IFIC Amar Bond scam: Salman, Shibli banned from capital market for life

- Update Time : Wednesday, July 30, 2025

Staff Correspondent:

The Bangladesh Securities and Exchange Commission (BSEC) has imposed lifetime bans on Salman F Rahman, former IFIC Bank PLC chairman and Beximco Group vice-chairman, former BSEC chairman Shibli Rubayat-Ul-Islam, and Salman’s son Ahmed Shayan Fazlur Rahman, former IFIC Bank vice-chairman, from participating in the capital market.

In a press release issued on Wednesday (July 30), BSEC also fined Salman Tk100 crore and Shayan Tk50 crore for their roles in what regulators described as one of the most egregious cases of investor deception involving the IFIC Guaranteed Sreepur Township Green Zero Coupon Bond, aka “IFIC Amar Bond”.

Alongside these three declared persona non grata for life, officials of IFIC Bank, BSEC, and several other entities also faced action over their involvement in the scam.

In a rare act of self-correction, Shibli faced the action for procedural violations tied to both the IFIC bond and the BEXIMCO Green Sukuk. The regulator also banned former commissioner Sheikh Shamsuddin Ahmed for five years due to the same violations.

The decisions were taken during the 965th Commission Meeting of the BSEC, chaired by the commission’s Chairman Khondoker Rashed Maqsood, in the commission’s meeting room on Tuesday (July 29), according to the press release.

These actions follow months of internal investigations by a BSEC-formed inquiry committee that unearthed serious regulatory breaches, misleading promotions, and misuse of institutional names to lure investors into risky and poorly disclosed financial instruments.

Although IFIC Bank PLC was merely the guarantor of the Sreepur Township bond, it was aggressively marketed using the bank’s brand, most notably under the misleading tagline “IFIC Amar Bond”, creating the impression that the bank itself was issuing the bond.

The real issuer, Sreepur Township Ltd, a real estate company incorporated only months before applying, had already withdrawn Tk248 crore in cash within four days of raising capital, raising red flags.

IFIC Bank PLC, along with several of its former nominated and independent directors, received official warnings from the BSEC, according to the press release.

The officials are the bank’s then nominated directors ARM Nazmus Sakib, Md Golam Mostofa, Md Zafar Iqbal, Quamrun Naher Ahmed, and former independent director Shudhangshu Shekhar Biswas.

The regulator also decided to take enforcement actions against Shah Alam Sarwar, then managing director of IFIC Bank.

Imran Ahmed, then CEO of IFIC Investments Ltd, has been banned from all capital market-related activities for five years.

The credit rating agency Emerging Credit Rating Ltd (ECRL), which rated the Amar Bond, was fined Tk10 lakh.

Earlier, following the 2010 stock market crash, the Awami League-led government formed a probe committee headed by Khondkar Ibrahim Khaled. The committee identified 60 individuals, including tycoon Salman — who had made fortunes through stock market manipulation.

It also cautioned the government to stay vigilant against influential figures like Salman, the former private industry and investment adviser to ousted prime minister Sheikh Hasina, to prevent future scams.

Salman is currently behind bars, after getting arrested and accused in numerous cases following the fall of the Awami League government through the mass uprising in July-August last year.

Police arrested Salman on 13 August last year from the capital’s Sadarghat area while he was attempting to flee via river route along with former law minister Anisul Huq.

Since then, Salman has been remanded multiple times in various cases filed with different police stations across Dhaka.

Meanwhile, his son Shayan’s whereabouts are yet to be known, although it has been alleged that he has fled the country and is currently abroad.

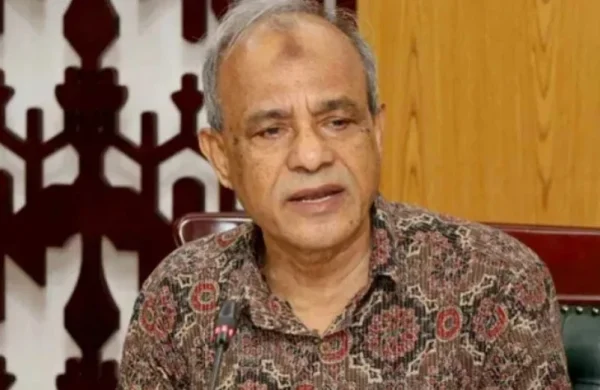

On the other hand, former BSEC chief Shibli was arrested by the police from the capital’s Dhanmondi area on 4 February this year in a case filed by the Anti-Corruption Commission (ACC). The following day, he was sent to jail by a Dhaka court.

On 5 February, ACC Deputy Director (money laundering) Md Masudur Rahman filed a case against Shibli and five others over allegations of bribery and financial irregularities.

According to the case statement, Shibli took bribes amounting to Tk1.92 crore by falsifying a house rental agreement. Additionally, he was accused of orchestrating fraudulent exports by fabricating sales contracts.

Bank officials, in collusion with others, reportedly brought $361,000 into Bangladesh without proper documentation and customer due diligence, violating banking norms. Of this amount, Shibli personally received Tk1.84 crore.

While in custody, a travel ban was also imposed on him on 25 June. A Dhaka court on 8 July ordered the seizure of a 10-storey commercial building, owned by Shibli, built on 15 kathas of land in Savar.