receiver with authority to sell company assets and repay customers—a provision absent from the 2010 law. The regulator would also be empowered to dissolve company boards and remove senior management to ensure accountability. Similar powers already exist under the Bank Company Act and the Securities and Exchange Commission Act.

CURBING FAMILY GRIP ON BOARD

To break entrenched family control, the draft ordinance caps ownership at 10% for any individual, institution, company, or family. “Family” is broadly defined to include spouses, parents, children, siblings, and in-laws. If anyone is found to be secretly holding more than 10%, the excess shares may be seized and sold at face or market value, whichever is lower.

The law would also limit the number of family members who can serve on a company’s board. Regardless of company by-laws, only two directors from the same family or their associated institutions may be appointed. Board appointments, including chairman and directors, would require prior approval from IDRA.

No individual would be allowed to serve as a director in more than one insurance company of the same category, and institutions would be restricted from appointing multiple directors or using influential individuals as proxies. The existing law gives the regulator no authority in board appointments, resulting in unchecked control by vested interests.

Director eligibility criteria would also be tightened. Prospective directors must have at least 10 years’ experience in management, business, or a professional field. Convicted criminals, financial fraudsters, loan defaulters, and those linked to liquidated or de-licensed companies would be disqualified.

To promote independent oversight, one-third of directors on any board must be independent. On a full 20-member board, at least six must be selected from a regulator-approved pool—another new provision absent from the existing law.

IDRA TO HAVE MORE TEETH

The amendments would also significantly expand IDRA’s supervisory authority. The regulator could inspect and seize documents from insurance companies and their subsidiaries, issue binding directives, and bar companies from collecting new premiums if they act against policyholders’ interests.

A new clause bans the use of company assets as collateral to secure personal loans for directors or their families. Insurance companies would also be barred from extending financial benefits to directors, shareholders, or their relatives.

“These changes are designed to prevent abuse of company resources and ensure stronger oversight,” the draft states.

IDRA would also gain the right to inspect any entity or foundation established with insurance company financing, regardless of its legal structure.

Sayeed Ahmed, president of Bangladesh Insurance Association, could not be reached despite several attempts.

CUSTOMER PROTECTION FUND INTRODUCED

To safeguard future claims, insurers would be required to create dedicated customer protection funds. After deducting approved management expenses, companies must deposit surplus funds into these reserves, which would be invested only in regulator-approved safe assets. All earnings from these investments would be reinvested in the fund.

The draft also proposes changes to agent commissions. Currently, agents receive 35% of the first-year premium, 10% in the second year, and 5% thereafter. Under the proposed rules, first-year commissions would be capped at 25%, followed by 15% in the second year and 5% from the third year onward.

In 2023, Bangladesh’s insurance industry generated Tk18,227 crore in gross premium income, with total assets reaching Tk64,646 crore. About 1.65 crore Bangladeshis are currently covered. During the year, life insurers faced claims worth Tk12,051 crore, of which Tk8,728 crore was paid. Non-life insurers handled claims of Tk3,215 crore, paying out Tk1,142 crore.