How CenBank now undoing Rouf Talukder’s reserve mess

- Update Time : Sunday, September 15, 2024

TDS Desk:

Bangladesh’s interbank forex market now shows an average $50 million surplus and banks are calling their clients asking whether those businesses need dollars for opening letters of credit for imports, a turnaround that was unheard of for many months.

Under the direction of Bangladesh Bank Governor Dr Ahsan H Mansur, banks are clearing overdue payments, resulting in improved market conditions. This progress comes despite a reduction in foreign currency trade credit limits imposed by foreign banks on local banks.

Bankers are optimistic about the interim government’s recent decision to seek $6 billion in budget support loans from development partners, believing it will further enhance forex market liquidity and stability. But what has the new central bank governor done in just a month that his predecessor could not do over the past two years?

First, demand for foreign currency has dropped, and second, trade-based money laundering has fallen significantly due to the central bank’s stringent monitoring.

Shortly after assuming office, the new governor implemented a 2.5% band to the mid-rate of Tk117 under the crawling peg exchange rate system, allowing banks to charge up to Tk120 for dollar transactions.

This move, along with assurances to banks, has boosted remittance inflows and reassured foreign banks to maintain credit lines to local banks.

The central bank also reduced selling dollars from the reserve to a minimum level and asked the government organisations to manage dollars for government LCs from commercial banks instead of seeking help from the central bank.

All these initiatives, taken in less than one month, have made the difference visible in the country’s foreign exchange management, bringing relief immediately and indicating more stability in the days ahead.

FACTORS THAT LED TO FAST RESERVE DEPLETION

It is indeed a Herculean task for the new guardian of the central bank to rebuild the country’s gross forex reserves that plummeted below $20 billion marking a steep fall from the record $48 billion in August 2021. Steady rise in reserves over the decades made the past government’s policy makers overconfident in using it in ventures which critics found imprudent.

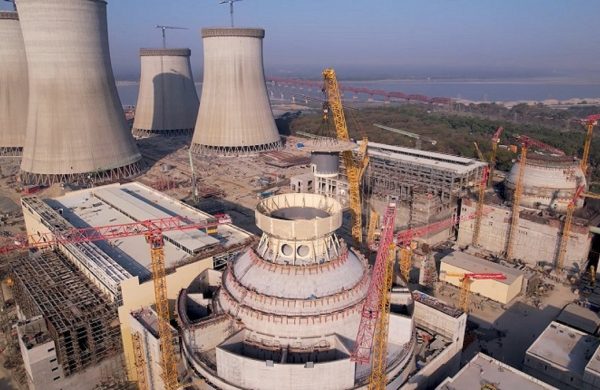

One such instance dates back to 2014 when Bangladesh Bank offered foreign currency funds for the Padma Bridge project after the World Bank and other global lenders abandoned the project amid corruption allegations. It was a critical boost for the government of Sheikh Hasina that had decided to go ahead with the bridge project with its own finance. Economists then warned that using foreign reserves for infrastructure projects would be unwise and might put the country’s external trade transaction and debt servicing at risk.

Those concerns were ignored. State-owned Agrani Bank took the responsibility to supply foreign currency in phases and when required for the Padma Bridge construction procurements. Of the $3.56 billion project cost, the state-lender was to provide $2.4 billion in foreign currency to pay bills for overseas procurements.

Be it from the central bank or any commercial bank, spending cash dollars in bulk from the vault puts strain on the country’s foreign exchange reserve, which does not happen in repaying soft loans received for infrastructure projects as lenders usually offer longer repayment time with grace period.

Formation of the Bangladesh Infrastructure Development Fund (BIDF) in March 2021 was another decision based on much-hyped ‘huge accumulation of forex reserves’ giving an impression that the reserve can be used in supplying dollars for development projects.

The fund started its journey with financing Ramnabad Channel of the Payra Port. It was agreed that Bangladesh Bank will use its “surplus” foreign reserves in that fund, which will lend to Payra Port through Sonali Bank. Abdur Rouf Talukder, who would later become the central bank governor, was then Finance Division secretary.

It was already a year since the Covid-19 pandemic raged through the country. The BB reserves exceeded $44 billion in March 2021 (as per BPM6 reserves were $36bn) on the back of a drastic fall in import bills, growth in remittance, and exports not falling as much as feared. The reserve grew further to $48 billion in August (as per BPM6 $40 billion) that year, the highest in the country’s history.

By then, Abdur Rouf Talukder was the central bank governor. With him at the helm, the central bank was generous in selling dollars to commercial banks to help them cope with the growing import pressures as the economy was struggling to recover from Covid damages. Meanwhile, Russia-Ukraine war broke out in February 2020, disrupting global food and fuel supplies as well as causing price volatility and high freight charges.

This was the period of an exodus of capital from the country, which had been surfacing since the abrupt fall of Awami League regime on 5 August. The Anti-corruption Commission, Bangladesh Financial Intelligence Unit, Criminal Investigation Department of police, all are in action now to reveal how the big fish emptied banks and laundered huge amounts of dollars out of the country through informal channels.

Rouf Talukder presided over the country’s worst and longest period of foreign exchange market volatility. From below Tk86 in the end of 2021, the US dollar shot to Tk118 in quick succession before settling at Tk120 now. The rate of dollars varied widely in banks and the kerb market.

Imports were restricted for nearly two years, but reserves continued to deplete fast and even a surge in remittance and exports could not rein back the fast emptying reserve falling to half of what it was three years ago.

The wide gap in dollar rates between banks and the informal market—sometimes reaching Tk8-10 per dollar—attracted more remittance through informal channels. This has been cited as a major reason for falling reserves despite a spectacular growth in the number of immigrant labourers going abroad.

Since August 2021, gross forex reserves fell by nearly $23 billion reaching $25.8 billion in August this year. The amount is even lower, $20.5b in BPM6 measure with net usable amount counting further lower.

AN UPHILL TASK NOW

What economists had warned of when the central bank opened its reserve for infrastructure funding in 2014 has come true. Dollar is dearer now. As unpaid bills of energy import keep mounting, the interim government is desperately looking for budget support from development partners.

While a $4.7 billion IMF loan package negotiated by the previous regime has been in place, the new interim government has sought $6 billion in budget support from four international lenders to stabilise forex reserves and rejuvenate the economy, clearing overseas dues.

The forex market appears to have stabilised now. With a strong message to wrong-doers, the informal market is in check. Banks need to walk extra miles to bring more remittance through formal channels. They need to improve their service, reduce cost and time for transactions from abroad so that non-resident Bangladeshis feel comfortable with banks to send money home and make deposits in dollar bonds and offshore accounts.

Dollar rate is now favourable enough for remitters and it is time to review the cash incentive—which is 2.5%– for remittance. It is a drain on the exchequer.

If any loopholes are still there, the interim government needs to plug those to make the hundi channel tougher for money launderers. Reserves need to be protected from being misused through avenues such as export development funds, infrastructure development funds and so on.

The onus now is on the interim government to stop erosion of the forex reserve and bring it back to a safe level. (Source: TBS)