How banks were forced to buy Tk3,000cr Beximco Sukuk bond

- Update Time : Saturday, August 17, 2024

TDS Desk:

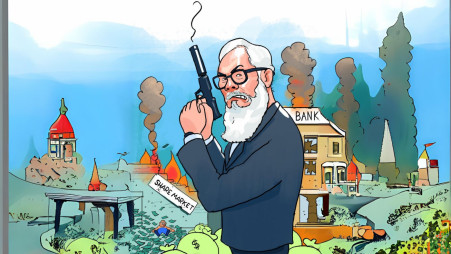

Beximco Sukuk bond was another new financial instrument that was introduced for the first time in the country to help Beximco Group owner Salaman F Rahman to raise Tk3,000 crore by forcing banks to invest in it.

Earlier in 2021, Beximco floated a Tk3,000 crore Sukuk bond — the first-ever asset-backed securities by a private sector entity in Bangladesh — to finance its two solar power plants and for expansion of its textile division.

Later, Beximco used Bangladesh Bank (BB) to issue a circular allowing banks to invest in Sukuk bonds from the capital market special fund which would be excluded from capital market exposure. Banks can invest 25% of their capital into stock, as per the banking act.

After this circular, top executives of most banks were called by the Bangladesh Securities and Exchange Commission (BSEC) and the Bangladesh Bank to buy Sukuk bonds, officials of at least 10 banks told that.

A senior executive of the central bank recalled that Salman F Rahman visited the then BB governor Fazle Kabir at his residence, pressuring him to implement a policy that would allow banks to invest in Sukuk bonds.

At the time, there was no separate policy for bond investment, he said. Salman Rahman was demanding that banks set aside a separate fund for bond investment. Due to his pressure, the Bangladesh Bank issued a circular that excluded bond investments from capital market exposure, he added.

City Bank unwillingly invested Tk300 crore in Sukuk bonds under pressure from various quarters, said the bank’s Managing Director Mashrur Arefin.

BRAC Bank Managing Director Selim RF Hussain said he was also pressured to invest in Sukuk bonds, like others. However, he refused, saying, “I’m not crazy enough to invest the bank’s money in this.”

He added that banks that gave in to the pressure are now regretting it. He said banks which invested in Sukuk should make provision immediately as it is a complete loss in terms of investment.

Explaining the loss, he said the entire amount raised through Sukuk is a liability of the Beximco Group, which lacks the capacity to repay.

He said any investor should look into the financial behaviour of the obligator. In the case of Sukuk, no investors will invest knowing of the financial behaviour of Beximco Group if they are not forced.

“I know that many managing directors and chairmen of banks were forced to invest and they did it out of fear. However, we did not do it as our board is strong and did not pay heed to their call to invest in Sukuk,” he added.

Of the total Sukuk amount, 70% of the subscriptions have come from the banking industry — both private and public — followed by the corporate investor and the mutual fund, respectively.

Besides, individual investors have subscribed below 2% while Beximco shareholders subscribed only 1% in debt security, according to the issue manager.

Of the amount, Tk750 crore was offered in IPO (Initial Public Offering) but it remained undersubscribed, which reflects the low confidence of general investors in the Beximco Group.

HOW INVESTORS WERE CHEATED WITH SUKUK

Although Sukuk was asset-backed, Beximco did not officially transfer the assets, which is seen as deceiving investors and violating BSEC regulations, according to sources at the Investment Corporation of Bangladesh (ICB), which serves as the bond trustee.

Only the solar panel equipment was transferred against the bond, making the investment risky for banks. However, they ultimately bought in under pressure.

Though the regulatory intention was to create confidence among investors to invest in bonds by introducing asset backed bonds, it did not work eventually as Beximco did not transfer the land bought for setting up solar panel projects to the issuer company to safeguard investors.

According to the international standard of issuing Sukuk bonds, the issuer will form a third company under a special purpose vehicle (SPV) to issue the bond. The fund raiser will transfer its assets in the name of that SPV company.

As a result, if the fundraiser fails by any chance to repay, investors will be protected with the assets. The international bond market developed with this mechanism by creating confidence among investors. It is because investors are not much interested to invest in conventional bonds as those are unsecured when Sukuk is secured.

However, in the case of Beximco Sukuk, the bond was left unsecured, putting investors at risk because there were no assets backing their investment. Despite being responsible for ensuring the asset transfer, the ICB did not fulfil this obligation, according to ICB sources.

WHY INVESTORS SHY AWAY FROM BONDS

Beximco was the first company in Bangladesh to issue debentures in the late 1990s, but it has remained a defaulter for the past 20 years. This is the main reason why the bond market in Bangladesh has not developed.

A market analyst, wishing anonymity, told that investors’ first experience with bond investment was negative, which created a lasting bad impression.

Despite being a defaulter, Beximco was allowed to raise funds in the same way again, he added. He said a company that has already defaulted on payments cannot be allowed to issue bonds again.

When Beximco moved to issuing Sukuk bonds, the ICB filed a case on non-payment of previous bonds, said a senior executive of the ICB. However, the BSEC gave clearance to issue the bond when Shibli Rubayat Ul Islam was its chairman.

This is how Salman F Rahman destroyed the bond market in Bangladesh, added the analyst.

Despite not making payments on debentures for 20 years, Beximco was not officially reported as a defaulter because there is no provision for classifying a company for failure to pay, said a senior executive of the Bangladesh Bank.

“That’s why a company’s financial performance analysis is very important before allowing it to issue bonds,” he added.

After the negative experience with Beximco’s unsecured bonds, the central bank introduced asset-backed bonds to protect investors, but this effort also failed due to fraudulent actions by the issuing company, he added.