Govt plans Tk1,019cr automation project to curb tax evasion, boost revenue

- Update Time : Sunday, April 20, 2025

Staff Correspondent:

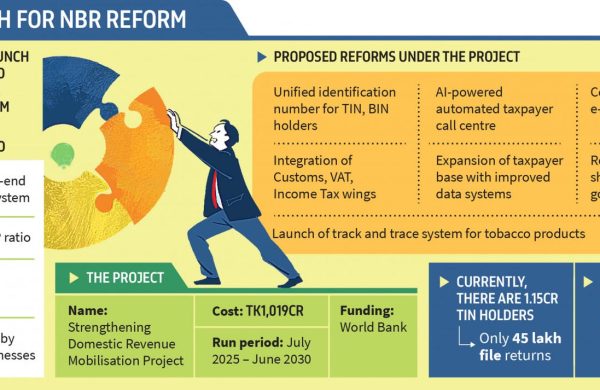

To modernise tax administration and increase revenue, the government is set to launch a Tk1,019 crore project aimed at fully digitising the National Board of Revenue (NBR), with support from the World Bank.

The “Strengthening Domestic Revenue Mobilisation Project” will automate income tax, VAT, and customs services and introduce a unified identification number for taxpayers—eliminating the current separation of Taxpayer Identification Numbers (TINs) and Business Identification Numbers (BINs). This integration aims to improve compliance, curb tax evasion, and reduce bureaucratic hassles.

“We’re working to get approval from the Executive Committee of the National Economic Council [Ecnec] by June. This project aligns with our long-term revenue strategy,” NBR Chairman Abdur Rahman Khan told journalist.

The five-year project (July 2025–June 2030) will roll out a centralised VAT e-invoicing system, an AI-powered taxpayer call centre, and full digitisation of all tax offices. It will also link NBR systems with other government agencies to enhance data sharing and enforcement.

Currently, only about 45 lakh of 1.15 crore TIN holders file tax returns, while just 40% of 5.81 lakh BIN holders submit VAT returns, NBR data shows. The unified ID system will help track compliance more effectively.

Experts, including NBR Reform Commission member and Dhaka University professor Abu Yusuf, welcomed the initiative. “Automation will reduce corruption, increase revenue, and ease taxpayer harassment. But a clear roadmap and strong implementation are essential,” he said.

OTHER PLANNED REFORMS INCLUDE:

- A VAT e-invoicing system to ensure transparent tax collection

- Automation of customs processes, including Duty Drawback and on-chassis delivery tracking

- A Track and Trace system for tobacco taxation

- Integration of income tax systems like e-TIN, e-Return, and e-TDS

- A new SAP Competency Centre and e-learning platform for NBR staff

The World Bank will provide Tk1,000 crore in funding, with the government covering the remainder. A portion of the World Bank’s $500 million budget support for FY25 may be allocated to this project.

However, officials acknowledged past failures. “This time, we’ll appoint a full-time project director to ensure timely implementation,” an NBR official.

Revenue sector expert Snehasis Barua stressed the need for interoperability between NBR systems and other databases such as land records, banking, and credit transactions. He also advised using local software to safeguard data and learning from previous project shortcomings.

WHY THE PROJECT MATTERS

Bangladesh’s revenue-to-GDP ratio has declined to 8.5% in FY24 from 9.1% in FY12, far below regional peers like India (19.8%) and Nepal (23.1%). The stagnant tax-to-GDP ratio—only 7.4% in FY24—is among the lowest globally.

ACCORDING TO THE DRAFT PROJECT PROPOSAL, KEY OBJECTIVES INCLUDE:

- Reducing compliance gaps and broadening the taxpayer base

- Rationalising tax exemptions

- Modernising tax administration to improve services and increase transparency